Chartwell Investment Partners LLC cut its position in shares of Patrick Industries, Inc. (NASDAQ:PATK - Free Report) by 10.1% during the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 45,168 shares of the construction company's stock after selling 5,069 shares during the period. Chartwell Investment Partners LLC owned 0.20% of Patrick Industries worth $6,431,000 as of its most recent filing with the SEC.

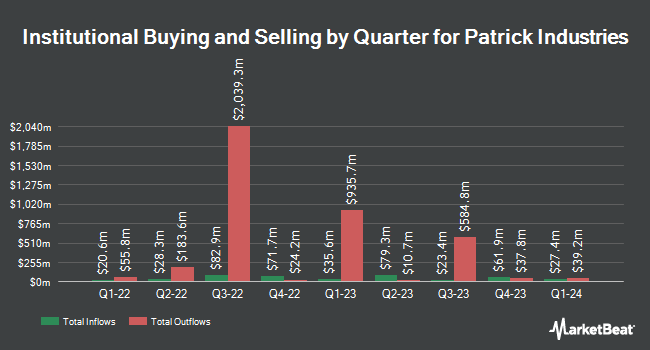

A number of other institutional investors have also recently made changes to their positions in the company. BNP Paribas Financial Markets lifted its holdings in shares of Patrick Industries by 52.4% in the 1st quarter. BNP Paribas Financial Markets now owns 11,163 shares of the construction company's stock valued at $1,334,000 after buying an additional 3,837 shares during the period. Texas Permanent School Fund Corp raised its stake in Patrick Industries by 1.3% during the 1st quarter. Texas Permanent School Fund Corp now owns 18,209 shares of the construction company's stock valued at $2,175,000 after purchasing an additional 236 shares during the period. Illinois Municipal Retirement Fund lifted its position in Patrick Industries by 7.4% in the 1st quarter. Illinois Municipal Retirement Fund now owns 12,684 shares of the construction company's stock worth $1,515,000 after buying an additional 869 shares in the last quarter. Inspire Investing LLC raised its holdings in shares of Patrick Industries by 48.9% during the 1st quarter. Inspire Investing LLC now owns 6,547 shares of the construction company's stock valued at $782,000 after purchasing an additional 2,150 shares in the last quarter. Finally, Russell Investments Group Ltd. boosted its holdings in Patrick Industries by 21.1% during the first quarter. Russell Investments Group Ltd. now owns 14,302 shares of the construction company's stock valued at $1,709,000 after acquiring an additional 2,492 shares during the period. 93.29% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, insider Jeff Rodino sold 20,000 shares of the stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $131.37, for a total transaction of $2,627,400.00. Following the completion of the sale, the insider now owns 139,109 shares of the company's stock, valued at $18,274,749.33. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In other news, insider Jeff Rodino sold 20,000 shares of the stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $131.37, for a total transaction of $2,627,400.00. Following the sale, the insider now owns 139,109 shares of the company's stock, valued at approximately $18,274,749.33. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Todd M. Cleveland sold 7,500 shares of the business's stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $131.05, for a total value of $982,875.00. Following the completion of the transaction, the director now directly owns 82,374 shares in the company, valued at approximately $10,795,112.70. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 29,411 shares of company stock valued at $3,858,915 in the last ninety days. 4.70% of the stock is owned by company insiders.

Patrick Industries Trading Down 1.7 %

Shares of PATK stock traded down $2.27 during mid-day trading on Tuesday, reaching $129.84. The stock had a trading volume of 332,176 shares, compared to its average volume of 186,487. Patrick Industries, Inc. has a 52-week low of $76.59 and a 52-week high of $148.35. The company has a current ratio of 2.41, a quick ratio of 0.97 and a debt-to-equity ratio of 1.22. The stock's 50-day moving average price is $136.03 and its two-hundred day moving average price is $122.79. The firm has a market capitalization of $2.91 billion, a PE ratio of 18.98, a price-to-earnings-growth ratio of 1.33 and a beta of 1.62.

Patrick Industries (NASDAQ:PATK - Get Free Report) last issued its earnings results on Thursday, October 31st. The construction company reported $1.80 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.83 by ($0.03). The firm had revenue of $919.44 million during the quarter, compared to analysts' expectations of $935.75 million. Patrick Industries had a return on equity of 14.84% and a net margin of 4.24%. The firm's quarterly revenue was up 6.2% on a year-over-year basis. During the same period last year, the firm posted $1.81 earnings per share. Equities analysts expect that Patrick Industries, Inc. will post 6.42 earnings per share for the current fiscal year.

Patrick Industries Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 9th. Shareholders of record on Monday, August 26th were paid a $0.55 dividend. The ex-dividend date of this dividend was Monday, August 26th. This represents a $2.20 dividend on an annualized basis and a dividend yield of 1.69%. Patrick Industries's payout ratio is currently 31.61%.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on PATK shares. Raymond James decreased their price objective on Patrick Industries from $160.00 to $136.00 and set an "outperform" rating on the stock in a report on Friday, November 1st. KeyCorp increased their price objective on shares of Patrick Industries from $135.00 to $150.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 23rd. Truist Financial upped their price target on shares of Patrick Industries from $150.00 to $165.00 and gave the company a "buy" rating in a research note on Friday, September 20th. BMO Capital Markets raised their target price on shares of Patrick Industries from $150.00 to $155.00 and gave the company an "outperform" rating in a report on Friday, November 1st. Finally, DA Davidson upped their price target on shares of Patrick Industries from $108.00 to $114.00 and gave the stock a "neutral" rating in a report on Monday, August 5th. Two analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat, Patrick Industries currently has a consensus rating of "Moderate Buy" and an average price target of $139.88.

Check Out Our Latest Stock Analysis on PATK

Patrick Industries Profile

(

Free Report)

Patrick Industries, Inc manufactures and distributes component products and materials for the recreational vehicle, marine, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada. Its Manufacturing segment manufactures and sells laminated products for furniture, shelving, wall, countertop, and cabinet products; cabinet doors, fiberglass bath fixtures, and tile systems; hardwood furniture, vinyl printing, amplifiers, tower speakers, soundbars, and subwoofers; solid surface, granite, and quartz countertop fabrication; aluminum products; fiberglass and plastic components; RV paintings; decorative vinyl and paper laminated panels; softwoods lumber; custom cabinets; polymer-based flooring products; dash panels; and other products.

Further Reading

Before you consider Patrick Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Patrick Industries wasn't on the list.

While Patrick Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report