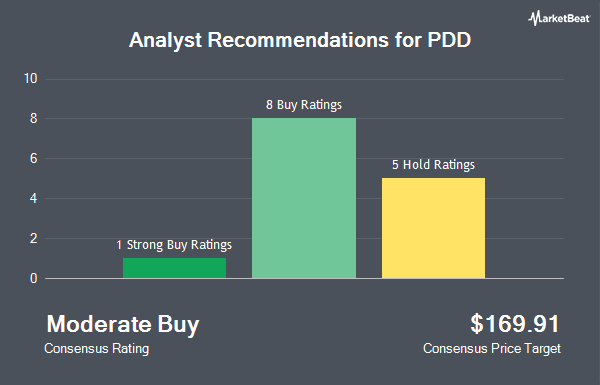

PDD Holdings Inc. (NASDAQ:PDD - Get Free Report) has earned an average recommendation of "Buy" from the twelve brokerages that are currently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a hold recommendation, nine have issued a buy recommendation and two have issued a strong buy recommendation on the company. The average twelve-month price target among brokerages that have covered the stock in the last year is $182.40.

Several analysts recently weighed in on PDD shares. Barclays dropped their target price on shares of PDD from $224.00 to $158.00 and set an "overweight" rating for the company in a report on Tuesday, August 27th. Daiwa America upgraded shares of PDD to a "strong-buy" rating in a research note on Tuesday, August 27th. Nomura Securities raised shares of PDD to a "strong-buy" rating in a research note on Tuesday, August 27th. Sanford C. Bernstein cut their target price on shares of PDD from $235.00 to $170.00 and set an "outperform" rating on the stock in a research note on Tuesday, August 27th. Finally, Citigroup cut shares of PDD from a "buy" rating to a "neutral" rating and decreased their price target for the company from $194.00 to $120.00 in a research report on Tuesday, August 27th.

Get Our Latest Stock Analysis on PDD

PDD Price Performance

PDD stock traded down $8.06 during mid-day trading on Friday, reaching $117.81. The company's stock had a trading volume of 15,150,266 shares, compared to its average volume of 10,634,343. The company has a current ratio of 2.11, a quick ratio of 2.11 and a debt-to-equity ratio of 0.02. The company's 50 day moving average is $119.63 and its two-hundred day moving average is $131.00. PDD has a fifty-two week low of $88.01 and a fifty-two week high of $164.69. The stock has a market cap of $162.09 billion, a PE ratio of 12.70, a P/E/G ratio of 0.29 and a beta of 0.71.

PDD (NASDAQ:PDD - Get Free Report) last issued its earnings results on Monday, August 26th. The company reported $23.24 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.66 by $20.58. PDD had a return on equity of 48.14% and a net margin of 28.92%. The company had revenue of $97.06 billion during the quarter, compared to analysts' expectations of $100.17 billion. During the same period in the prior year, the business earned $1.27 EPS. The firm's quarterly revenue was up 85.7% on a year-over-year basis. Equities research analysts expect that PDD will post 11.19 EPS for the current year.

Institutional Investors Weigh In On PDD

A number of institutional investors and hedge funds have recently made changes to their positions in the business. Anthracite Investment Company Inc. purchased a new stake in shares of PDD during the third quarter worth approximately $4,044,000. Advisors Asset Management Inc. increased its stake in PDD by 39.9% in the 3rd quarter. Advisors Asset Management Inc. now owns 4,148 shares of the company's stock valued at $559,000 after buying an additional 1,184 shares during the period. Prospera Private Wealth LLC acquired a new position in PDD in the 3rd quarter valued at $27,000. Avior Wealth Management LLC raised its position in PDD by 50.9% during the 3rd quarter. Avior Wealth Management LLC now owns 501 shares of the company's stock worth $68,000 after buying an additional 169 shares during the last quarter. Finally, West Family Investments Inc. lifted its stake in shares of PDD by 7.1% in the 3rd quarter. West Family Investments Inc. now owns 3,144 shares of the company's stock worth $424,000 after acquiring an additional 208 shares during the period. 29.07% of the stock is owned by hedge funds and other institutional investors.

About PDD

(

Get Free ReportPDD Holdings Inc, a multinational commerce group, owns and operates a portfolio of businesses. It operates Pinduoduo, an e-commerce platform that offers products in various categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverage, electronic appliances, furniture and household goods, cosmetics and other personal care, sports and fitness items and auto accessories; and Temu, an online marketplace.

Read More

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.