PCJ Investment Counsel Ltd. reduced its position in Denison Mines Corp. (NYSEAMERICAN:DNN - Free Report) TSE: DML by 39.9% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 794,390 shares of the basic materials company's stock after selling 528,210 shares during the period. PCJ Investment Counsel Ltd. owned 0.09% of Denison Mines worth $1,445,000 at the end of the most recent quarter.

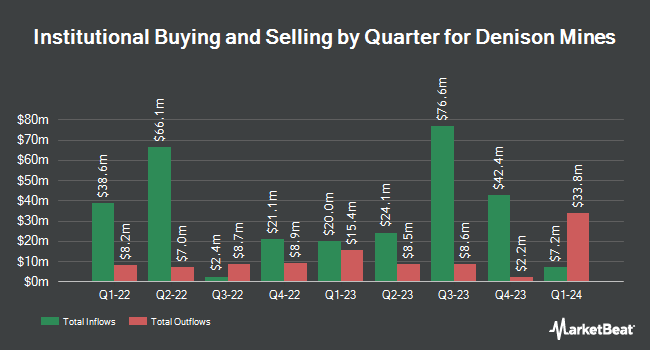

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Aigen Investment Management LP grew its position in Denison Mines by 32.4% during the 3rd quarter. Aigen Investment Management LP now owns 192,983 shares of the basic materials company's stock worth $351,000 after purchasing an additional 47,252 shares in the last quarter. Confluence Investment Management LLC grew its position in shares of Denison Mines by 5.9% in the 3rd quarter. Confluence Investment Management LLC now owns 257,386 shares of the basic materials company's stock valued at $471,000 after acquiring an additional 14,247 shares during the period. Arlington Capital Management Inc. raised its stake in Denison Mines by 3.2% in the 3rd quarter. Arlington Capital Management Inc. now owns 441,192 shares of the basic materials company's stock worth $807,000 after purchasing an additional 13,481 shares in the last quarter. Van ECK Associates Corp increased its position in Denison Mines by 96.8% in the 3rd quarter. Van ECK Associates Corp now owns 14,574,159 shares of the basic materials company's stock valued at $26,671,000 after acquiring an additional 7,168,934 shares during the period. Finally, Legacy Capital Group California Inc. grew its holdings in Denison Mines by 47.5% in the third quarter. Legacy Capital Group California Inc. now owns 34,372 shares of the basic materials company's stock worth $63,000 after purchasing an additional 11,066 shares during the period. Institutional investors and hedge funds own 36.74% of the company's stock.

Analysts Set New Price Targets

A number of brokerages recently issued reports on DNN. StockNews.com upgraded Denison Mines to a "sell" rating in a research report on Wednesday, July 31st. Roth Mkm reissued a "buy" rating and set a $2.75 target price (up previously from $2.60) on shares of Denison Mines in a research note on Wednesday, October 23rd. CIBC began coverage on Denison Mines in a research note on Thursday, September 26th. They issued a "sector outperform" rating and a $3.25 price target on the stock. Cibc World Mkts raised Denison Mines to a "strong-buy" rating in a research report on Thursday, September 26th. Finally, National Bank Financial upgraded Denison Mines to a "strong-buy" rating in a research report on Tuesday, September 3rd. One research analyst has rated the stock with a sell rating, three have given a buy rating and four have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Buy" and an average price target of $3.00.

Read Our Latest Analysis on DNN

Denison Mines Stock Down 5.1 %

Shares of DNN traded down $0.12 during trading hours on Wednesday, hitting $2.25. The stock had a trading volume of 18,705,572 shares, compared to its average volume of 16,779,535. Denison Mines Corp. has a 1-year low of $1.40 and a 1-year high of $2.47. The business's 50 day moving average is $1.99. The firm has a market cap of $2.01 billion, a price-to-earnings ratio of -237.00 and a beta of 1.69.

Denison Mines Company Profile

(

Free Report)

Denison Mines Corp. engages in the acquisition, exploration, and development of uranium bearing properties in Canada. Its flagship project is the Wheeler River uranium project covering an area of approximately 300,000 hectares located in the Athabasca Basin region in northern Saskatchewan. The company was formerly known as International Uranium Corporation and changed its name to Denison Mines Corp.

See Also

Before you consider Denison Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Denison Mines wasn't on the list.

While Denison Mines currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.