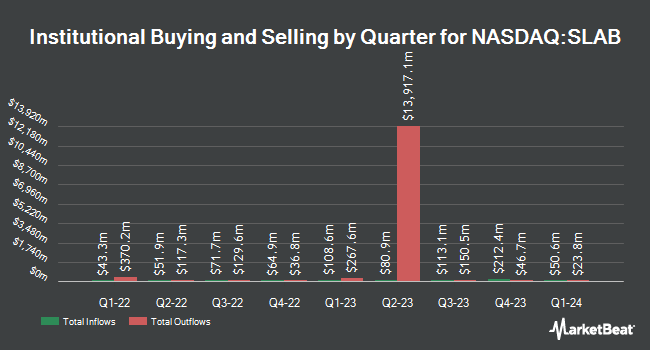

Pathstone Holdings LLC cut its holdings in Silicon Laboratories Inc. (NASDAQ:SLAB - Free Report) by 2.6% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 431,414 shares of the semiconductor company's stock after selling 11,482 shares during the period. Pathstone Holdings LLC owned about 1.34% of Silicon Laboratories worth $49,858,000 as of its most recent SEC filing.

A number of other large investors have also recently added to or reduced their stakes in SLAB. CWM LLC increased its position in Silicon Laboratories by 185.0% during the 2nd quarter. CWM LLC now owns 8,435 shares of the semiconductor company's stock worth $933,000 after purchasing an additional 5,475 shares in the last quarter. Natixis acquired a new position in shares of Silicon Laboratories in the first quarter valued at approximately $647,000. Vanguard Group Inc. raised its position in shares of Silicon Laboratories by 0.7% in the first quarter. Vanguard Group Inc. now owns 3,489,160 shares of the semiconductor company's stock valued at $501,462,000 after buying an additional 24,997 shares during the last quarter. SG Americas Securities LLC lifted its stake in shares of Silicon Laboratories by 284.6% during the second quarter. SG Americas Securities LLC now owns 7,076 shares of the semiconductor company's stock valued at $783,000 after buying an additional 5,236 shares during the period. Finally, Clearbridge Investments LLC boosted its position in Silicon Laboratories by 84.0% during the second quarter. Clearbridge Investments LLC now owns 273,776 shares of the semiconductor company's stock worth $30,288,000 after acquiring an additional 125,022 shares during the last quarter.

Silicon Laboratories Trading Down 2.3 %

SLAB traded down $2.31 during trading on Tuesday, hitting $98.40. 165,730 shares of the company's stock were exchanged, compared to its average volume of 298,730. The stock has a 50 day moving average price of $111.42 and a 200 day moving average price of $114.48. Silicon Laboratories Inc. has a 1 year low of $94.00 and a 1 year high of $154.91. The firm has a market cap of $3.19 billion, a P/E ratio of -13.30 and a beta of 1.20.

Silicon Laboratories (NASDAQ:SLAB - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The semiconductor company reported ($0.13) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.20) by $0.07. The firm had revenue of $166.00 million during the quarter, compared to the consensus estimate of $165.50 million. Silicon Laboratories had a negative return on equity of 12.60% and a negative net margin of 46.93%. The firm's quarterly revenue was down 18.5% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.48 EPS. Analysts forecast that Silicon Laboratories Inc. will post -3.56 earnings per share for the current fiscal year.

Insider Activity

In other news, SVP Brandon Tolany sold 845 shares of Silicon Laboratories stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $115.00, for a total transaction of $97,175.00. Following the sale, the senior vice president now directly owns 43,615 shares of the company's stock, valued at approximately $5,015,725. The trade was a 1.90 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 1.72% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on SLAB. StockNews.com raised Silicon Laboratories to a "sell" rating in a research note on Friday, November 8th. Needham & Company LLC reissued a "buy" rating and issued a $150.00 price target on shares of Silicon Laboratories in a research note on Thursday, July 25th. Barclays dropped their price objective on shares of Silicon Laboratories from $120.00 to $75.00 and set an "equal weight" rating for the company in a research note on Tuesday, November 5th. Benchmark reiterated a "hold" rating on shares of Silicon Laboratories in a report on Tuesday, November 5th. Finally, KeyCorp dropped their price target on shares of Silicon Laboratories from $150.00 to $115.00 and set an "overweight" rating for the company in a research report on Tuesday, November 5th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $121.50.

View Our Latest Stock Report on Silicon Laboratories

Silicon Laboratories Profile

(

Free Report)

Silicon Laboratories Inc, a fabless semiconductor company, provides various analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally. The company's products include wireless microcontrollers and sensor products. Its products are used in various electronic products in a range of applications for the industrial Internet of Things (IoT), including industrial automation and control, smart buildings, access control, HVAC control, and industrial wearables and power tools; smart cities applications, such as smart metering, smart street lighting, renewable energy, electric vehicle supply equipment, and smart agriculture; commercial IoT applications, including smart lighting, asset tracking, electronic shelf labels, theft protection, and enterprise access points; smart home applications, comprising home automation/security systems, smart speakers, smart lighting, HVAC control, smart cameras, smart appliances, smart home sensing, smart locks, and window/blind controls; and connected health applications, including diabetes management, consumer health and fitness, elderly care, patient monitoring, and activity tracking; as well as in commercial building automation, consumer electronics, and medical instrumentation.

Featured Articles

Before you consider Silicon Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicon Laboratories wasn't on the list.

While Silicon Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.