Partners Group Holding AG trimmed its holdings in shares of ADT Inc. (NYSE:ADT - Free Report) by 13.2% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 4,015,484 shares of the security and automation business's stock after selling 611,799 shares during the quarter. ADT accounts for approximately 1.0% of Partners Group Holding AG's portfolio, making the stock its 24th biggest position. Partners Group Holding AG owned about 0.44% of ADT worth $27,747,000 as of its most recent SEC filing.

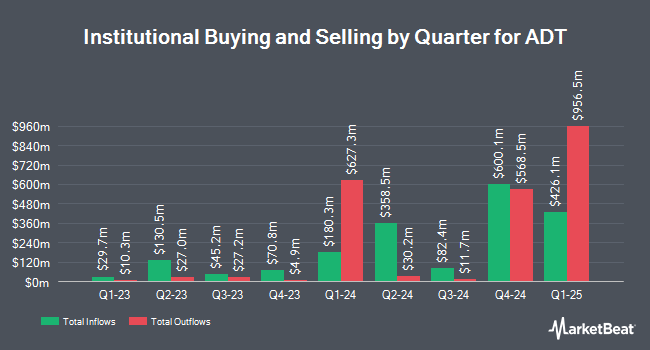

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Vanguard Group Inc. boosted its holdings in ADT by 20.6% during the 4th quarter. Vanguard Group Inc. now owns 44,555,115 shares of the security and automation business's stock valued at $307,876,000 after acquiring an additional 7,610,709 shares during the period. Fox Run Management L.L.C. acquired a new stake in shares of ADT during the fourth quarter worth about $408,000. KLP Kapitalforvaltning AS purchased a new position in shares of ADT in the fourth quarter valued at approximately $426,000. Hillsdale Investment Management Inc. grew its holdings in shares of ADT by 4.6% in the fourth quarter. Hillsdale Investment Management Inc. now owns 100,500 shares of the security and automation business's stock valued at $694,000 after purchasing an additional 4,400 shares in the last quarter. Finally, Sei Investments Co. grew its holdings in shares of ADT by 1,132.1% in the fourth quarter. Sei Investments Co. now owns 243,702 shares of the security and automation business's stock valued at $1,684,000 after purchasing an additional 223,922 shares in the last quarter. 87.22% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

ADT has been the topic of a number of research reports. Morgan Stanley increased their target price on shares of ADT from $8.50 to $9.00 and gave the stock an "equal weight" rating in a report on Thursday, December 12th. Royal Bank of Canada reiterated a "sector perform" rating and issued a $9.00 price objective on shares of ADT in a research note on Wednesday, January 29th.

View Our Latest Analysis on ADT

ADT Stock Performance

Shares of ADT stock traded up $0.06 during trading hours on Thursday, hitting $8.23. The stock had a trading volume of 9,674,768 shares, compared to its average volume of 6,688,058. The company has a debt-to-equity ratio of 1.93, a current ratio of 0.81 and a quick ratio of 0.64. The firm has a market capitalization of $7.21 billion, a PE ratio of 8.94 and a beta of 1.58. The stock's 50 day moving average is $7.62 and its 200 day moving average is $7.37. ADT Inc. has a twelve month low of $6.10 and a twelve month high of $8.39.

ADT Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, April 3rd. Investors of record on Thursday, March 13th will be given a $0.055 dividend. The ex-dividend date of this dividend is Thursday, March 13th. This represents a $0.22 annualized dividend and a dividend yield of 2.67%. ADT's dividend payout ratio is presently 41.51%.

ADT Company Profile

(

Free Report)

ADT Inc provides security, interactive, and smart home solutions to residential and small business customers in the United States. It operates through two segments, Consumer and Small Business, and Solar. The company provides burglar and life safety alarms, smart security cameras, smart home automation systems, and video surveillance systems.

Featured Articles

Before you consider ADT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADT wasn't on the list.

While ADT currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.