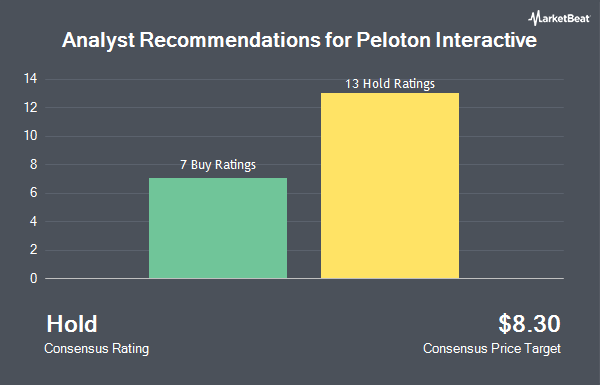

Peloton Interactive, Inc. (NASDAQ:PTON - Get Free Report) has received a consensus recommendation of "Hold" from the eighteen analysts that are presently covering the company, Marketbeat reports. Fifteen investment analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The average 1-year target price among analysts that have issued a report on the stock in the last year is $6.75.

A number of research analysts have recently commented on PTON shares. Macquarie increased their price objective on Peloton Interactive from $4.90 to $9.00 and gave the company a "neutral" rating in a report on Friday, November 1st. JPMorgan Chase & Co. increased their price objective on Peloton Interactive from $5.00 to $7.00 and gave the company a "neutral" rating in a report on Friday, November 1st. Bank of America raised Peloton Interactive from an "underperform" rating to a "buy" rating and upped their target price for the company from $3.75 to $9.00 in a research report on Monday, November 4th. Sanford C. Bernstein upped their target price on Peloton Interactive from $4.25 to $6.50 and gave the company a "market perform" rating in a research report on Friday, November 1st. Finally, Morgan Stanley upped their target price on Peloton Interactive from $3.50 to $5.00 and gave the company an "equal weight" rating in a research report on Friday, November 1st.

Read Our Latest Stock Analysis on PTON

Peloton Interactive Price Performance

NASDAQ PTON traded up $0.10 during trading hours on Monday, hitting $9.64. 10,164,885 shares of the company were exchanged, compared to its average volume of 16,433,193. The company has a 50 day moving average of $6.21 and a two-hundred day moving average of $4.60. Peloton Interactive has a 52-week low of $2.70 and a 52-week high of $9.88.

Peloton Interactive (NASDAQ:PTON - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The company reported ($0.16) EPS for the quarter, missing analysts' consensus estimates of ($0.15) by ($0.01). The firm had revenue of $586.00 million during the quarter, compared to analyst estimates of $572.97 million. During the same quarter in the prior year, the firm posted ($0.44) EPS. The business's revenue was down 1.6% on a year-over-year basis. Analysts forecast that Peloton Interactive will post -0.38 EPS for the current fiscal year.

Insider Activity at Peloton Interactive

In related news, CAO Saqib Baig sold 36,776 shares of the firm's stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $7.53, for a total value of $276,923.28. Following the completion of the transaction, the chief accounting officer now directly owns 137,357 shares of the company's stock, valued at $1,034,298.21. This trade represents a 21.12 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, insider Andrew S. Rendich sold 138,391 shares of the firm's stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $7.51, for a total value of $1,039,316.41. Following the completion of the transaction, the insider now directly owns 287,973 shares of the company's stock, valued at $2,162,677.23. The trade was a 32.46 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 506,517 shares of company stock valued at $3,524,339 in the last ninety days. Corporate insiders own 1.34% of the company's stock.

Hedge Funds Weigh In On Peloton Interactive

Several hedge funds have recently bought and sold shares of the company. Gtcr LLC purchased a new position in Peloton Interactive during the third quarter worth $65,520,000. DME Capital Management LP purchased a new position in Peloton Interactive during the second quarter worth $22,947,000. DNB Asset Management AS increased its position in Peloton Interactive by 42.4% during the second quarter. DNB Asset Management AS now owns 12,130,553 shares of the company's stock worth $40,880,000 after buying an additional 3,611,069 shares in the last quarter. Clearline Capital LP purchased a new position in Peloton Interactive during the second quarter worth $7,527,000. Finally, Healthcare of Ontario Pension Plan Trust Fund purchased a new position in Peloton Interactive during the third quarter worth $8,363,000. 77.01% of the stock is owned by hedge funds and other institutional investors.

Peloton Interactive Company Profile

(

Get Free ReportPeloton Interactive, Inc operates interactive fitness platform in North America and internationally. The company offers connected fitness products with touchscreen that streams live and on-demand classes under the Peloton Bike, Peloton Bike+, Peloton Tread, Peloton Tread+, Peloton Guide, and Peloton Row names.

Recommended Stories

Before you consider Peloton Interactive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Peloton Interactive wasn't on the list.

While Peloton Interactive currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.