Peapack Gladstone Financial Corp lowered its holdings in shares of Blackstone Inc. (NYSE:BX - Free Report) by 4.8% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 69,667 shares of the asset manager's stock after selling 3,536 shares during the quarter. Peapack Gladstone Financial Corp's holdings in Blackstone were worth $12,012,000 at the end of the most recent reporting period.

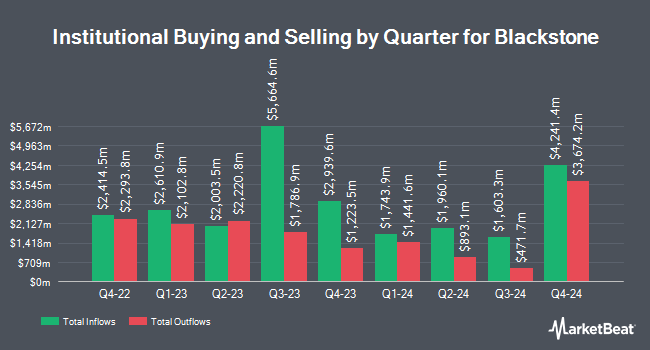

A number of other institutional investors have also added to or reduced their stakes in BX. Glen Eagle Advisors LLC lifted its stake in Blackstone by 1.8% in the 3rd quarter. Glen Eagle Advisors LLC now owns 3,251 shares of the asset manager's stock worth $498,000 after purchasing an additional 59 shares in the last quarter. Avidian Wealth Enterprises LLC grew its holdings in Blackstone by 0.4% during the 4th quarter. Avidian Wealth Enterprises LLC now owns 16,184 shares of the asset manager's stock valued at $2,790,000 after buying an additional 59 shares in the last quarter. McIlrath & Eck LLC raised its holdings in shares of Blackstone by 6.5% during the 3rd quarter. McIlrath & Eck LLC now owns 1,019 shares of the asset manager's stock worth $156,000 after acquiring an additional 62 shares in the last quarter. Meiji Yasuda Asset Management Co Ltd. grew its holdings in shares of Blackstone by 0.5% in the fourth quarter. Meiji Yasuda Asset Management Co Ltd. now owns 11,426 shares of the asset manager's stock valued at $1,970,000 after purchasing an additional 62 shares in the last quarter. Finally, McAdam LLC raised its stake in Blackstone by 3.9% during the fourth quarter. McAdam LLC now owns 1,687 shares of the asset manager's stock valued at $291,000 after purchasing an additional 63 shares in the last quarter. 70.00% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In related news, Director Ruth Porat purchased 301 shares of the business's stock in a transaction that occurred on Tuesday, February 18th. The stock was bought at an average price of $164.85 per share, with a total value of $49,619.85. Following the acquisition, the director now owns 36,829 shares in the company, valued at $6,071,260.65. The trade was a 0.82 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 1.00% of the company's stock.

Blackstone Stock Performance

NYSE BX traded down $0.26 on Friday, hitting $127.19. 7,805,964 shares of the company's stock traded hands, compared to its average volume of 3,690,525. The firm has a market capitalization of $92.77 billion, a PE ratio of 35.04, a P/E/G ratio of 1.07 and a beta of 1.61. Blackstone Inc. has a 1-year low of $115.66 and a 1-year high of $200.96. The firm's 50-day moving average price is $149.11 and its two-hundred day moving average price is $165.63. The company has a current ratio of 0.67, a quick ratio of 0.71 and a debt-to-equity ratio of 0.61.

Blackstone (NYSE:BX - Get Free Report) last announced its quarterly earnings results on Thursday, January 30th. The asset manager reported $1.69 earnings per share for the quarter, beating the consensus estimate of $1.50 by $0.19. Blackstone had a return on equity of 19.58% and a net margin of 20.99%. As a group, analysts expect that Blackstone Inc. will post 5.87 EPS for the current year.

Blackstone Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, February 18th. Shareholders of record on Monday, February 10th were given a $1.44 dividend. The ex-dividend date was Monday, February 10th. This represents a $5.76 dividend on an annualized basis and a dividend yield of 4.53%. This is an increase from Blackstone's previous quarterly dividend of $0.86. Blackstone's dividend payout ratio is 158.68%.

Wall Street Analyst Weigh In

Several research firms have recently weighed in on BX. JPMorgan Chase & Co. boosted their target price on Blackstone from $149.00 to $154.00 and gave the company a "neutral" rating in a research report on Friday, January 31st. JMP Securities upgraded shares of Blackstone from a "market perform" rating to a "market outperform" rating and set a $165.00 target price for the company in a report on Tuesday. UBS Group raised shares of Blackstone from a "neutral" rating to a "buy" rating and set a $180.00 price objective on the stock in a research report on Monday, March 17th. Citizens Jmp upgraded Blackstone from a "market perform" rating to an "outperform" rating and set a $165.00 target price for the company in a research report on Tuesday. Finally, TD Cowen decreased their price target on Blackstone from $233.00 to $147.00 and set a "buy" rating for the company in a research note on Wednesday. Eleven research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $157.22.

Read Our Latest Report on Blackstone

Blackstone Profile

(

Free Report)

Blackstone Inc is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies. The firm typically invests in early-stage companies. It also provide capital markets services.

Read More

Before you consider Blackstone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone wasn't on the list.

While Blackstone currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.