APEIRON CAPITAL Ltd cut its position in PDD Holdings Inc. (NASDAQ:PDD - Free Report) by 28.8% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 89,000 shares of the company's stock after selling 35,985 shares during the quarter. PDD accounts for 3.2% of APEIRON CAPITAL Ltd's holdings, making the stock its 7th largest holding. APEIRON CAPITAL Ltd's holdings in PDD were worth $8,632,000 at the end of the most recent reporting period.

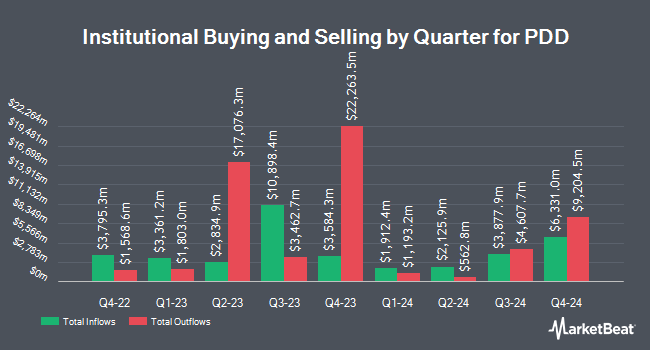

Several other institutional investors and hedge funds have also recently bought and sold shares of PDD. Commonwealth Equity Services LLC lifted its holdings in shares of PDD by 13.2% in the 2nd quarter. Commonwealth Equity Services LLC now owns 21,008 shares of the company's stock valued at $2,793,000 after buying an additional 2,442 shares during the period. Strategic Financial Concepts LLC purchased a new stake in shares of PDD during the second quarter worth about $40,000. Caprock Group LLC increased its position in shares of PDD by 152.8% during the second quarter. Caprock Group LLC now owns 4,959 shares of the company's stock worth $659,000 after acquiring an additional 2,997 shares during the last quarter. Ballentine Partners LLC increased its holdings in PDD by 4.6% in the second quarter. Ballentine Partners LLC now owns 2,701 shares of the company's stock valued at $359,000 after buying an additional 120 shares during the last quarter. Finally, Ausdal Financial Partners Inc. bought a new stake in PDD in the second quarter valued at about $216,000. 39.83% of the stock is owned by institutional investors and hedge funds.

PDD Price Performance

Shares of PDD stock traded up $1.60 on Tuesday, reaching $100.62. The company's stock had a trading volume of 6,754,087 shares, compared to its average volume of 6,689,944. The company has a current ratio of 2.15, a quick ratio of 2.15 and a debt-to-equity ratio of 0.02. The stock's fifty day simple moving average is $106.36 and its 200-day simple moving average is $119.44. The company has a market capitalization of $138.44 billion, a price-to-earnings ratio of 9.83, a price-to-earnings-growth ratio of 0.29 and a beta of 0.66. PDD Holdings Inc. has a 1 year low of $88.01 and a 1 year high of $164.69.

Analyst Ratings Changes

PDD has been the topic of several research reports. JPMorgan Chase & Co. cut PDD from an "overweight" rating to a "neutral" rating and dropped their price target for the company from $170.00 to $105.00 in a report on Friday, November 22nd. Macquarie raised shares of PDD from a "neutral" rating to an "outperform" rating and boosted their target price for the company from $126.00 to $224.00 in a research note on Monday, October 7th. Benchmark cut their target price on shares of PDD from $185.00 to $160.00 and set a "buy" rating on the stock in a research note on Friday, November 22nd. Dbs Bank downgraded shares of PDD from a "strong-buy" rating to a "hold" rating in a research note on Friday, November 22nd. Finally, Jefferies Financial Group dropped their price target on shares of PDD from $181.00 to $171.00 and set a "buy" rating on the stock in a research note on Thursday, November 21st. Three investment analysts have rated the stock with a hold rating, eight have given a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $173.40.

Get Our Latest Report on PDD

PDD Profile

(

Free Report)

PDD Holdings Inc, a multinational commerce group, owns and operates a portfolio of businesses. It operates Pinduoduo, an e-commerce platform that offers products in various categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverage, electronic appliances, furniture and household goods, cosmetics and other personal care, sports and fitness items and auto accessories; and Temu, an online marketplace.

Featured Articles

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.