Y Intercept Hong Kong Ltd trimmed its holdings in Patria Investments Limited (NYSE:PAX - Free Report) by 61.8% in the third quarter, according to its most recent disclosure with the SEC. The fund owned 45,957 shares of the company's stock after selling 74,332 shares during the period. Y Intercept Hong Kong Ltd owned 0.08% of Patria Investments worth $513,000 at the end of the most recent reporting period.

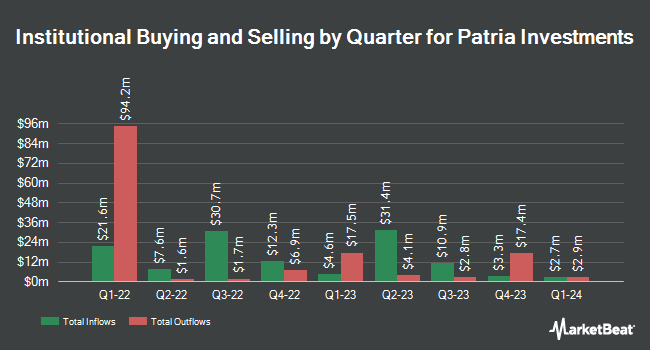

Several other large investors have also modified their holdings of the stock. Coronation Fund Managers Ltd. grew its stake in shares of Patria Investments by 1.3% during the 2nd quarter. Coronation Fund Managers Ltd. now owns 93,916 shares of the company's stock worth $1,133,000 after purchasing an additional 1,228 shares during the period. Bank of New York Mellon Corp increased its holdings in Patria Investments by 13.3% during the 2nd quarter. Bank of New York Mellon Corp now owns 181,777 shares of the company's stock valued at $2,192,000 after acquiring an additional 21,282 shares in the last quarter. Commonwealth Equity Services LLC lifted its holdings in shares of Patria Investments by 24.9% in the second quarter. Commonwealth Equity Services LLC now owns 22,851 shares of the company's stock valued at $276,000 after purchasing an additional 4,551 shares in the last quarter. Rhumbline Advisers grew its position in shares of Patria Investments by 10.1% in the second quarter. Rhumbline Advisers now owns 77,732 shares of the company's stock valued at $937,000 after purchasing an additional 7,158 shares during the last quarter. Finally, Allegheny Financial Group LTD increased its stake in shares of Patria Investments by 43.6% during the 2nd quarter. Allegheny Financial Group LTD now owns 22,728 shares of the company's stock worth $274,000 after purchasing an additional 6,899 shares in the last quarter. Hedge funds and other institutional investors own 96.27% of the company's stock.

Analyst Ratings Changes

Separately, The Goldman Sachs Group lowered their target price on Patria Investments from $16.00 to $14.00 and set a "buy" rating on the stock in a report on Tuesday, October 22nd.

Check Out Our Latest Stock Report on PAX

Patria Investments Trading Down 1.2 %

Shares of NYSE:PAX traded down $0.15 during trading on Monday, reaching $12.40. The stock had a trading volume of 438,056 shares, compared to its average volume of 471,116. The company has a quick ratio of 0.88, a current ratio of 0.88 and a debt-to-equity ratio of 0.31. The stock has a market cap of $741.15 million, a P/E ratio of 28.84, a PEG ratio of 1.74 and a beta of 0.58. The business has a fifty day moving average price of $11.92 and a 200-day moving average price of $11.95. Patria Investments Limited has a fifty-two week low of $10.63 and a fifty-two week high of $16.16.

Patria Investments (NYSE:PAX - Get Free Report) last issued its quarterly earnings results on Tuesday, November 5th. The company reported $0.23 earnings per share for the quarter, missing analysts' consensus estimates of $0.24 by ($0.01). Patria Investments had a return on equity of 34.00% and a net margin of 19.68%. The business had revenue of $78.10 million for the quarter, compared to analysts' expectations of $76.55 million. During the same period in the prior year, the company earned $0.23 EPS. As a group, analysts anticipate that Patria Investments Limited will post 1.05 earnings per share for the current fiscal year.

Patria Investments Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, December 9th. Shareholders of record on Monday, November 18th were paid a dividend of $0.15 per share. This represents a $0.60 dividend on an annualized basis and a yield of 4.84%. The ex-dividend date was Monday, November 18th. Patria Investments's dividend payout ratio is currently 139.53%.

About Patria Investments

(

Free Report)

Patria Investments Limited operates as a private market investment firm focused on investing in Latin America. The company offers asset management services to investors focusing on private equity funds, infrastructure development funds, co-investments funds, constructivist equity funds, and real estate and credit funds.

Featured Articles

Before you consider Patria Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Patria Investments wasn't on the list.

While Patria Investments currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.