Thrivent Financial for Lutherans decreased its holdings in Paramount Global (NASDAQ:PARA - Free Report) by 84.0% in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 23,335 shares of the company's stock after selling 122,303 shares during the quarter. Thrivent Financial for Lutherans' holdings in Paramount Global were worth $248,000 as of its most recent SEC filing.

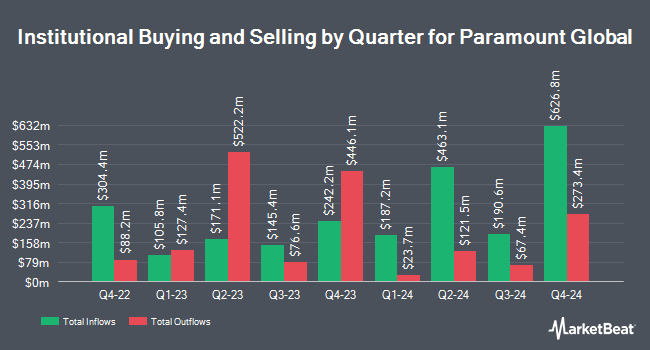

A number of other institutional investors and hedge funds also recently bought and sold shares of the business. Lingotto Investment Management LLP increased its position in Paramount Global by 628.8% in the 2nd quarter. Lingotto Investment Management LLP now owns 29,937,007 shares of the company's stock valued at $311,046,000 after acquiring an additional 25,829,185 shares in the last quarter. Ariel Investments LLC grew its stake in shares of Paramount Global by 16.5% during the second quarter. Ariel Investments LLC now owns 14,042,265 shares of the company's stock valued at $145,899,000 after purchasing an additional 1,992,576 shares during the last quarter. AQR Capital Management LLC increased its holdings in shares of Paramount Global by 602.8% in the second quarter. AQR Capital Management LLC now owns 1,783,489 shares of the company's stock valued at $18,530,000 after purchasing an additional 1,529,719 shares in the last quarter. Shah Capital Management raised its position in Paramount Global by 1,019.9% in the 2nd quarter. Shah Capital Management now owns 1,121,000 shares of the company's stock worth $11,647,000 after purchasing an additional 1,020,900 shares during the last quarter. Finally, AustralianSuper Pty Ltd acquired a new position in Paramount Global during the 3rd quarter worth $7,222,000. Institutional investors and hedge funds own 73.00% of the company's stock.

Paramount Global Stock Up 1.7 %

Shares of NASDAQ PARA traded up $0.18 during mid-day trading on Friday, reaching $10.99. 7,609,361 shares of the company's stock were exchanged, compared to its average volume of 12,479,188. The company has a current ratio of 1.27, a quick ratio of 1.10 and a debt-to-equity ratio of 0.85. The business has a fifty day simple moving average of $10.73 and a 200 day simple moving average of $10.88. Paramount Global has a twelve month low of $9.54 and a twelve month high of $17.50. The firm has a market capitalization of $7.33 billion, a price-to-earnings ratio of -1.34, a PEG ratio of 1.33 and a beta of 1.71.

Paramount Global (NASDAQ:PARA - Get Free Report) last announced its quarterly earnings results on Friday, November 8th. The company reported $0.49 earnings per share for the quarter, beating analysts' consensus estimates of $0.24 by $0.25. Paramount Global had a negative net margin of 18.89% and a positive return on equity of 5.81%. The firm had revenue of $6.73 billion for the quarter, compared to analyst estimates of $6.94 billion. During the same quarter in the previous year, the firm posted $0.30 earnings per share. The business's revenue was down 5.6% on a year-over-year basis. As a group, equities analysts expect that Paramount Global will post 1.86 EPS for the current fiscal year.

Paramount Global Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Monday, December 16th will be issued a dividend of $0.05 per share. This represents a $0.20 dividend on an annualized basis and a yield of 1.82%. The ex-dividend date of this dividend is Monday, December 16th. Paramount Global's dividend payout ratio (DPR) is presently -2.43%.

Analyst Ratings Changes

PARA has been the subject of several research reports. Benchmark reissued a "buy" rating and issued a $19.00 target price on shares of Paramount Global in a research note on Friday, August 9th. Needham & Company LLC reiterated a "hold" rating on shares of Paramount Global in a research report on Monday, November 11th. Macquarie restated an "underperform" rating and set a $10.00 target price on shares of Paramount Global in a research report on Monday, November 11th. Guggenheim lowered their price target on shares of Paramount Global from $19.00 to $14.00 and set a "buy" rating for the company in a research report on Wednesday, September 25th. Finally, StockNews.com upgraded shares of Paramount Global from a "sell" rating to a "hold" rating in a report on Monday, November 11th. Eight equities research analysts have rated the stock with a sell rating, eight have given a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $12.40.

View Our Latest Stock Analysis on PARA

Paramount Global Profile

(

Free Report)

Paramount Global operates as a media, streaming, and entertainment company worldwide. It operates through TV Media, Direct-to-Consumer, and Filmed Entertainment segments. The TV Media segment operates CBS Television Network, a domestic broadcast television network; CBS Stations, a television station; and international free-to-air networks comprising Network 10, Channel 5, Telefe, and Chilevisión; domestic premium and basic cable networks, such as Paramount+ with Showtime, MTV, Comedy Central, Paramount Network, The Smithsonian Channel, Nickelodeon, BET Media Group, and CBS Sports Network; and international extensions of these brands.

See Also

Before you consider Paramount Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paramount Global wasn't on the list.

While Paramount Global currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.