PDT Partners LLC bought a new position in shares of Franco-Nevada Co. (NYSE:FNV - Free Report) TSE: FNV in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 10,534 shares of the basic materials company's stock, valued at approximately $1,309,000.

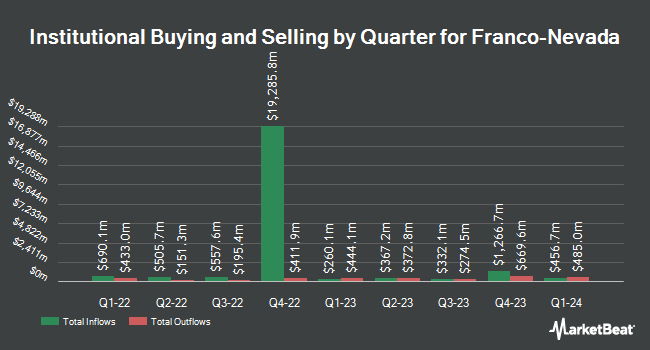

A number of other large investors have also recently modified their holdings of the business. Verition Fund Management LLC acquired a new stake in shares of Franco-Nevada in the 3rd quarter valued at approximately $2,995,000. Icon Wealth Advisors LLC bought a new position in Franco-Nevada in the 3rd quarter valued at approximately $151,000. Zurcher Kantonalbank Zurich Cantonalbank boosted its position in Franco-Nevada by 8.1% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 89,489 shares of the basic materials company's stock valued at $11,127,000 after buying an additional 6,676 shares in the last quarter. Horizon Kinetics Asset Management LLC boosted its position in Franco-Nevada by 1.9% in the third quarter. Horizon Kinetics Asset Management LLC now owns 935,834 shares of the basic materials company's stock valued at $116,277,000 after buying an additional 17,232 shares in the last quarter. Finally, Dynamic Technology Lab Private Ltd bought a new stake in shares of Franco-Nevada during the third quarter worth $717,000. Institutional investors and hedge funds own 77.06% of the company's stock.

Analyst Ratings Changes

Several equities research analysts recently weighed in on FNV shares. TD Cowen raised Franco-Nevada from a "hold" rating to a "buy" rating in a report on Thursday, August 15th. StockNews.com raised Franco-Nevada from a "sell" rating to a "hold" rating in a research note on Thursday, August 22nd. Canaccord Genuity Group raised Franco-Nevada from a "hold" rating to a "buy" rating in a research note on Monday, November 18th. Scotiabank cut their target price on shares of Franco-Nevada from $142.00 to $141.00 and set a "sector perform" rating on the stock in a research report on Friday, November 8th. Finally, Canaccord Genuity Group upgraded shares of Franco-Nevada from a "hold" rating to a "buy" rating in a research report on Monday, November 18th. Four research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $152.83.

Check Out Our Latest Stock Analysis on Franco-Nevada

Franco-Nevada Price Performance

NYSE FNV traded down $1.25 during mid-day trading on Monday, reaching $121.37. 304,364 shares of the stock were exchanged, compared to its average volume of 663,907. The stock has a market cap of $23.36 billion, a P/E ratio of -38.55, a P/E/G ratio of 20.72 and a beta of 0.75. Franco-Nevada Co. has a one year low of $102.29 and a one year high of $137.60. The stock has a 50 day simple moving average of $125.77 and a 200-day simple moving average of $123.70.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last posted its quarterly earnings data on Wednesday, November 6th. The basic materials company reported $0.80 earnings per share for the quarter, missing the consensus estimate of $0.83 by ($0.03). Franco-Nevada had a positive return on equity of 10.55% and a negative net margin of 55.28%. The business had revenue of $275.70 million during the quarter, compared to the consensus estimate of $279.11 million. During the same period last year, the business posted $0.91 earnings per share. The business's revenue was down 10.9% on a year-over-year basis. Sell-side analysts anticipate that Franco-Nevada Co. will post 3.22 EPS for the current fiscal year.

Franco-Nevada Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, December 5th will be given a dividend of $0.36 per share. This represents a $1.44 annualized dividend and a dividend yield of 1.19%. The ex-dividend date of this dividend is Thursday, December 5th. Franco-Nevada's dividend payout ratio (DPR) is -45.57%.

About Franco-Nevada

(

Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Recommended Stories

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.