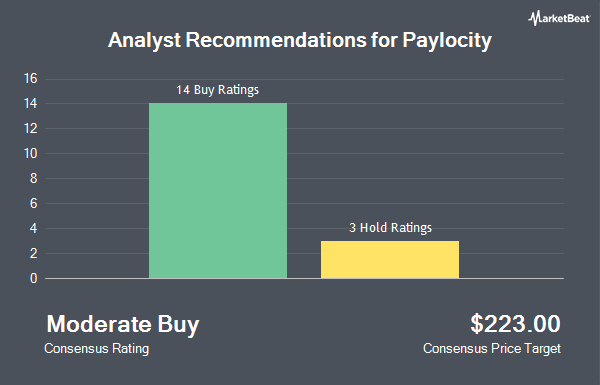

Shares of Paylocity Holding Co. (NASDAQ:PCTY - Get Free Report) have received a consensus rating of "Moderate Buy" from the fourteen analysts that are currently covering the stock, Marketbeat Ratings reports. Three research analysts have rated the stock with a hold rating and eleven have given a buy rating to the company. The average 1 year price objective among brokerages that have updated their coverage on the stock in the last year is $205.71.

A number of analysts recently commented on the company. Mizuho increased their price target on Paylocity from $180.00 to $200.00 and gave the company a "neutral" rating in a research report on Friday. KeyCorp increased their price target on Paylocity from $187.00 to $210.00 and gave the company an "overweight" rating in a research report on Thursday, October 31st. BMO Capital Markets increased their price target on Paylocity from $175.00 to $203.00 and gave the company an "outperform" rating in a research report on Thursday, October 31st. Jefferies Financial Group increased their price target on Paylocity from $215.00 to $240.00 and gave the company a "buy" rating in a research report on Monday, December 9th. Finally, StockNews.com raised Paylocity from a "hold" rating to a "buy" rating in a research report on Saturday, December 7th.

Check Out Our Latest Analysis on PCTY

Insider Transactions at Paylocity

In other Paylocity news, Director Steven I. Sarowitz sold 13,689 shares of the firm's stock in a transaction dated Wednesday, December 11th. The stock was sold at an average price of $203.29, for a total transaction of $2,782,836.81. Following the sale, the director now owns 8,385,954 shares in the company, valued at $1,704,780,588.66. This trade represents a 0.16 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Ryan Glenn sold 2,600 shares of the firm's stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $205.40, for a total value of $534,040.00. Following the sale, the chief financial officer now owns 48,150 shares in the company, valued at $9,890,010. The trade was a 5.12 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 129,089 shares of company stock valued at $25,991,644 over the last three months. Company insiders own 21.91% of the company's stock.

Institutional Inflows and Outflows

Several large investors have recently modified their holdings of PCTY. CWM LLC increased its holdings in shares of Paylocity by 103.3% in the second quarter. CWM LLC now owns 557 shares of the software maker's stock worth $73,000 after buying an additional 283 shares during the period. SG Americas Securities LLC increased its holdings in Paylocity by 2.9% during the 2nd quarter. SG Americas Securities LLC now owns 5,843 shares of the software maker's stock valued at $770,000 after purchasing an additional 162 shares during the period. Washington Capital Management Inc. increased its holdings in Paylocity by 62.6% during the 2nd quarter. Washington Capital Management Inc. now owns 5,530 shares of the software maker's stock valued at $729,000 after purchasing an additional 2,130 shares during the period. Neo Ivy Capital Management purchased a new position in Paylocity during the 2nd quarter valued at about $3,014,000. Finally, Harel Insurance Investments & Financial Services Ltd. increased its holdings in Paylocity by 26,132.2% during the 2nd quarter. Harel Insurance Investments & Financial Services Ltd. now owns 15,477 shares of the software maker's stock valued at $2,046,000 after purchasing an additional 15,418 shares during the period. Hedge funds and other institutional investors own 94.76% of the company's stock.

Paylocity Stock Down 2.2 %

Shares of Paylocity stock traded down $4.42 on Friday, hitting $200.17. The company had a trading volume of 364,430 shares, compared to its average volume of 491,655. The company has a debt-to-equity ratio of 0.29, a quick ratio of 1.32 and a current ratio of 1.32. The stock has a market capitalization of $11.16 billion, a price-to-earnings ratio of 51.19, a P/E/G ratio of 5.00 and a beta of 0.92. The stock has a 50 day moving average of $191.97 and a 200-day moving average of $164.21. Paylocity has a 1 year low of $129.94 and a 1 year high of $215.68.

Paylocity Company Profile

(

Get Free ReportPaylocity Holding Corporation engages in the provision of cloud-based human capital management and payroll software solutions for workforce in the United States. The company offers payroll software solution for global payroll, expense management, tax services, on demand payment, and garnishment managed services; and time and labor management software for time and attendance, scheduling, and time collection.

Further Reading

Before you consider Paylocity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paylocity wasn't on the list.

While Paylocity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.