Pathstone Holdings LLC increased its holdings in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX - Free Report) by 5.5% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 40,653 shares of the pharmaceutical company's stock after purchasing an additional 2,112 shares during the quarter. Pathstone Holdings LLC's holdings in Vertex Pharmaceuticals were worth $18,907,000 at the end of the most recent reporting period.

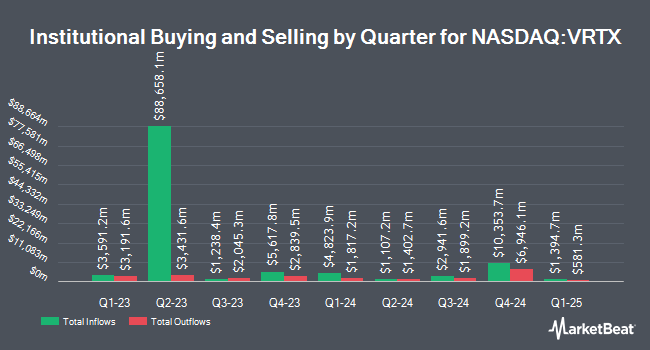

A number of other institutional investors and hedge funds have also bought and sold shares of VRTX. Northwest Investment Counselors LLC bought a new position in Vertex Pharmaceuticals during the 3rd quarter worth approximately $25,000. Highline Wealth Partners LLC bought a new position in Vertex Pharmaceuticals during the third quarter worth $27,000. GHP Investment Advisors Inc. acquired a new position in Vertex Pharmaceuticals in the second quarter valued at $29,000. Stephens Consulting LLC bought a new stake in Vertex Pharmaceuticals during the second quarter valued at $31,000. Finally, Founders Capital Management grew its holdings in Vertex Pharmaceuticals by 50.0% during the 2nd quarter. Founders Capital Management now owns 75 shares of the pharmaceutical company's stock worth $35,000 after acquiring an additional 25 shares during the period. 90.96% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Vertex Pharmaceuticals

In other news, Chairman Jeffrey M. Leiden sold 3,784 shares of Vertex Pharmaceuticals stock in a transaction on Friday, August 30th. The stock was sold at an average price of $499.00, for a total transaction of $1,888,216.00. Following the sale, the chairman now directly owns 9,994 shares in the company, valued at $4,987,006. The trade was a 27.46 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Sangeeta N. Bhatia sold 646 shares of the stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $500.00, for a total transaction of $323,000.00. Following the transaction, the director now owns 4,435 shares of the company's stock, valued at approximately $2,217,500. The trade was a 12.71 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 4,445 shares of company stock worth $2,218,394 in the last 90 days. Insiders own 0.20% of the company's stock.

Vertex Pharmaceuticals Price Performance

Shares of NASDAQ:VRTX opened at $448.01 on Wednesday. The company has a current ratio of 2.47, a quick ratio of 2.20 and a debt-to-equity ratio of 0.01. The stock has a market cap of $115.38 billion, a PE ratio of -225.13 and a beta of 0.39. The stock's fifty day simple moving average is $475.85 and its two-hundred day simple moving average is $472.89. Vertex Pharmaceuticals Incorporated has a 1-year low of $346.29 and a 1-year high of $519.88.

Vertex Pharmaceuticals (NASDAQ:VRTX - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The pharmaceutical company reported $4.38 earnings per share for the quarter, beating analysts' consensus estimates of $3.61 by $0.77. Vertex Pharmaceuticals had a negative net margin of 4.52% and a negative return on equity of 1.91%. The company had revenue of $2.77 billion for the quarter, compared to analyst estimates of $2.69 billion. During the same period last year, the firm earned $3.67 earnings per share. The firm's revenue was up 11.6% on a year-over-year basis. As a group, analysts forecast that Vertex Pharmaceuticals Incorporated will post -1.82 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

VRTX has been the topic of a number of recent analyst reports. Barclays downgraded Vertex Pharmaceuticals from an "overweight" rating to an "equal weight" rating and boosted their price objective for the company from $472.00 to $509.00 in a research note on Monday, August 5th. Royal Bank of Canada boosted their price target on Vertex Pharmaceuticals from $437.00 to $451.00 and gave the company a "sector perform" rating in a research note on Tuesday, November 5th. Scotiabank raised their price objective on shares of Vertex Pharmaceuticals from $480.00 to $486.00 and gave the stock a "sector perform" rating in a research report on Tuesday, November 5th. UBS Group boosted their target price on shares of Vertex Pharmaceuticals from $562.00 to $586.00 and gave the company a "buy" rating in a research report on Tuesday, November 5th. Finally, Cantor Fitzgerald restated an "overweight" rating and issued a $480.00 price target on shares of Vertex Pharmaceuticals in a report on Tuesday, November 5th. Three equities research analysts have rated the stock with a sell rating, nine have given a hold rating, seventeen have issued a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $499.12.

Check Out Our Latest Analysis on Vertex Pharmaceuticals

About Vertex Pharmaceuticals

(

Free Report)

Vertex Pharmaceuticals Incorporated, a biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF). It markets TRIKAFTA/KAFTRIO for people with CF with at least one F508del mutation for 2 years of age or older; SYMDEKO/SYMKEVI for people with CF for 6 years of age or older; ORKAMBI for CF patients 1 year or older; and KALYDECO for the treatment of patients with 1 year or older who have CF with ivacaftor.

Read More

Before you consider Vertex Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertex Pharmaceuticals wasn't on the list.

While Vertex Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.