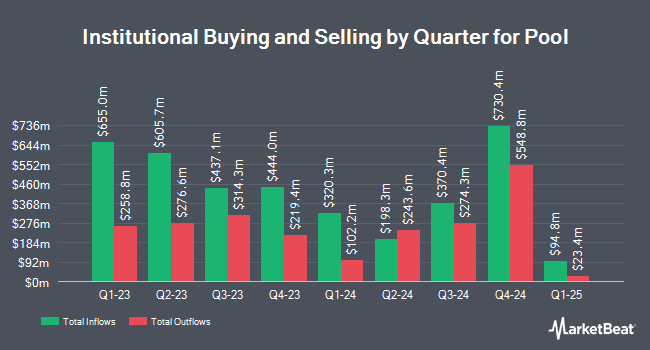

Parnassus Investments LLC lifted its position in Pool Co. (NASDAQ:POOL - Free Report) by 3.5% in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 204,730 shares of the specialty retailer's stock after buying an additional 6,987 shares during the quarter. Parnassus Investments LLC owned about 0.54% of Pool worth $77,142,000 as of its most recent filing with the SEC.

Several other large investors have also made changes to their positions in the company. International Assets Investment Management LLC grew its position in Pool by 37,863.6% in the third quarter. International Assets Investment Management LLC now owns 137,808 shares of the specialty retailer's stock worth $51,926,000 after acquiring an additional 137,445 shares in the last quarter. Toronto Dominion Bank boosted its holdings in Pool by 16.1% in the second quarter. Toronto Dominion Bank now owns 13,369 shares of the specialty retailer's stock worth $4,109,000 after purchasing an additional 1,858 shares in the last quarter. Torray Investment Partners LLC increased its position in Pool by 16.8% during the second quarter. Torray Investment Partners LLC now owns 14,128 shares of the specialty retailer's stock worth $4,342,000 after buying an additional 2,034 shares during the last quarter. UniSuper Management Pty Ltd raised its holdings in Pool by 459.3% during the first quarter. UniSuper Management Pty Ltd now owns 2,724 shares of the specialty retailer's stock valued at $1,099,000 after buying an additional 2,237 shares in the last quarter. Finally, O Shaughnessy Asset Management LLC lifted its position in shares of Pool by 81.1% in the first quarter. O Shaughnessy Asset Management LLC now owns 3,168 shares of the specialty retailer's stock worth $1,278,000 after buying an additional 1,419 shares during the last quarter. Institutional investors own 98.99% of the company's stock.

Pool Stock Performance

POOL traded up $1.87 on Tuesday, hitting $362.71. 405,308 shares of the stock traded hands, compared to its average volume of 348,303. The business has a fifty day moving average price of $365.05 and a two-hundred day moving average price of $352.31. The company has a current ratio of 2.39, a quick ratio of 0.77 and a debt-to-equity ratio of 0.61. The firm has a market capitalization of $13.80 billion, a PE ratio of 31.21, a P/E/G ratio of 2.18 and a beta of 1.01. Pool Co. has a 52 week low of $293.51 and a 52 week high of $422.73.

Pool (NASDAQ:POOL - Get Free Report) last released its quarterly earnings data on Thursday, October 24th. The specialty retailer reported $3.26 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.15 by $0.11. Pool had a return on equity of 31.89% and a net margin of 8.42%. The business had revenue of $1.43 billion for the quarter, compared to analysts' expectations of $1.40 billion. During the same period in the previous year, the business posted $3.50 earnings per share. Pool's quarterly revenue was down 2.8% on a year-over-year basis. On average, research analysts predict that Pool Co. will post 11 EPS for the current fiscal year.

Pool Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, November 27th. Shareholders of record on Wednesday, November 13th will be issued a dividend of $1.20 per share. This represents a $4.80 dividend on an annualized basis and a yield of 1.32%. The ex-dividend date of this dividend is Wednesday, November 13th. Pool's payout ratio is 41.31%.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on POOL. Stifel Nicolaus increased their price objective on Pool from $335.00 to $340.00 and gave the company a "hold" rating in a report on Monday, October 28th. StockNews.com raised shares of Pool from a "sell" rating to a "hold" rating in a research report on Saturday, November 2nd. Oppenheimer boosted their price objective on shares of Pool from $380.00 to $386.00 and gave the stock an "outperform" rating in a research note on Monday, October 28th. The Goldman Sachs Group raised their target price on shares of Pool from $365.00 to $415.00 and gave the company a "buy" rating in a research note on Friday, July 26th. Finally, Robert W. Baird boosted their target price on shares of Pool from $377.00 to $408.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 16th. One analyst has rated the stock with a sell rating, six have issued a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $369.11.

Check Out Our Latest Report on Pool

Pool Profile

(

Free Report)

Pool Corporation distributes swimming pool supplies, equipment, and related leisure products in the United States and internationally. The company offers maintenance products, including chemicals, supplies, and pool accessories; repair and replacement parts for pool equipment, such as cleaners, filters, heaters, pumps, and lights; and building materials, such as concrete, plumbing and electrical components, functional and decorative pool surfaces, decking materials, tiles, hardscapes, and natural stones for pool installations and remodeling.

See Also

Before you consider Pool, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pool wasn't on the list.

While Pool currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.