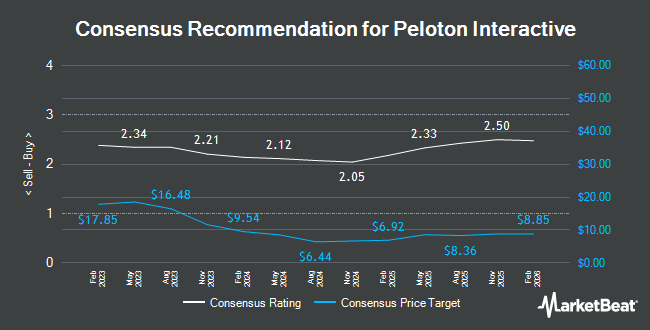

Peloton Interactive (NASDAQ:PTON - Get Free Report) was upgraded by investment analysts at UBS Group from a "sell" rating to a "neutral" rating in a note issued to investors on Friday, Marketbeat.com reports. The firm presently has a $10.00 target price on the stock, up from their prior target price of $2.50. UBS Group's price objective would suggest a potential downside of 0.10% from the stock's current price.

PTON has been the topic of several other reports. TD Cowen boosted their target price on shares of Peloton Interactive from $3.00 to $4.00 and gave the company a "hold" rating in a research note on Friday, August 23rd. Bank of America raised Peloton Interactive from an "underperform" rating to a "buy" rating and upped their price target for the company from $3.75 to $9.00 in a research report on Monday, November 4th. BMO Capital Markets raised their price objective on Peloton Interactive from $6.50 to $8.50 and gave the stock a "market perform" rating in a research report on Monday, November 4th. JPMorgan Chase & Co. upped their target price on Peloton Interactive from $5.00 to $7.00 and gave the company a "neutral" rating in a report on Friday, November 1st. Finally, Truist Financial raised their price target on shares of Peloton Interactive from $6.00 to $10.00 and gave the stock a "hold" rating in a report on Friday, November 1st. Sixteen research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Peloton Interactive currently has an average rating of "Hold" and an average price target of $6.97.

Check Out Our Latest Stock Report on Peloton Interactive

Peloton Interactive Stock Up 3.7 %

Shares of Peloton Interactive stock traded up $0.36 on Friday, reaching $10.01. 14,735,376 shares of the company were exchanged, compared to its average volume of 15,026,742. Peloton Interactive has a fifty-two week low of $2.70 and a fifty-two week high of $10.59. The stock has a fifty day moving average price of $7.10 and a 200-day moving average price of $4.94.

Peloton Interactive (NASDAQ:PTON - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported ($0.16) EPS for the quarter, missing analysts' consensus estimates of ($0.15) by ($0.01). The business had revenue of $586.00 million for the quarter, compared to the consensus estimate of $572.97 million. The company's quarterly revenue was down 1.6% on a year-over-year basis. During the same period in the previous year, the company earned ($0.44) earnings per share. Equities analysts anticipate that Peloton Interactive will post -0.38 earnings per share for the current year.

Insiders Place Their Bets

In other news, CFO Elizabeth F. Coddington sold 186,462 shares of the firm's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $7.58, for a total value of $1,413,381.96. Following the sale, the chief financial officer now directly owns 223,017 shares of the company's stock, valued at approximately $1,690,468.86. This trade represents a 45.54 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Andrew S. Rendich sold 138,391 shares of Peloton Interactive stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $7.51, for a total value of $1,039,316.41. Following the completion of the transaction, the insider now owns 287,973 shares in the company, valued at $2,162,677.23. The trade was a 32.46 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 467,358 shares of company stock valued at $3,435,118 over the last quarter. Insiders own 1.34% of the company's stock.

Institutional Trading of Peloton Interactive

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Point72 Asia Singapore Pte. Ltd. increased its holdings in shares of Peloton Interactive by 31.9% during the 3rd quarter. Point72 Asia Singapore Pte. Ltd. now owns 6,605 shares of the company's stock worth $31,000 after purchasing an additional 1,597 shares during the period. Mercer Global Advisors Inc. ADV bought a new stake in shares of Peloton Interactive in the 2nd quarter worth approximately $27,000. Skylands Capital LLC acquired a new stake in shares of Peloton Interactive during the 2nd quarter worth approximately $30,000. Nisa Investment Advisors LLC raised its stake in shares of Peloton Interactive by 1,836.7% in the second quarter. Nisa Investment Advisors LLC now owns 9,490 shares of the company's stock valued at $32,000 after purchasing an additional 9,000 shares in the last quarter. Finally, Schneider Downs Wealth Management Advisors LP bought a new position in Peloton Interactive in the second quarter worth $35,000. Institutional investors and hedge funds own 77.01% of the company's stock.

About Peloton Interactive

(

Get Free Report)

Peloton Interactive, Inc operates interactive fitness platform in North America and internationally. The company offers connected fitness products with touchscreen that streams live and on-demand classes under the Peloton Bike, Peloton Bike+, Peloton Tread, Peloton Tread+, Peloton Guide, and Peloton Row names.

Further Reading

Before you consider Peloton Interactive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Peloton Interactive wasn't on the list.

While Peloton Interactive currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.