PCJ Investment Counsel Ltd. lessened its position in Ero Copper Corp. (NYSE:ERO - Free Report) by 41.7% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 99,300 shares of the company's stock after selling 71,150 shares during the period. PCJ Investment Counsel Ltd. owned approximately 0.10% of Ero Copper worth $2,210,000 as of its most recent filing with the SEC.

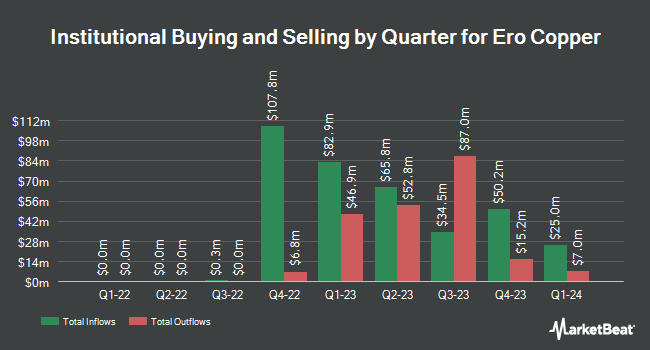

Other large investors have also recently added to or reduced their stakes in the company. Boston Partners raised its stake in shares of Ero Copper by 226.9% during the first quarter. Boston Partners now owns 726,068 shares of the company's stock worth $14,010,000 after acquiring an additional 503,972 shares in the last quarter. Dimensional Fund Advisors LP raised its position in Ero Copper by 32.9% during the second quarter. Dimensional Fund Advisors LP now owns 464,047 shares of the company's stock valued at $9,922,000 after acquiring an additional 115,002 shares in the last quarter. Goehring & Rozencwajg Associates LLC boosted its stake in Ero Copper by 22.5% during the second quarter. Goehring & Rozencwajg Associates LLC now owns 340,008 shares of the company's stock worth $7,266,000 after buying an additional 62,500 shares during the last quarter. Old West Investment Management LLC grew its stake in Ero Copper by 100.0% during the 3rd quarter. Old West Investment Management LLC now owns 160,000 shares of the company's stock worth $3,563,000 after purchasing an additional 80,000 shares in the last quarter. Finally, Van ECK Associates Corp grew its stake in Ero Copper by 3.1% during the 3rd quarter. Van ECK Associates Corp now owns 136,990 shares of the company's stock worth $3,051,000 after buying an additional 4,097 shares during the last quarter. Institutional investors and hedge funds own 71.30% of the company's stock.

Ero Copper Stock Down 1.5 %

NYSE:ERO traded down $0.24 during trading hours on Wednesday, hitting $15.87. 146,096 shares of the company traded hands, compared to its average volume of 336,092. The company has a quick ratio of 0.60, a current ratio of 0.82 and a debt-to-equity ratio of 0.59. The company has a market cap of $1.64 billion, a PE ratio of 94.71 and a beta of 1.23. Ero Copper Corp. has a one year low of $11.96 and a one year high of $24.34. The firm's 50-day simple moving average is $19.64 and its 200-day simple moving average is $20.34.

Analyst Ratings Changes

ERO has been the subject of several recent research reports. Jefferies Financial Group raised Ero Copper from a "hold" rating to a "buy" rating in a report on Monday, August 5th. Raymond James upgraded shares of Ero Copper from a "market perform" rating to an "outperform" rating in a report on Tuesday, September 3rd. Bank of America began coverage on shares of Ero Copper in a research report on Tuesday, September 3rd. They set a "buy" rating and a $28.00 price target for the company. Finally, StockNews.com upgraded shares of Ero Copper from a "sell" rating to a "hold" rating in a research report on Friday, October 25th. One analyst has rated the stock with a hold rating, six have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Buy" and a consensus price target of $30.00.

Check Out Our Latest Analysis on Ero Copper

Ero Copper Profile

(

Free Report)

Ero Copper Corp. engages in the exploration, development, and production of mining projects in Brazil. The company is involved in the production and sale of copper concentrate from the Caraíba operations located in the Curaçá Valley, northeastern Bahia state, Brazil, as well as gold and silver by-products.

Featured Articles

Before you consider Ero Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ero Copper wasn't on the list.

While Ero Copper currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.