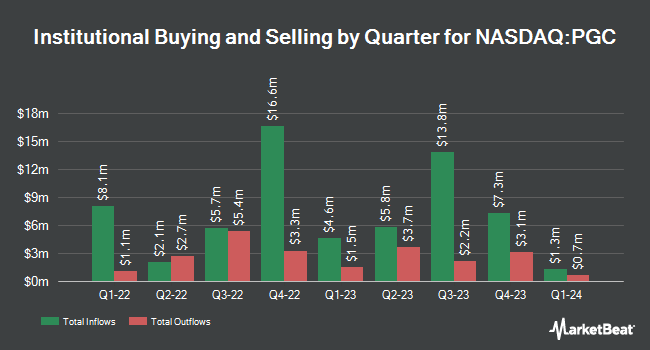

Peapack Gladstone Financial Corp reduced its holdings in shares of Peapack-Gladstone Financial Co. (NASDAQ:PGC - Free Report) by 7.3% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 861,743 shares of the financial services provider's stock after selling 67,929 shares during the quarter. Peapack Gladstone Financial Corp owned approximately 4.90% of Peapack-Gladstone Financial worth $27,619,000 as of its most recent filing with the SEC.

Other hedge funds have also made changes to their positions in the company. FMR LLC grew its position in Peapack-Gladstone Financial by 27.1% during the 3rd quarter. FMR LLC now owns 28,358 shares of the financial services provider's stock worth $777,000 after purchasing an additional 6,054 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in shares of Peapack-Gladstone Financial by 108.4% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 26,195 shares of the financial services provider's stock valued at $718,000 after purchasing an additional 13,623 shares during the period. Janus Henderson Group PLC purchased a new stake in shares of Peapack-Gladstone Financial during the 3rd quarter worth approximately $211,000. Point72 Asset Management L.P. grew its holdings in Peapack-Gladstone Financial by 157.5% in the third quarter. Point72 Asset Management L.P. now owns 2,400 shares of the financial services provider's stock valued at $66,000 after purchasing an additional 1,468 shares during the last quarter. Finally, State Street Corp lifted its holdings in shares of Peapack-Gladstone Financial by 2.4% in the third quarter. State Street Corp now owns 524,231 shares of the financial services provider's stock valued at $14,369,000 after purchasing an additional 12,332 shares in the last quarter. Hedge funds and other institutional investors own 72.75% of the company's stock.

Peapack-Gladstone Financial Trading Up 1.1 %

PGC stock traded up $0.28 during midday trading on Friday, hitting $24.92. The stock had a trading volume of 77,496 shares, compared to its average volume of 94,595. The company's 50-day moving average price is $30.38 and its 200 day moving average price is $31.77. The company has a debt-to-equity ratio of 0.22, a current ratio of 0.97 and a quick ratio of 0.97. The firm has a market cap of $438.49 million, a PE ratio of 13.47 and a beta of 0.82. Peapack-Gladstone Financial Co. has a 12-month low of $20.30 and a 12-month high of $37.88.

Peapack-Gladstone Financial (NASDAQ:PGC - Get Free Report) last announced its quarterly earnings data on Tuesday, January 28th. The financial services provider reported $0.52 EPS for the quarter, beating analysts' consensus estimates of $0.45 by $0.07. Peapack-Gladstone Financial had a return on equity of 5.57% and a net margin of 8.11%. On average, equities research analysts predict that Peapack-Gladstone Financial Co. will post 2.71 earnings per share for the current fiscal year.

Insider Activity at Peapack-Gladstone Financial

In other news, CEO Douglas L. Kennedy sold 5,000 shares of the business's stock in a transaction dated Friday, March 28th. The stock was sold at an average price of $28.58, for a total transaction of $142,900.00. Following the completion of the sale, the chief executive officer now owns 35,409 shares in the company, valued at approximately $1,011,989.22. The trade was a 12.37 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director F Duffield Meyercord acquired 6,316 shares of the company's stock in a transaction dated Monday, March 31st. The stock was acquired at an average cost of $28.44 per share, with a total value of $179,627.04. Following the transaction, the director now directly owns 140,372 shares of the company's stock, valued at approximately $3,992,179.68. This represents a 4.71 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last three months, insiders sold 57,633 shares of company stock worth $1,716,024. 6.95% of the stock is owned by company insiders.

Analyst Ratings Changes

Separately, Raymond James started coverage on Peapack-Gladstone Financial in a research report on Friday. They set a "strong-buy" rating and a $39.00 price objective for the company.

Read Our Latest Research Report on Peapack-Gladstone Financial

About Peapack-Gladstone Financial

(

Free Report)

Peapack-Gladstone Financial Corporation operates as the bank holding company for Peapack-Gladstone Bank that provides private banking and wealth management services in the United States. The company operates in two segments, Banking and Peapack Private. It offers checking and savings accounts, money market and interest-bearing checking accounts, certificates of deposit, and individual retirement accounts.

Read More

Before you consider Peapack-Gladstone Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Peapack-Gladstone Financial wasn't on the list.

While Peapack-Gladstone Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.