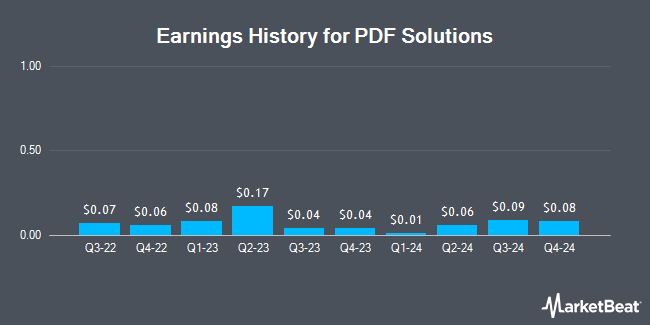

PDF Solutions (NASDAQ:PDFS - Get Free Report) announced its quarterly earnings data on Thursday. The technology company reported $0.08 earnings per share for the quarter, missing analysts' consensus estimates of $0.23 by ($0.15), Zacks reports. PDF Solutions had a net margin of 2.58% and a return on equity of 3.24%. The business had revenue of $50.09 million for the quarter, compared to the consensus estimate of $49.40 million. PDF Solutions updated its FY 2025 guidance to EPS.

PDF Solutions Trading Down 18.2 %

PDF Solutions stock traded down $5.10 during midday trading on Monday, reaching $22.98. 809,206 shares of the stock traded hands, compared to its average volume of 205,290. The firm has a fifty day moving average price of $28.08 and a two-hundred day moving average price of $29.63. The firm has a market cap of $890.93 million, a price-to-earnings ratio of 208.93 and a beta of 1.52. PDF Solutions has a fifty-two week low of $22.84 and a fifty-two week high of $39.70.

Wall Street Analysts Forecast Growth

A number of brokerages recently weighed in on PDFS. Northland Securities reaffirmed an "outperform" rating and set a $45.00 price objective on shares of PDF Solutions in a research report on Tuesday, December 24th. StockNews.com raised shares of PDF Solutions from a "hold" rating to a "buy" rating in a research note on Tuesday, November 12th. Finally, Rosenblatt Securities reduced their target price on shares of PDF Solutions from $40.00 to $37.00 and set a "buy" rating for the company in a research note on Friday.

Get Our Latest Research Report on PDF Solutions

Insider Transactions at PDF Solutions

In other news, insider Andrzej Strojwas sold 5,030 shares of the company's stock in a transaction that occurred on Monday, December 16th. The shares were sold at an average price of $30.85, for a total value of $155,175.50. Following the completion of the sale, the insider now directly owns 94,717 shares of the company's stock, valued at approximately $2,922,019.45. This represents a 5.04 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Nancy Erba sold 2,000 shares of the company's stock in a transaction that occurred on Wednesday, December 11th. The stock was sold at an average price of $30.81, for a total transaction of $61,620.00. Following the completion of the sale, the director now directly owns 13,739 shares of the company's stock, valued at approximately $423,298.59. This represents a 12.71 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 11.13% of the company's stock.

About PDF Solutions

(

Get Free Report)

PDF Solutions, Inc provides proprietary software and physical intellectual property products for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, China, Japan, and internationally. The company offers Exensio software products, such as Manufacturing Analytics that store collected data in a common environment with a consistent view for enabling product engineers to identify and analyze production yield, performance, reliability, and other issues; Process Control that provides failure detection and classification capabilities for monitoring, alarming, and controlling manufacturing tool sets; Test Operations that offer data collection and analysis capabilities; and Assembly Operations that provide device manufacturers with the capability to link assembly and packaging data, including fabrication and characterization data over the product life cycle.

Featured Stories

Before you consider PDF Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDF Solutions wasn't on the list.

While PDF Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.