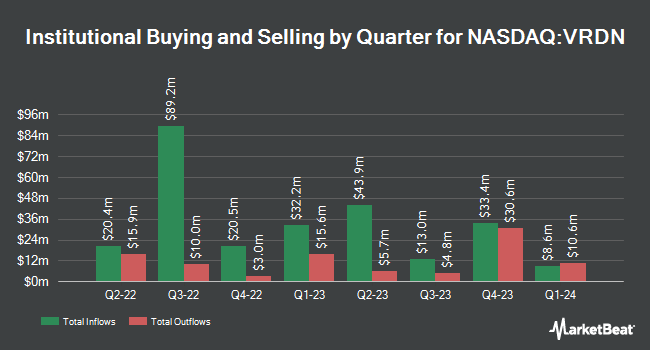

PDT Partners LLC purchased a new position in shares of Viridian Therapeutics, Inc. (NASDAQ:VRDN - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm purchased 33,475 shares of the company's stock, valued at approximately $762,000. PDT Partners LLC owned approximately 0.05% of Viridian Therapeutics at the end of the most recent reporting period.

Several other large investors also recently bought and sold shares of the stock. Quest Partners LLC raised its holdings in Viridian Therapeutics by 344.0% during the second quarter. Quest Partners LLC now owns 6,056 shares of the company's stock worth $79,000 after purchasing an additional 4,692 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank grew its position in shares of Viridian Therapeutics by 24.6% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 11,961 shares of the company's stock valued at $156,000 after purchasing an additional 2,359 shares during the last quarter. AlphaCentric Advisors LLC raised its stake in Viridian Therapeutics by 108.3% in the 2nd quarter. AlphaCentric Advisors LLC now owns 12,500 shares of the company's stock valued at $163,000 after purchasing an additional 6,500 shares during the last quarter. Arizona State Retirement System boosted its holdings in shares of Viridian Therapeutics by 14.7% during the second quarter. Arizona State Retirement System now owns 13,178 shares of the company's stock worth $171,000 after purchasing an additional 1,688 shares during the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. acquired a new position in Viridian Therapeutics during the third quarter worth approximately $208,000.

Viridian Therapeutics Trading Down 4.3 %

Shares of Viridian Therapeutics stock traded down $0.91 during trading hours on Tuesday, hitting $20.09. The company's stock had a trading volume of 832,040 shares, compared to its average volume of 1,113,318. The company has a debt-to-equity ratio of 0.04, a current ratio of 18.55 and a quick ratio of 18.55. The company has a market capitalization of $1.59 billion, a PE ratio of -4.66 and a beta of 1.04. The stock has a 50 day moving average of $22.72 and a 200 day moving average of $17.50. Viridian Therapeutics, Inc. has a 12 month low of $11.40 and a 12 month high of $27.20.

Viridian Therapeutics (NASDAQ:VRDN - Get Free Report) last released its earnings results on Tuesday, November 12th. The company reported ($1.15) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.11) by ($0.04). The company had revenue of $0.09 million during the quarter, compared to analyst estimates of $0.08 million. Viridian Therapeutics had a negative net margin of 85,127.16% and a negative return on equity of 70.12%. Analysts predict that Viridian Therapeutics, Inc. will post -4.03 earnings per share for the current year.

Insiders Place Their Bets

In other Viridian Therapeutics news, CEO Stephen F. Mahoney purchased 21,400 shares of the firm's stock in a transaction on Friday, September 27th. The stock was purchased at an average cost of $23.33 per share, for a total transaction of $499,262.00. Following the transaction, the chief executive officer now owns 21,400 shares in the company, valued at $499,262. The trade was a ∞ increase in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, Director Fairmount Funds Management Llc bought 1,600,000 shares of the firm's stock in a transaction on Friday, September 13th. The shares were purchased at an average cost of $18.75 per share, with a total value of $30,000,000.00. Following the transaction, the director now directly owns 3,445,813 shares in the company, valued at approximately $64,608,993.75. This trade represents a 86.68 % increase in their position. The disclosure for this purchase can be found here. Insiders have bought 1,626,400 shares of company stock worth $30,616,312 in the last 90 days. Company insiders own 0.65% of the company's stock.

Analysts Set New Price Targets

VRDN has been the topic of a number of research reports. TD Cowen started coverage on shares of Viridian Therapeutics in a research note on Monday, November 25th. They issued a "buy" rating on the stock. HC Wainwright raised their price objective on Viridian Therapeutics from $27.00 to $34.00 and gave the stock a "buy" rating in a research note on Thursday, November 14th. BTIG Research raised their price target on Viridian Therapeutics from $56.00 to $61.00 and gave the stock a "buy" rating in a report on Thursday, September 26th. Needham & Company LLC reiterated a "buy" rating and set a $38.00 price objective on shares of Viridian Therapeutics in a research report on Monday, November 25th. Finally, Oppenheimer reiterated an "outperform" rating and issued a $28.00 price objective (down from $31.00) on shares of Viridian Therapeutics in a report on Monday, August 12th. Two analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $36.33.

View Our Latest Analysis on VRDN

About Viridian Therapeutics

(

Free Report)

Viridian Therapeutics, Inc, a biotechnology company, discover and develops treatments for serious and rare diseases. The company's product pipeline includes VRDN-001, a monoclonal antibody targeting insulin-like growth factor-1 receptor that is in Phase 3 clinical trial for the treatment of thyroid eye disease (TED); and VRDN-003, a next generation IGF-1R humanized monoclonal antibodies targeting IGF-1R and incorporating half-life extension technology for the treatment of TED.

Further Reading

Before you consider Viridian Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viridian Therapeutics wasn't on the list.

While Viridian Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.