PCJ Investment Counsel Ltd. decreased its stake in Endeavour Silver Corp. (NYSE:EXK - Free Report) TSE: EDR by 43.5% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 198,620 shares of the mining company's stock after selling 152,710 shares during the period. PCJ Investment Counsel Ltd. owned approximately 0.08% of Endeavour Silver worth $784,000 at the end of the most recent reporting period.

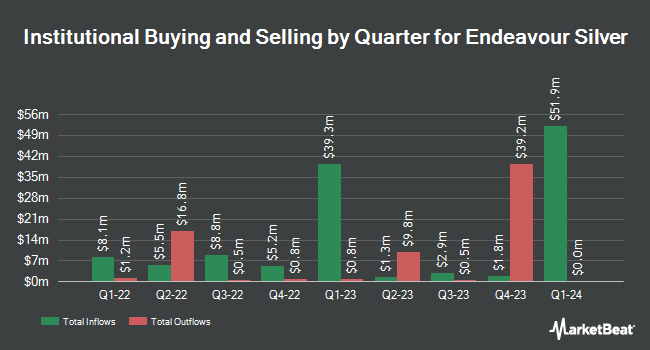

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in EXK. SG Americas Securities LLC lifted its position in shares of Endeavour Silver by 61.6% during the 1st quarter. SG Americas Securities LLC now owns 20,603 shares of the mining company's stock worth $50,000 after buying an additional 7,852 shares during the last quarter. B. Riley Wealth Advisors Inc. raised its position in shares of Endeavour Silver by 9.7% in the 1st quarter. B. Riley Wealth Advisors Inc. now owns 76,800 shares of the mining company's stock worth $187,000 after acquiring an additional 6,800 shares in the last quarter. Tidal Investments LLC purchased a new position in shares of Endeavour Silver in the 1st quarter worth $19,008,000. Virtu Financial LLC raised its holdings in Endeavour Silver by 158.3% during the first quarter. Virtu Financial LLC now owns 147,287 shares of the mining company's stock valued at $355,000 after acquiring an additional 90,259 shares during the period. Finally, Baader Bank Aktiengesellschaft purchased a new position in shares of Endeavour Silver during the second quarter valued at approximately $42,000. 20.06% of the stock is currently owned by institutional investors and hedge funds.

Endeavour Silver Stock Performance

NYSE EXK traded down $0.47 on Wednesday, hitting $4.47. 10,516,912 shares of the company's stock were exchanged, compared to its average volume of 5,554,897. The firm has a market cap of $1.10 billion, a price-to-earnings ratio of -34.62 and a beta of 1.67. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.39 and a quick ratio of 1.07. The firm's 50-day moving average price is $4.44 and its two-hundred day moving average price is $3.92. Endeavour Silver Corp. has a fifty-two week low of $1.42 and a fifty-two week high of $5.67.

Endeavour Silver (NYSE:EXK - Get Free Report) TSE: EDR last announced its earnings results on Tuesday, November 5th. The mining company reported $0.01 EPS for the quarter, topping the consensus estimate of ($0.01) by $0.02. Endeavour Silver had a positive return on equity of 0.97% and a negative net margin of 13.04%. The firm had revenue of $53.40 million for the quarter, compared to analysts' expectations of $54.91 million. During the same quarter in the previous year, the company earned ($0.04) earnings per share. The firm's quarterly revenue was up 7.9% compared to the same quarter last year. On average, research analysts expect that Endeavour Silver Corp. will post 0.04 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of analysts have commented on EXK shares. Alliance Global Partners increased their price objective on shares of Endeavour Silver from $5.25 to $6.25 and gave the company a "buy" rating in a report on Tuesday, October 22nd. HC Wainwright boosted their price target on Endeavour Silver from $6.00 to $7.25 and gave the stock a "buy" rating in a research report on Wednesday, November 6th. StockNews.com raised Endeavour Silver to a "sell" rating in a report on Wednesday, November 6th. Finally, Ventum Cap Mkts upgraded Endeavour Silver to a "strong-buy" rating in a research report on Wednesday, November 13th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $6.63.

Check Out Our Latest Report on Endeavour Silver

Endeavour Silver Company Profile

(

Free Report)

Endeavour Silver Corp., a silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Chile and the United States. It explores for gold and silver deposits, and precious metals. The company was formerly known as Endeavour Gold Corp.

Featured Stories

Before you consider Endeavour Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Endeavour Silver wasn't on the list.

While Endeavour Silver currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.