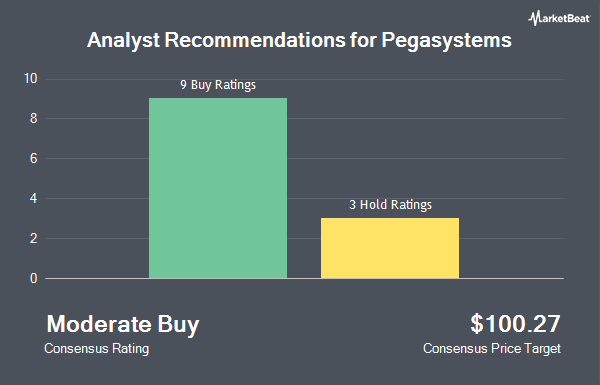

Pegasystems Inc. (NASDAQ:PEGA - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the eleven analysts that are covering the stock, MarketBeat reports. Three equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. The average 12-month price target among analysts that have issued ratings on the stock in the last year is $85.90.

A number of research firms have weighed in on PEGA. StockNews.com upgraded shares of Pegasystems from a "hold" rating to a "buy" rating in a research report on Thursday, November 21st. Barclays upped their price target on shares of Pegasystems from $74.00 to $82.00 and gave the stock an "equal weight" rating in a research report on Friday, October 25th. Rosenblatt Securities upped their target price on shares of Pegasystems from $90.00 to $95.00 and gave the stock a "buy" rating in a research report on Friday, October 25th. Loop Capital upgraded shares of Pegasystems from a "hold" rating to a "buy" rating and upped their target price for the stock from $68.00 to $84.00 in a research report on Thursday, August 1st. Finally, Wedbush upped their target price on shares of Pegasystems from $90.00 to $100.00 and gave the stock an "outperform" rating in a research report on Friday, October 25th.

View Our Latest Research Report on PEGA

Pegasystems Trading Up 0.9 %

PEGA stock traded up $0.88 during midday trading on Tuesday, reaching $96.21. 460,088 shares of the company's stock traded hands, compared to its average volume of 543,567. Pegasystems has a 52-week low of $44.07 and a 52-week high of $96.68. The stock has a market cap of $8.25 billion, a P/E ratio of 69.58 and a beta of 1.06. The stock's 50-day moving average is $77.87 and its 200 day moving average is $68.13.

Pegasystems (NASDAQ:PEGA - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The technology company reported $0.39 EPS for the quarter, beating analysts' consensus estimates of $0.35 by $0.04. Pegasystems had a net margin of 8.29% and a return on equity of 37.83%. The business had revenue of $325.10 million during the quarter, compared to analysts' expectations of $326.16 million. During the same period in the prior year, the company earned $0.14 earnings per share. The firm's revenue was down 2.8% on a year-over-year basis. As a group, research analysts expect that Pegasystems will post 1.61 EPS for the current fiscal year.

Pegasystems Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Tuesday, October 1st were paid a $0.03 dividend. This represents a $0.12 annualized dividend and a dividend yield of 0.12%. The ex-dividend date was Tuesday, October 1st. Pegasystems's dividend payout ratio is currently 8.76%.

Insider Activity

In related news, CAO Efstathios A. Kouninis sold 528 shares of the firm's stock in a transaction dated Tuesday, November 5th. The shares were sold at an average price of $83.00, for a total value of $43,824.00. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, insider Rifat Kerim Akgonul sold 1,000 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $70.41, for a total transaction of $70,410.00. Following the completion of the transaction, the insider now directly owns 46,505 shares in the company, valued at $3,274,417.05. This represents a 2.11 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 32,595 shares of company stock valued at $2,454,034. 50.10% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the stock. Vanguard Group Inc. increased its position in Pegasystems by 4.9% during the 1st quarter. Vanguard Group Inc. now owns 5,369,237 shares of the technology company's stock valued at $347,067,000 after purchasing an additional 250,273 shares during the period. Price T Rowe Associates Inc. MD increased its position in Pegasystems by 309.5% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 130,281 shares of the technology company's stock valued at $8,422,000 after purchasing an additional 98,465 shares during the period. Motley Fool Asset Management LLC purchased a new position in Pegasystems during the 1st quarter valued at about $423,000. Comerica Bank increased its position in Pegasystems by 2,166.3% during the 1st quarter. Comerica Bank now owns 24,589 shares of the technology company's stock valued at $1,589,000 after purchasing an additional 23,504 shares during the period. Finally, Versant Capital Management Inc increased its position in Pegasystems by 15,120.0% during the 2nd quarter. Versant Capital Management Inc now owns 761 shares of the technology company's stock valued at $46,000 after purchasing an additional 756 shares during the period. Hedge funds and other institutional investors own 46.89% of the company's stock.

About Pegasystems

(

Get Free ReportPegasystems Inc develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific. The company provides Pega Infinity, a software portfolio comprising of Pega Customer Decision Hub, a real-time AI-powered decision engine to enhance customer acquisition and experiences across inbound, outbound, and paid media channels; Pega Customer Service to anticipate customer needs, connect customers to people and systems, and automate customer interactions to evolve the customer service experience, as well as to allow enterprises to deliver interactions across channels and enhance employee productivity; and Pega Platform, an intelligent automation software for increasing efficiency of clients' processes and workflows.

Featured Stories

Before you consider Pegasystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pegasystems wasn't on the list.

While Pegasystems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.