Dillon & Associates Inc. reduced its holdings in Paycom Software, Inc. (NYSE:PAYC - Free Report) by 10.4% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 59,360 shares of the software maker's stock after selling 6,859 shares during the quarter. Paycom Software comprises 1.4% of Dillon & Associates Inc.'s investment portfolio, making the stock its 25th largest position. Dillon & Associates Inc. owned approximately 0.10% of Paycom Software worth $9,913,000 as of its most recent SEC filing.

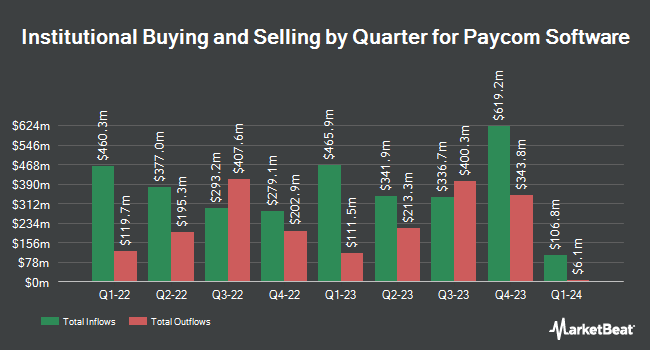

Several other large investors have also added to or reduced their stakes in PAYC. Sylebra Capital LLC boosted its stake in Paycom Software by 53.9% during the 2nd quarter. Sylebra Capital LLC now owns 1,957,468 shares of the software maker's stock valued at $279,996,000 after purchasing an additional 685,190 shares during the last quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA lifted its holdings in Paycom Software by 9.4% in the 2nd quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 1,069,104 shares of the software maker's stock worth $152,925,000 after purchasing an additional 92,049 shares in the last quarter. Federated Hermes Inc. grew its stake in Paycom Software by 1,011.2% during the second quarter. Federated Hermes Inc. now owns 581,964 shares of the software maker's stock valued at $83,244,000 after acquiring an additional 529,591 shares in the last quarter. Bank of New York Mellon Corp lifted its position in shares of Paycom Software by 6.3% in the second quarter. Bank of New York Mellon Corp now owns 455,271 shares of the software maker's stock worth $65,122,000 after buying an additional 26,934 shares in the last quarter. Finally, Confluence Investment Management LLC raised its stake in Paycom Software by 147.3% during the third quarter. Confluence Investment Management LLC now owns 377,876 shares of the software maker's stock valued at $62,943,000 after purchasing an additional 225,081 shares in the last quarter. Institutional investors own 87.77% of the company's stock.

Insider Buying and Selling

In related news, CEO Chad R. Richison sold 1,950 shares of the business's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $228.38, for a total value of $445,341.00. Following the transaction, the chief executive officer now owns 2,735,310 shares in the company, valued at approximately $624,690,097.80. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. In the last quarter, insiders sold 60,450 shares of company stock valued at $10,535,480. 14.50% of the stock is currently owned by corporate insiders.

Paycom Software Stock Down 0.1 %

Shares of PAYC traded down $0.15 during mid-day trading on Wednesday, reaching $228.74. 132,717 shares of the company's stock were exchanged, compared to its average volume of 813,971. Paycom Software, Inc. has a 52-week low of $139.50 and a 52-week high of $233.69. The company has a market cap of $13.19 billion, a price-to-earnings ratio of 27.69, a PEG ratio of 3.06 and a beta of 1.14. The company has a 50-day simple moving average of $174.86 and a two-hundred day simple moving average of $164.60.

Paycom Software Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 9th. Stockholders of record on Monday, November 25th will be issued a dividend of $0.375 per share. The ex-dividend date of this dividend is Monday, November 25th. This represents a $1.50 dividend on an annualized basis and a dividend yield of 0.66%. Paycom Software's payout ratio is 18.05%.

Wall Street Analyst Weigh In

A number of research firms recently commented on PAYC. Needham & Company LLC reaffirmed a "hold" rating on shares of Paycom Software in a research note on Thursday, August 1st. TD Cowen lifted their price target on Paycom Software from $171.00 to $188.00 and gave the company a "hold" rating in a report on Monday, September 23rd. Piper Sandler upped their price target on Paycom Software from $160.00 to $191.00 and gave the stock a "neutral" rating in a research report on Thursday, October 31st. Barclays lifted their target price on shares of Paycom Software from $172.00 to $181.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 31st. Finally, Jefferies Financial Group raised their price objective on Paycom Software from $170.00 to $175.00 and gave the stock a "hold" rating in a research note on Thursday, October 31st. Twelve equities research analysts have rated the stock with a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $193.67.

Get Our Latest Stock Analysis on PAYC

Paycom Software Company Profile

(

Free Report)

Paycom Software, Inc provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States. It offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.

Featured Articles

Before you consider Paycom Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycom Software wasn't on the list.

While Paycom Software currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.