Parkman Healthcare Partners LLC decreased its position in shares of Agios Pharmaceuticals, Inc. (NASDAQ:AGIO - Free Report) by 36.1% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 285,099 shares of the biopharmaceutical company's stock after selling 161,317 shares during the period. Agios Pharmaceuticals accounts for 1.6% of Parkman Healthcare Partners LLC's holdings, making the stock its 22nd biggest position. Parkman Healthcare Partners LLC owned 0.50% of Agios Pharmaceuticals worth $12,667,000 at the end of the most recent quarter.

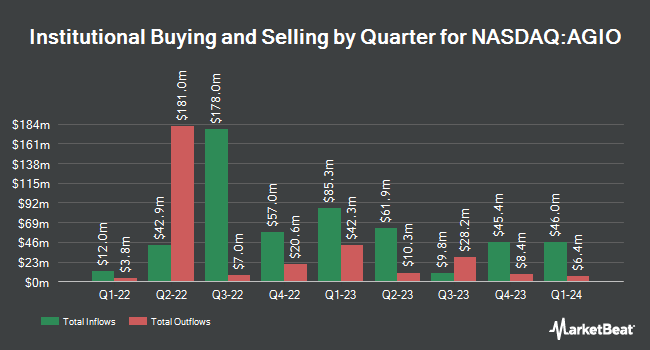

Other institutional investors also recently bought and sold shares of the company. Farallon Capital Management LLC boosted its position in shares of Agios Pharmaceuticals by 1.1% in the 2nd quarter. Farallon Capital Management LLC now owns 5,654,502 shares of the biopharmaceutical company's stock worth $243,822,000 after purchasing an additional 63,900 shares in the last quarter. Erste Asset Management GmbH acquired a new stake in Agios Pharmaceuticals in the 3rd quarter worth approximately $97,199,000. Marshall Wace LLP grew its position in Agios Pharmaceuticals by 307.8% during the 2nd quarter. Marshall Wace LLP now owns 1,133,735 shares of the biopharmaceutical company's stock worth $48,887,000 after purchasing an additional 855,739 shares during the last quarter. Frazier Life Sciences Management L.P. raised its holdings in shares of Agios Pharmaceuticals by 66.7% in the second quarter. Frazier Life Sciences Management L.P. now owns 871,974 shares of the biopharmaceutical company's stock worth $37,600,000 after buying an additional 348,808 shares during the last quarter. Finally, Fisher Asset Management LLC lifted its stake in shares of Agios Pharmaceuticals by 20.5% during the third quarter. Fisher Asset Management LLC now owns 855,328 shares of the biopharmaceutical company's stock worth $38,002,000 after buying an additional 145,416 shares during the period.

Analyst Upgrades and Downgrades

AGIO has been the subject of a number of research reports. Raymond James reaffirmed an "outperform" rating and set a $51.00 price target on shares of Agios Pharmaceuticals in a research report on Thursday, October 10th. Scotiabank lifted their target price on shares of Agios Pharmaceuticals from $51.00 to $53.00 and gave the company a "sector outperform" rating in a research report on Friday, November 1st. Cantor Fitzgerald restated an "overweight" rating on shares of Agios Pharmaceuticals in a research report on Friday, September 20th. Leerink Partners lowered Agios Pharmaceuticals from an "outperform" rating to a "market perform" rating and cut their price objective for the stock from $60.00 to $56.00 in a research note on Friday, September 27th. Finally, Royal Bank of Canada restated an "outperform" rating and issued a $55.00 target price on shares of Agios Pharmaceuticals in a research report on Friday, November 1st. Five research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $52.33.

View Our Latest Research Report on Agios Pharmaceuticals

Agios Pharmaceuticals Trading Up 1.0 %

Agios Pharmaceuticals stock traded up $0.57 during midday trading on Wednesday, hitting $59.45. 765,399 shares of the stock were exchanged, compared to its average volume of 692,514. The stock has a market capitalization of $3.39 billion, a price-to-earnings ratio of 5.18 and a beta of 0.80. The stock's 50-day simple moving average is $49.18 and its 200 day simple moving average is $45.90. Agios Pharmaceuticals, Inc. has a fifty-two week low of $20.96 and a fifty-two week high of $62.58.

Insider Buying and Selling at Agios Pharmaceuticals

In related news, CFO Cecilia Jones sold 2,542 shares of the business's stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $49.03, for a total value of $124,634.26. Following the sale, the chief financial officer now directly owns 20,158 shares in the company, valued at approximately $988,346.74. The trade was a 11.20 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 4.93% of the company's stock.

About Agios Pharmaceuticals

(

Free Report)

Agios Pharmaceuticals, Inc, a biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States. Its lead product includes PYRUKYND (mitapivat), an activator of wild-type and mutant pyruvate kinase (PK), enzymes for the treatment of hemolytic anemias.

Read More

Before you consider Agios Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agios Pharmaceuticals wasn't on the list.

While Agios Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.