PDT Partners LLC trimmed its holdings in shares of Comfort Systems USA, Inc. (NYSE:FIX - Free Report) by 24.9% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 5,436 shares of the construction company's stock after selling 1,798 shares during the quarter. PDT Partners LLC's holdings in Comfort Systems USA were worth $2,122,000 as of its most recent SEC filing.

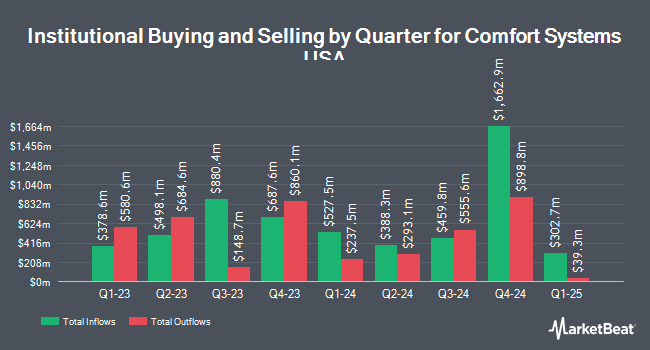

Several other institutional investors also recently bought and sold shares of FIX. Hollencrest Capital Management purchased a new position in Comfort Systems USA during the third quarter valued at approximately $28,000. Thurston Springer Miller Herd & Titak Inc. purchased a new position in Comfort Systems USA during the third quarter valued at approximately $38,000. Opal Wealth Advisors LLC purchased a new position in Comfort Systems USA during the second quarter valued at approximately $41,000. V Square Quantitative Management LLC increased its holdings in Comfort Systems USA by 59.5% during the third quarter. V Square Quantitative Management LLC now owns 126 shares of the construction company's stock valued at $49,000 after buying an additional 47 shares during the period. Finally, Contravisory Investment Management Inc. increased its holdings in Comfort Systems USA by 126.9% during the third quarter. Contravisory Investment Management Inc. now owns 152 shares of the construction company's stock valued at $59,000 after buying an additional 85 shares during the period. 96.51% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Comfort Systems USA

In other Comfort Systems USA news, Director Vance W. Tang sold 2,700 shares of the firm's stock in a transaction that occurred on Monday, October 28th. The shares were sold at an average price of $390.00, for a total value of $1,053,000.00. Following the completion of the transaction, the director now owns 5,498 shares of the company's stock, valued at $2,144,220. This trade represents a 32.93 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Also, insider Brian E. Lane sold 15,000 shares of Comfort Systems USA stock in a transaction on Wednesday, November 13th. The stock was sold at an average price of $448.88, for a total transaction of $6,733,200.00. Following the sale, the insider now directly owns 204,205 shares of the company's stock, valued at approximately $91,663,540.40. This trade represents a 6.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 36,200 shares of company stock worth $15,431,250 in the last 90 days. Insiders own 1.80% of the company's stock.

Comfort Systems USA Price Performance

Shares of FIX stock traded up $6.62 during mid-day trading on Friday, hitting $493.27. 167,318 shares of the stock were exchanged, compared to its average volume of 342,365. The firm has a fifty day moving average of $426.20 and a 200 day moving average of $359.03. The company has a quick ratio of 1.02, a current ratio of 1.04 and a debt-to-equity ratio of 0.04. Comfort Systems USA, Inc. has a 52-week low of $185.83 and a 52-week high of $510.79. The company has a market cap of $17.56 billion, a PE ratio of 37.74 and a beta of 1.13.

Comfort Systems USA (NYSE:FIX - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The construction company reported $4.09 earnings per share for the quarter, beating analysts' consensus estimates of $3.97 by $0.12. The firm had revenue of $1.81 billion for the quarter, compared to analyst estimates of $1.84 billion. Comfort Systems USA had a net margin of 7.18% and a return on equity of 32.74%. Comfort Systems USA's quarterly revenue was up 31.5% compared to the same quarter last year. During the same period last year, the company posted $2.74 EPS. Research analysts anticipate that Comfort Systems USA, Inc. will post 13.95 earnings per share for the current year.

Comfort Systems USA Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, November 25th. Stockholders of record on Thursday, November 14th were issued a dividend of $0.35 per share. The ex-dividend date of this dividend was Thursday, November 14th. This represents a $1.40 dividend on an annualized basis and a dividend yield of 0.28%. This is an increase from Comfort Systems USA's previous quarterly dividend of $0.30. Comfort Systems USA's dividend payout ratio (DPR) is currently 10.71%.

Wall Street Analyst Weigh In

FIX has been the topic of a number of recent analyst reports. Stifel Nicolaus initiated coverage on Comfort Systems USA in a research report on Friday, November 15th. They set a "buy" rating and a $524.00 price target on the stock. StockNews.com raised Comfort Systems USA from a "hold" rating to a "buy" rating in a research report on Saturday, October 12th. UBS Group raised Comfort Systems USA from a "neutral" rating to a "buy" rating and upped their target price for the company from $396.00 to $525.00 in a research report on Tuesday, November 19th. Finally, Northcoast Research assumed coverage on Comfort Systems USA in a research report on Friday, November 22nd. They issued a "buy" rating and a $525.00 target price on the stock. One analyst has rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat, Comfort Systems USA has a consensus rating of "Moderate Buy" and an average target price of $481.00.

View Our Latest Stock Analysis on FIX

Comfort Systems USA Company Profile

(

Free Report)

Comfort Systems USA, Inc, together with its subsidiaries, provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States. It operates through two segments, Mechanical and Electrical. The company offers heating, ventilation, and air conditioning systems, as well as plumbing, electrical, piping and controls, off-site construction, monitoring, and fire protection.

Further Reading

Before you consider Comfort Systems USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comfort Systems USA wasn't on the list.

While Comfort Systems USA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.