PENN Entertainment (NASDAQ:PENN - Get Free Report) had its target price raised by Macquarie from $26.00 to $27.00 in a research note issued to investors on Friday,Benzinga reports. The brokerage currently has an "outperform" rating on the stock. Macquarie's price objective indicates a potential upside of 31.71% from the stock's current price.

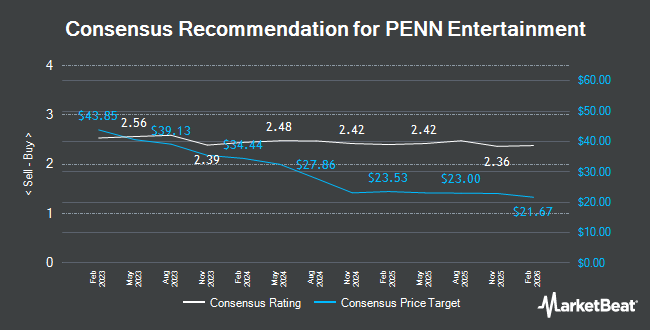

Several other brokerages have also issued reports on PENN. Mizuho reduced their target price on shares of PENN Entertainment from $25.00 to $24.00 and set an "outperform" rating on the stock in a research note on Tuesday, October 22nd. Barclays reduced their price objective on shares of PENN Entertainment from $23.00 to $22.00 and set an "overweight" rating on the stock in a research note on Thursday, October 17th. Deutsche Bank Aktiengesellschaft lifted their price objective on shares of PENN Entertainment from $18.00 to $20.00 and gave the stock a "hold" rating in a research note on Friday, August 9th. JMP Securities reissued a "market perform" rating on shares of PENN Entertainment in a research note on Friday, October 4th. Finally, Wells Fargo & Company lifted their price objective on shares of PENN Entertainment from $18.00 to $20.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 17th. One research analyst has rated the stock with a sell rating, eight have issued a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $22.96.

Read Our Latest Research Report on PENN

PENN Entertainment Trading Up 1.4 %

Shares of NASDAQ PENN traded up $0.28 during mid-day trading on Friday, hitting $20.50. The company's stock had a trading volume of 3,864,415 shares, compared to its average volume of 5,122,847. The stock has a market cap of $3.13 billion, a price-to-earnings ratio of -2.53 and a beta of 2.09. The company has a debt-to-equity ratio of 2.35, a current ratio of 1.03 and a quick ratio of 1.03. PENN Entertainment has a one year low of $13.50 and a one year high of $27.20. The company's fifty day simple moving average is $18.98 and its 200-day simple moving average is $18.31.

PENN Entertainment (NASDAQ:PENN - Get Free Report) last issued its earnings results on Thursday, November 7th. The company reported ($0.24) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.28) by $0.04. The company had revenue of $1.64 billion for the quarter, compared to analyst estimates of $1.65 billion. PENN Entertainment had a negative net margin of 19.48% and a negative return on equity of 7.13%. The company's revenue for the quarter was up 1.2% on a year-over-year basis. During the same quarter last year, the firm earned $1.21 EPS. On average, sell-side analysts anticipate that PENN Entertainment will post -1.41 earnings per share for the current fiscal year.

Insider Activity

In other PENN Entertainment news, CEO Jay A. Snowden acquired 54,200 shares of the stock in a transaction dated Tuesday, September 3rd. The shares were bought at an average cost of $18.44 per share, for a total transaction of $999,448.00. Following the completion of the acquisition, the chief executive officer now directly owns 853,045 shares of the company's stock, valued at approximately $15,730,149.80. This trade represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, Director David A. Handler bought 10,000 shares of the stock in a transaction that occurred on Tuesday, September 10th. The shares were acquired at an average cost of $17.51 per share, for a total transaction of $175,100.00. Following the completion of the acquisition, the director now owns 293,450 shares in the company, valued at approximately $5,138,309.50. This represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CEO Jay A. Snowden bought 54,200 shares of the stock in a transaction that occurred on Tuesday, September 3rd. The shares were purchased at an average price of $18.44 per share, for a total transaction of $999,448.00. Following the completion of the acquisition, the chief executive officer now owns 853,045 shares of the company's stock, valued at $15,730,149.80. The trade was a 0.00 % increase in their position. The disclosure for this purchase can be found here. Insiders have acquired 79,200 shares of company stock worth $1,450,548 over the last ninety days. Insiders own 2.19% of the company's stock.

Hedge Funds Weigh In On PENN Entertainment

A number of institutional investors have recently added to or reduced their stakes in the company. Vanguard Group Inc. increased its holdings in PENN Entertainment by 0.4% during the first quarter. Vanguard Group Inc. now owns 14,789,817 shares of the company's stock worth $269,323,000 after buying an additional 59,897 shares during the last quarter. DME Capital Management LP increased its holdings in PENN Entertainment by 11.9% during the second quarter. DME Capital Management LP now owns 5,095,340 shares of the company's stock worth $98,620,000 after buying an additional 540,630 shares during the last quarter. Earnest Partners LLC increased its holdings in PENN Entertainment by 4.6% during the second quarter. Earnest Partners LLC now owns 4,117,946 shares of the company's stock worth $79,703,000 after buying an additional 179,813 shares during the last quarter. Armistice Capital LLC increased its holdings in PENN Entertainment by 91.9% during the second quarter. Armistice Capital LLC now owns 2,643,060 shares of the company's stock worth $51,156,000 after buying an additional 1,266,023 shares during the last quarter. Finally, Sei Investments Co. increased its holdings in PENN Entertainment by 3.7% during the second quarter. Sei Investments Co. now owns 2,461,074 shares of the company's stock worth $47,634,000 after buying an additional 88,797 shares during the last quarter. 91.69% of the stock is currently owned by institutional investors and hedge funds.

About PENN Entertainment

(

Get Free Report)

PENN Entertainment, Inc, together with its subsidiaries, provides integrated entertainment, sports content, and casino gaming experiences. The company operates through five segments: Northeast, South, West, Midwest, and Interactive. It operates online sports betting in various jurisdictions; and iCasino under Hollywood Casino, L'Auberge, ESPN BET, and theScore Bet Sportsbook and Casino brands.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PENN Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PENN Entertainment wasn't on the list.

While PENN Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report