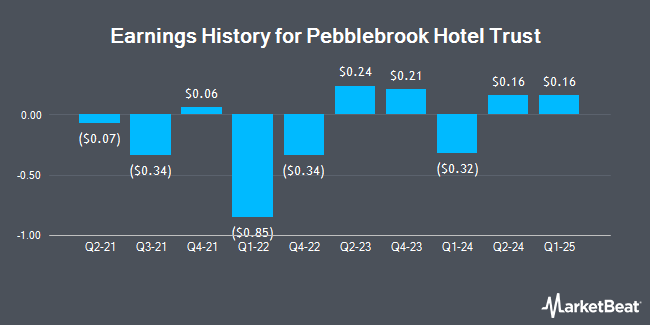

Pebblebrook Hotel Trust (NYSE:PEB - Get Free Report) is projected to issue its quarterly earnings data after the market closes on Wednesday, February 26th. Analysts expect the company to announce earnings of $0.12 per share and revenue of $331.90 million for the quarter. Individual interested in registering for the company's earnings conference call can do so using this link.

Pebblebrook Hotel Trust Stock Down 3.2 %

PEB stock traded down $0.39 during midday trading on Friday, hitting $11.89. The company's stock had a trading volume of 2,509,286 shares, compared to its average volume of 1,785,821. The firm has a market capitalization of $1.42 billion, a P/E ratio of -41.00, a PEG ratio of 0.60 and a beta of 1.85. The firm has a 50-day simple moving average of $13.31 and a 200-day simple moving average of $13.12. Pebblebrook Hotel Trust has a 52-week low of $11.65 and a 52-week high of $16.61. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 0.78.

Pebblebrook Hotel Trust Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st were paid a $0.01 dividend. The ex-dividend date was Tuesday, December 31st. This represents a $0.04 dividend on an annualized basis and a yield of 0.34%. Pebblebrook Hotel Trust's dividend payout ratio is presently -13.79%.

Analyst Ratings Changes

A number of research analysts have recently issued reports on PEB shares. Wedbush lowered shares of Pebblebrook Hotel Trust from a "neutral" rating to an "underperform" rating and set a $13.00 price target on the stock. in a research note on Thursday, January 2nd. Compass Point upgraded shares of Pebblebrook Hotel Trust from a "neutral" rating to a "buy" rating and set a $17.00 price target on the stock in a research note on Thursday, November 21st. Truist Financial lowered their target price on shares of Pebblebrook Hotel Trust from $14.00 to $13.00 and set a "hold" rating on the stock in a research report on Tuesday, February 4th. Robert W. Baird lowered their target price on shares of Pebblebrook Hotel Trust from $15.00 to $14.00 and set a "neutral" rating on the stock in a research report on Thursday, October 31st. Finally, Stifel Nicolaus upgraded shares of Pebblebrook Hotel Trust from a "hold" rating to a "buy" rating and upped their target price for the stock from $14.75 to $15.00 in a research report on Friday, November 22nd. Two analysts have rated the stock with a sell rating, three have issued a hold rating and two have given a buy rating to the stock. According to data from MarketBeat, Pebblebrook Hotel Trust currently has a consensus rating of "Hold" and an average price target of $14.17.

Read Our Latest Report on PEB

About Pebblebrook Hotel Trust

(

Get Free Report)

Pebblebrook Hotel Trust NYSE: PEB is a publicly traded real estate investment trust ("REIT") and the largest owner of urban and resort lifestyle hotels and resorts in the United States. The Company owns 47 hotels and resorts, totaling approximately 12,200 guest rooms across 13 urban and resort markets.

See Also

Before you consider Pebblebrook Hotel Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pebblebrook Hotel Trust wasn't on the list.

While Pebblebrook Hotel Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.