PDT Partners LLC acquired a new stake in shares of Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 13,000 shares of the construction company's stock, valued at approximately $1,885,000.

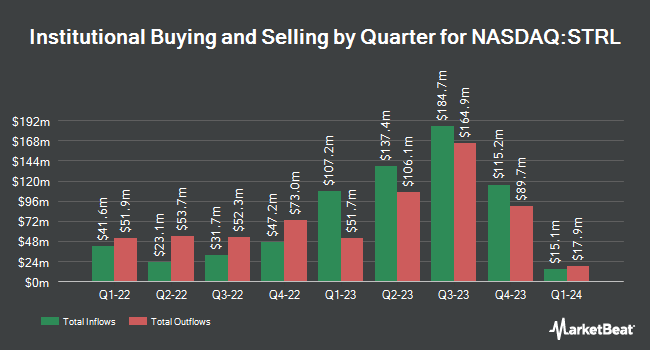

A number of other large investors have also recently added to or reduced their stakes in the stock. Capital Performance Advisors LLP acquired a new stake in shares of Sterling Infrastructure in the 3rd quarter worth about $26,000. Huntington National Bank increased its stake in Sterling Infrastructure by 21,300.0% during the 3rd quarter. Huntington National Bank now owns 214 shares of the construction company's stock valued at $31,000 after buying an additional 213 shares during the period. Hantz Financial Services Inc. acquired a new position in Sterling Infrastructure during the 2nd quarter valued at about $30,000. Nisa Investment Advisors LLC increased its stake in Sterling Infrastructure by 391.1% during the 2nd quarter. Nisa Investment Advisors LLC now owns 275 shares of the construction company's stock valued at $33,000 after buying an additional 219 shares during the period. Finally, Crewe Advisors LLC increased its stake in Sterling Infrastructure by 85.4% during the 2nd quarter. Crewe Advisors LLC now owns 293 shares of the construction company's stock valued at $35,000 after buying an additional 135 shares during the period. 80.95% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In related news, EVP Ronald A. Ballschmiede sold 18,700 shares of the firm's stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $143.59, for a total transaction of $2,685,133.00. Following the transaction, the executive vice president now owns 248,471 shares of the company's stock, valued at approximately $35,677,950.89. This trade represents a 7.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 3.70% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, StockNews.com cut shares of Sterling Infrastructure from a "buy" rating to a "hold" rating in a research note on Sunday, September 15th.

Check Out Our Latest Stock Analysis on STRL

Sterling Infrastructure Price Performance

Shares of STRL traded down $0.96 during mid-day trading on Friday, hitting $194.45. The company's stock had a trading volume of 319,842 shares, compared to its average volume of 387,807. The firm has a 50-day moving average price of $166.30 and a 200 day moving average price of $134.81. The stock has a market capitalization of $5.97 billion, a price-to-earnings ratio of 32.85, a PEG ratio of 2.18 and a beta of 1.15. The company has a debt-to-equity ratio of 0.41, a current ratio of 1.29 and a quick ratio of 1.29. Sterling Infrastructure, Inc. has a fifty-two week low of $62.13 and a fifty-two week high of $203.49.

Sterling Infrastructure (NASDAQ:STRL - Get Free Report) last announced its earnings results on Wednesday, November 6th. The construction company reported $1.97 EPS for the quarter, topping the consensus estimate of $1.68 by $0.29. Sterling Infrastructure had a net margin of 8.77% and a return on equity of 27.52%. The company had revenue of $593.74 million during the quarter, compared to analysts' expectations of $599.90 million. During the same period last year, the company posted $1.26 earnings per share. On average, research analysts predict that Sterling Infrastructure, Inc. will post 5.96 EPS for the current fiscal year.

Sterling Infrastructure Company Profile

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

Featured Stories

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.