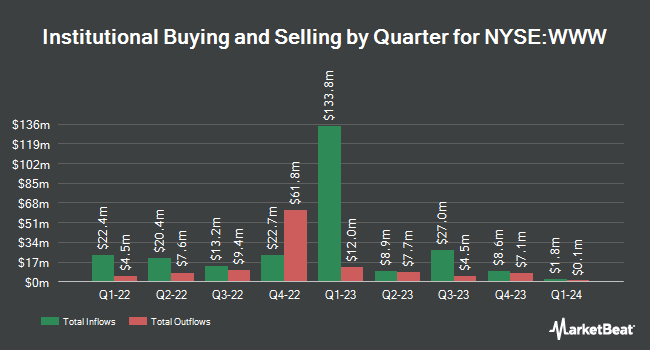

PEAK6 Investments LLC bought a new stake in Wolverine World Wide, Inc. (NYSE:WWW - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor bought 29,254 shares of the textile maker's stock, valued at approximately $510,000.

Other hedge funds have also recently made changes to their positions in the company. Pacer Advisors Inc. acquired a new stake in Wolverine World Wide during the 2nd quarter worth about $64,295,000. Jennison Associates LLC purchased a new stake in shares of Wolverine World Wide during the 3rd quarter worth about $10,974,000. Federated Hermes Inc. boosted its stake in shares of Wolverine World Wide by 10,607.4% during the 2nd quarter. Federated Hermes Inc. now owns 540,402 shares of the textile maker's stock worth $7,306,000 after acquiring an additional 535,355 shares in the last quarter. Manning & Napier Advisors LLC purchased a new stake in shares of Wolverine World Wide during the 2nd quarter worth about $7,098,000. Finally, Panagora Asset Management Inc. purchased a new stake in shares of Wolverine World Wide during the 2nd quarter worth about $3,979,000. 90.25% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Wolverine World Wide

In related news, insider Amy M. Klimek sold 10,214 shares of the stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $20.11, for a total transaction of $205,403.54. Following the completion of the transaction, the insider now directly owns 19,093 shares of the company's stock, valued at $383,960.23. This represents a 34.85 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this link. Also, insider David A. Latchana sold 7,706 shares of the stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $17.02, for a total transaction of $131,156.12. Following the completion of the transaction, the insider now directly owns 13,889 shares of the company's stock, valued at approximately $236,390.78. This trade represents a 35.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 41,920 shares of company stock valued at $866,240 over the last ninety days. Insiders own 2.28% of the company's stock.

Analyst Ratings Changes

WWW has been the topic of several recent analyst reports. KeyCorp raised shares of Wolverine World Wide from a "sector weight" rating to an "overweight" rating and set a $20.00 target price on the stock in a research note on Thursday, August 8th. Argus raised shares of Wolverine World Wide to a "hold" rating in a research note on Friday, August 16th. Piper Sandler reiterated an "overweight" rating and issued a $18.00 price objective on shares of Wolverine World Wide in a report on Friday, August 23rd. BNP Paribas upgraded shares of Wolverine World Wide from a "neutral" rating to an "outperform" rating and set a $22.00 price target for the company in a report on Thursday, October 3rd. Finally, Telsey Advisory Group restated a "market perform" rating and set a $15.00 price target on shares of Wolverine World Wide in a report on Thursday, November 7th. Three research analysts have rated the stock with a hold rating and six have issued a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $18.00.

Check Out Our Latest Research Report on Wolverine World Wide

Wolverine World Wide Stock Up 1.3 %

WWW stock traded up $0.30 during midday trading on Wednesday, hitting $23.98. The company's stock had a trading volume of 767,257 shares, compared to its average volume of 1,108,297. The company has a debt-to-equity ratio of 1.91, a quick ratio of 0.77 and a current ratio of 1.23. Wolverine World Wide, Inc. has a 52-week low of $7.58 and a 52-week high of $24.16. The firm has a 50-day simple moving average of $18.80 and a 200-day simple moving average of $15.38.

Wolverine World Wide Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, February 3rd. Stockholders of record on Thursday, January 2nd will be given a dividend of $0.10 per share. The ex-dividend date is Thursday, January 2nd. This represents a $0.40 annualized dividend and a dividend yield of 1.67%. Wolverine World Wide's dividend payout ratio (DPR) is currently -44.94%.

Wolverine World Wide Company Profile

(

Free Report)

Wolverine World Wide, Inc designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America. It operates through Active Group and Work Group segments. The company offers casual footwear and apparel; performance outdoor and athletic footwear and apparel; kids' footwear; industrial work boots and apparel; and uniform shoes and boots.

Featured Articles

Before you consider Wolverine World Wide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wolverine World Wide wasn't on the list.

While Wolverine World Wide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.