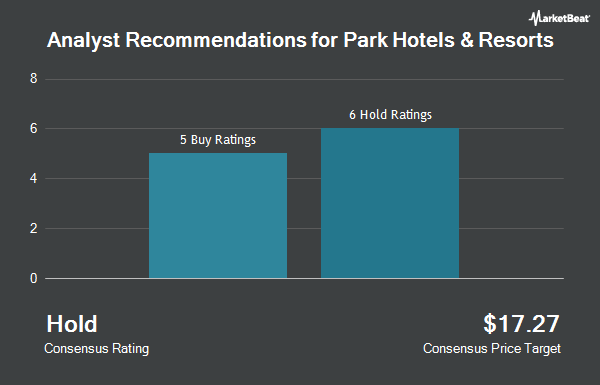

Park Hotels & Resorts Inc. (NYSE:PK - Get Free Report) has been assigned an average rating of "Moderate Buy" from the twelve ratings firms that are currently covering the firm, MarketBeat Ratings reports. Six investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. The average 12 month price target among brokers that have issued ratings on the stock in the last year is $18.09.

A number of brokerages have recently weighed in on PK. Truist Financial lowered their price target on Park Hotels & Resorts from $20.00 to $18.00 and set a "buy" rating on the stock in a report on Wednesday, September 4th. Evercore ISI decreased their price target on shares of Park Hotels & Resorts from $20.00 to $19.00 and set an "outperform" rating for the company in a report on Tuesday, August 13th. UBS Group upped their price objective on shares of Park Hotels & Resorts from $14.00 to $15.00 and gave the company a "neutral" rating in a research note on Monday. Wells Fargo & Company decreased their target price on shares of Park Hotels & Resorts from $17.00 to $14.50 and set an "equal weight" rating for the company in a research note on Friday, September 13th. Finally, Bank of America dropped their price target on shares of Park Hotels & Resorts from $17.00 to $16.50 and set a "neutral" rating on the stock in a research note on Monday, October 21st.

Get Our Latest Analysis on PK

Park Hotels & Resorts Price Performance

PK stock traded up $0.04 during trading hours on Tuesday, hitting $14.32. 2,358,434 shares of the stock traded hands, compared to its average volume of 2,777,031. The company has a current ratio of 1.51, a quick ratio of 1.51 and a debt-to-equity ratio of 1.24. The stock has a 50-day simple moving average of $14.36 and a 200 day simple moving average of $14.77. Park Hotels & Resorts has a one year low of $13.23 and a one year high of $18.05. The company has a market cap of $2.96 billion, a P/E ratio of 9.00, a P/E/G ratio of 0.80 and a beta of 2.02.

Park Hotels & Resorts (NYSE:PK - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The financial services provider reported $0.26 earnings per share for the quarter, missing the consensus estimate of $0.47 by ($0.21). Park Hotels & Resorts had a return on equity of 9.63% and a net margin of 12.66%. The company had revenue of $649.00 million for the quarter, compared to the consensus estimate of $646.15 million. During the same period in the prior year, the business earned $0.51 earnings per share. The business's revenue was down 4.4% compared to the same quarter last year. Equities analysts forecast that Park Hotels & Resorts will post 2.09 earnings per share for the current year.

Hedge Funds Weigh In On Park Hotels & Resorts

A number of hedge funds and other institutional investors have recently made changes to their positions in PK. Barclays PLC grew its position in Park Hotels & Resorts by 22.4% in the third quarter. Barclays PLC now owns 319,593 shares of the financial services provider's stock valued at $4,507,000 after acquiring an additional 58,432 shares during the period. Y Intercept Hong Kong Ltd grew its holdings in shares of Park Hotels & Resorts by 81.6% in the 3rd quarter. Y Intercept Hong Kong Ltd now owns 42,051 shares of the financial services provider's stock worth $593,000 after purchasing an additional 18,892 shares during the last quarter. MML Investors Services LLC grew its holdings in shares of Park Hotels & Resorts by 55.1% in the 3rd quarter. MML Investors Services LLC now owns 24,634 shares of the financial services provider's stock worth $347,000 after purchasing an additional 8,749 shares during the last quarter. XTX Topco Ltd lifted its holdings in Park Hotels & Resorts by 420.7% during the 3rd quarter. XTX Topco Ltd now owns 89,168 shares of the financial services provider's stock valued at $1,257,000 after purchasing an additional 72,044 shares during the last quarter. Finally, EP Wealth Advisors LLC acquired a new position in Park Hotels & Resorts in the third quarter valued at about $224,000. 92.69% of the stock is owned by institutional investors.

Park Hotels & Resorts Company Profile

(

Get Free ReportPark is one of the largest publicly traded lodging REITs with a diverse portfolio of market-leading hotels and resorts with significant underlying real estate value. Park's portfolio currently consists of 43 premium-branded hotels and resorts with over 26,000 rooms primarily located in prime city center and resort locations.

See Also

Before you consider Park Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Park Hotels & Resorts wasn't on the list.

While Park Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.