PDT Partners LLC purchased a new position in shares of MediaAlpha, Inc. (NYSE:MAX - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor purchased 68,331 shares of the company's stock, valued at approximately $1,237,000. PDT Partners LLC owned approximately 0.10% of MediaAlpha as of its most recent filing with the Securities & Exchange Commission.

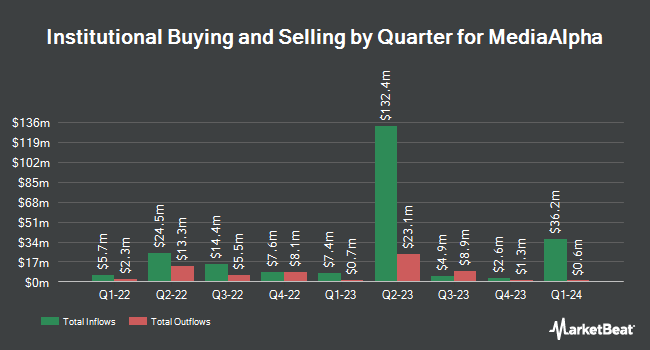

Several other hedge funds and other institutional investors have also made changes to their positions in the business. Vanguard Group Inc. lifted its holdings in MediaAlpha by 15.0% during the 1st quarter. Vanguard Group Inc. now owns 2,119,189 shares of the company's stock worth $43,168,000 after buying an additional 276,641 shares in the last quarter. Price T Rowe Associates Inc. MD raised its stake in shares of MediaAlpha by 9.4% in the first quarter. Price T Rowe Associates Inc. MD now owns 14,321 shares of the company's stock valued at $292,000 after acquiring an additional 1,235 shares in the last quarter. Janus Henderson Group PLC acquired a new position in MediaAlpha during the 1st quarter worth $284,000. Bay Colony Advisory Group Inc d b a Bay Colony Advisors grew its stake in MediaAlpha by 5.1% during the 2nd quarter. Bay Colony Advisory Group Inc d b a Bay Colony Advisors now owns 23,890 shares of the company's stock worth $315,000 after purchasing an additional 1,150 shares in the last quarter. Finally, Bank of New York Mellon Corp increased its holdings in MediaAlpha by 15.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 84,155 shares of the company's stock worth $1,108,000 after purchasing an additional 11,503 shares during the period. Hedge funds and other institutional investors own 64.39% of the company's stock.

Analyst Upgrades and Downgrades

Separately, The Goldman Sachs Group lifted their price objective on MediaAlpha from $20.00 to $26.00 and gave the company a "buy" rating in a research note on Friday, November 1st. One research analyst has rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat, MediaAlpha currently has a consensus rating of "Moderate Buy" and a consensus target price of $25.14.

Get Our Latest Report on MAX

Insider Buying and Selling

In related news, insider Eugene Nonko sold 72,000 shares of the firm's stock in a transaction that occurred on Wednesday, October 30th. The stock was sold at an average price of $20.67, for a total transaction of $1,488,240.00. Following the transaction, the insider now owns 1,550,990 shares in the company, valued at $32,058,963.30. This trade represents a 4.44 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. 11.53% of the stock is owned by company insiders.

MediaAlpha Stock Performance

Shares of NYSE:MAX traded up $0.08 on Monday, hitting $12.71. 338,691 shares of the company's stock were exchanged, compared to its average volume of 573,689. MediaAlpha, Inc. has a 1-year low of $9.96 and a 1-year high of $25.78. The company has a market capitalization of $847.30 million, a PE ratio of 75.00 and a beta of 1.23. The firm's 50-day moving average is $16.09 and its 200 day moving average is $16.16.

MediaAlpha (NYSE:MAX - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The company reported $0.17 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.13 by $0.04. The firm had revenue of $259.13 million during the quarter, compared to the consensus estimate of $246.96 million. MediaAlpha had a negative return on equity of 11.98% and a net margin of 1.41%. On average, analysts anticipate that MediaAlpha, Inc. will post 0.42 EPS for the current fiscal year.

MediaAlpha Company Profile

(

Free Report)

MediaAlpha, Inc, through its subsidiaries, operates an insurance customer acquisition platform in the United States. It optimizes customer acquisition in various verticals of property and casualty insurance, health insurance, and life insurance. The company was founded in 2014 and is headquartered in Los Angeles, California.

Featured Stories

Before you consider MediaAlpha, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MediaAlpha wasn't on the list.

While MediaAlpha currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.