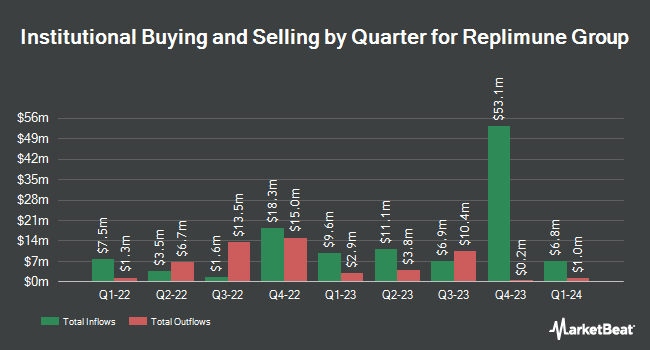

Parkman Healthcare Partners LLC grew its holdings in Replimune Group, Inc. (NASDAQ:REPL - Free Report) by 45.5% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 763,747 shares of the company's stock after acquiring an additional 238,747 shares during the quarter. Parkman Healthcare Partners LLC owned 1.12% of Replimune Group worth $8,371,000 at the end of the most recent reporting period.

Several other large investors also recently modified their holdings of the business. Arizona PSPRS Trust bought a new stake in shares of Replimune Group in the third quarter valued at about $834,000. Baker BROS. Advisors LP boosted its position in Replimune Group by 10.0% during the 3rd quarter. Baker BROS. Advisors LP now owns 11,045,336 shares of the company's stock worth $121,057,000 after acquiring an additional 1,000,000 shares during the last quarter. Erste Asset Management GmbH acquired a new position in Replimune Group during the 3rd quarter worth approximately $133,000. Braidwell LP grew its stake in shares of Replimune Group by 203.0% during the 3rd quarter. Braidwell LP now owns 3,070,837 shares of the company's stock worth $33,656,000 after acquiring an additional 2,057,460 shares in the last quarter. Finally, MetLife Investment Management LLC grew its stake in shares of Replimune Group by 21.5% during the 3rd quarter. MetLife Investment Management LLC now owns 35,134 shares of the company's stock worth $385,000 after acquiring an additional 6,216 shares in the last quarter. 92.53% of the stock is currently owned by institutional investors.

Replimune Group Stock Performance

REPL traded up $0.03 during trading on Wednesday, hitting $13.17. The stock had a trading volume of 1,058,272 shares, compared to its average volume of 1,063,443. The company has a 50 day moving average price of $11.98 and a 200-day moving average price of $10.11. The firm has a market cap of $901.09 million, a price-to-earnings ratio of -4.32 and a beta of 1.26. Replimune Group, Inc. has a one year low of $4.92 and a one year high of $17.00. The company has a debt-to-equity ratio of 0.18, a current ratio of 10.11 and a quick ratio of 10.11.

Replimune Group (NASDAQ:REPL - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.68) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.75) by $0.07. As a group, research analysts predict that Replimune Group, Inc. will post -2.99 EPS for the current year.

Insider Activity at Replimune Group

In other Replimune Group news, insider Konstantinos Xynos sold 7,246 shares of the company's stock in a transaction on Monday, November 18th. The stock was sold at an average price of $10.78, for a total transaction of $78,111.88. Following the completion of the sale, the insider now directly owns 109,885 shares in the company, valued at $1,184,560.30. This represents a 6.19 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 8.80% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of research analysts recently weighed in on REPL shares. JPMorgan Chase & Co. raised their target price on shares of Replimune Group from $14.00 to $17.00 and gave the company an "overweight" rating in a research report on Tuesday, September 24th. HC Wainwright restated a "buy" rating and issued a $17.00 price target on shares of Replimune Group in a research note on Friday, November 22nd. BMO Capital Markets raised their target price on shares of Replimune Group from $14.00 to $18.00 and gave the company an "outperform" rating in a research note on Friday, November 22nd. Roth Mkm started coverage on shares of Replimune Group in a research note on Tuesday, August 27th. They issued a "buy" rating and a $17.00 target price for the company. Finally, Jefferies Financial Group lifted their price objective on shares of Replimune Group from $16.00 to $19.00 and gave the company a "buy" rating in a research report on Wednesday. Seven investment analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Buy" and a consensus price target of $17.29.

Read Our Latest Stock Report on Replimune Group

Replimune Group Company Profile

(

Free Report)

Replimune Group, Inc, a clinical-stage biotechnology company, focuses on the development of oncolytic immunotherapies to treat cancer. The company's proprietary tumor-directed oncolytic immunotherapy product candidates are designed and intended to activate the immune system against cancer. Its lead product candidate is RP1, a selectively replicating version of HSV-1 that expresses GALV-GP R(-) and human GM-CSF, which is in Phase I/II clinical trials for a range of solid tumors; and that has completed Phase II clinical trials for treating cutaneous squamous cell carcinoma.

Read More

Before you consider Replimune Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Replimune Group wasn't on the list.

While Replimune Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.