Cerity Partners LLC boosted its holdings in Paylocity Holding Co. (NASDAQ:PCTY - Free Report) by 28.6% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 17,046 shares of the software maker's stock after acquiring an additional 3,794 shares during the quarter. Cerity Partners LLC's holdings in Paylocity were worth $2,812,000 as of its most recent SEC filing.

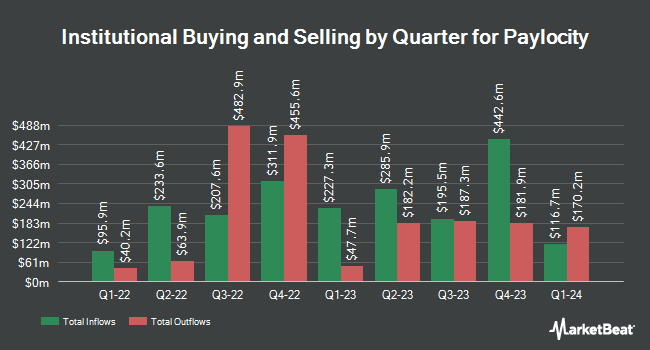

A number of other institutional investors and hedge funds also recently bought and sold shares of PCTY. Liontrust Investment Partners LLP raised its holdings in shares of Paylocity by 27.1% in the 2nd quarter. Liontrust Investment Partners LLP now owns 810,314 shares of the software maker's stock worth $106,840,000 after purchasing an additional 172,807 shares in the last quarter. Van Berkom & Associates Inc. increased its holdings in shares of Paylocity by 20.5% in the second quarter. Van Berkom & Associates Inc. now owns 579,801 shares of the software maker's stock valued at $76,447,000 after buying an additional 98,478 shares in the last quarter. Bank of New York Mellon Corp lifted its position in shares of Paylocity by 4.7% during the 2nd quarter. Bank of New York Mellon Corp now owns 472,686 shares of the software maker's stock valued at $62,324,000 after acquiring an additional 21,127 shares during the last quarter. Dimensional Fund Advisors LP boosted its stake in shares of Paylocity by 58.3% during the 2nd quarter. Dimensional Fund Advisors LP now owns 335,946 shares of the software maker's stock worth $44,296,000 after acquiring an additional 123,744 shares in the last quarter. Finally, Millennium Management LLC grew its holdings in shares of Paylocity by 435.2% in the 2nd quarter. Millennium Management LLC now owns 331,253 shares of the software maker's stock worth $43,676,000 after acquiring an additional 269,354 shares during the last quarter. 94.76% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

PCTY has been the subject of a number of recent analyst reports. JMP Securities reiterated a "market outperform" rating and issued a $250.00 price target on shares of Paylocity in a research report on Monday, August 5th. BMO Capital Markets raised their target price on shares of Paylocity from $175.00 to $203.00 and gave the stock an "outperform" rating in a report on Thursday, October 31st. StockNews.com lowered shares of Paylocity from a "buy" rating to a "hold" rating in a report on Friday. KeyCorp raised their price objective on shares of Paylocity from $187.00 to $210.00 and gave the stock an "overweight" rating in a research note on Thursday, October 31st. Finally, Mizuho boosted their target price on shares of Paylocity from $175.00 to $180.00 and gave the company a "neutral" rating in a research note on Monday, November 4th. Four investment analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $196.64.

View Our Latest Research Report on PCTY

Insider Activity

In other news, Director Steven I. Sarowitz sold 15,444 shares of the business's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $195.43, for a total value of $3,018,220.92. Following the completion of the sale, the director now directly owns 9,272,906 shares in the company, valued at approximately $1,812,204,019.58. The trade was a 0.17 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Jeffrey T. Diehl sold 4,513 shares of the firm's stock in a transaction on Monday, November 25th. The shares were sold at an average price of $209.91, for a total transaction of $947,323.83. Following the completion of the transaction, the director now owns 1,003 shares in the company, valued at $210,539.73. The trade was a 81.82 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 75,790 shares of company stock worth $15,004,635. 21.91% of the stock is owned by corporate insiders.

Paylocity Stock Down 1.1 %

Shares of PCTY traded down $2.33 during midday trading on Friday, reaching $207.54. 226,511 shares of the stock were exchanged, compared to its average volume of 466,489. The company has a market cap of $11.57 billion, a price-to-earnings ratio of 53.08, a P/E/G ratio of 5.11 and a beta of 0.93. The company has a quick ratio of 1.32, a current ratio of 1.32 and a debt-to-equity ratio of 0.29. Paylocity Holding Co. has a 12-month low of $129.94 and a 12-month high of $215.68. The firm has a 50 day simple moving average of $183.90 and a 200-day simple moving average of $161.32.

Paylocity Profile

(

Free Report)

Paylocity Holding Corporation engages in the provision of cloud-based human capital management and payroll software solutions for workforce in the United States. The company offers payroll software solution for global payroll, expense management, tax services, on demand payment, and garnishment managed services; and time and labor management software for time and attendance, scheduling, and time collection.

See Also

Before you consider Paylocity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paylocity wasn't on the list.

While Paylocity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.