PENN Entertainment (NASDAQ:PENN - Get Free Report)'s stock had its "hold" rating reiterated by equities research analysts at Benchmark in a report issued on Friday,Benzinga reports.

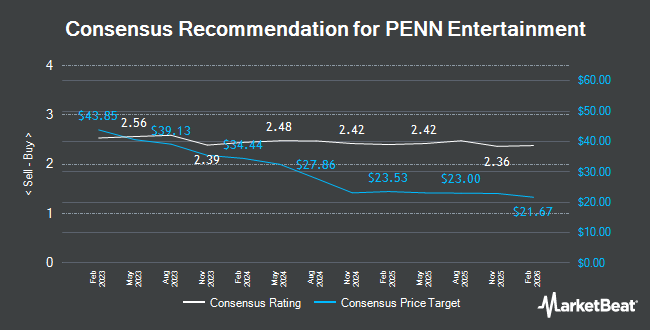

A number of other equities research analysts have also commented on the stock. Morgan Stanley lowered their price target on shares of PENN Entertainment from $20.00 to $19.00 and set an "equal weight" rating for the company in a report on Tuesday, October 22nd. JMP Securities reaffirmed a "market perform" rating on shares of PENN Entertainment in a research note on Friday, October 4th. Macquarie reissued an "outperform" rating and issued a $26.00 target price on shares of PENN Entertainment in a research note on Friday, August 9th. Craig Hallum reaffirmed a "buy" rating and set a $30.00 price target on shares of PENN Entertainment in a research report on Tuesday, October 8th. Finally, Susquehanna dropped their price objective on PENN Entertainment from $26.00 to $25.00 and set a "positive" rating for the company in a report on Monday. One investment analyst has rated the stock with a sell rating, eight have issued a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat.com, PENN Entertainment has an average rating of "Hold" and an average target price of $22.96.

View Our Latest Stock Analysis on PENN Entertainment

PENN Entertainment Trading Up 1.3 %

PENN Entertainment stock traded up $0.27 during mid-day trading on Friday, hitting $20.49. The company's stock had a trading volume of 3,864,787 shares, compared to its average volume of 5,122,848. The business has a 50 day moving average price of $18.98 and a 200-day moving average price of $18.31. The company has a debt-to-equity ratio of 2.35, a current ratio of 1.03 and a quick ratio of 1.03. PENN Entertainment has a 12 month low of $13.50 and a 12 month high of $27.20. The stock has a market cap of $3.13 billion, a price-to-earnings ratio of -2.53 and a beta of 2.09.

PENN Entertainment (NASDAQ:PENN - Get Free Report) last issued its earnings results on Thursday, November 7th. The company reported ($0.24) earnings per share for the quarter, beating the consensus estimate of ($0.28) by $0.04. The company had revenue of $1.64 billion during the quarter, compared to analysts' expectations of $1.65 billion. PENN Entertainment had a negative return on equity of 7.13% and a negative net margin of 19.48%. PENN Entertainment's quarterly revenue was up 1.2% compared to the same quarter last year. During the same period in the prior year, the business posted $1.21 EPS. As a group, analysts forecast that PENN Entertainment will post -1.41 EPS for the current year.

Insider Transactions at PENN Entertainment

In related news, Director David A. Handler purchased 10,000 shares of the stock in a transaction dated Tuesday, September 10th. The stock was purchased at an average price of $17.51 per share, with a total value of $175,100.00. Following the transaction, the director now directly owns 293,450 shares in the company, valued at $5,138,309.50. This trade represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. In other news, Director David A. Handler purchased 10,000 shares of PENN Entertainment stock in a transaction that occurred on Tuesday, September 10th. The stock was bought at an average price of $17.51 per share, with a total value of $175,100.00. Following the completion of the transaction, the director now directly owns 293,450 shares of the company's stock, valued at approximately $5,138,309.50. The trade was a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Anuj Dhanda acquired 15,000 shares of the stock in a transaction that occurred on Friday, September 6th. The stock was acquired at an average cost of $18.40 per share, for a total transaction of $276,000.00. Following the completion of the transaction, the director now directly owns 31,523 shares in the company, valued at $580,023.20. This represents a 0.00 % increase in their position. The disclosure for this purchase can be found here. Over the last three months, insiders have purchased 79,200 shares of company stock valued at $1,450,548. Insiders own 2.19% of the company's stock.

Institutional Investors Weigh In On PENN Entertainment

Several large investors have recently bought and sold shares of PENN. Northwestern Mutual Wealth Management Co. boosted its holdings in shares of PENN Entertainment by 4,624.5% during the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 1,456,094 shares of the company's stock valued at $28,183,000 after acquiring an additional 1,425,274 shares during the last quarter. Assenagon Asset Management S.A. boosted its holdings in PENN Entertainment by 1,051.0% in the third quarter. Assenagon Asset Management S.A. now owns 1,421,471 shares of the company's stock worth $26,809,000 after purchasing an additional 1,297,976 shares during the last quarter. Armistice Capital LLC grew its position in PENN Entertainment by 91.9% in the 2nd quarter. Armistice Capital LLC now owns 2,643,060 shares of the company's stock worth $51,156,000 after purchasing an additional 1,266,023 shares during the period. Invenomic Capital Management LP raised its stake in PENN Entertainment by 71.9% during the 1st quarter. Invenomic Capital Management LP now owns 1,884,284 shares of the company's stock valued at $34,313,000 after buying an additional 787,968 shares during the last quarter. Finally, National Bank of Canada FI lifted its holdings in shares of PENN Entertainment by 284.6% during the 1st quarter. National Bank of Canada FI now owns 968,514 shares of the company's stock valued at $17,637,000 after buying an additional 716,686 shares during the period. 91.69% of the stock is currently owned by institutional investors.

About PENN Entertainment

(

Get Free Report)

PENN Entertainment, Inc, together with its subsidiaries, provides integrated entertainment, sports content, and casino gaming experiences. The company operates through five segments: Northeast, South, West, Midwest, and Interactive. It operates online sports betting in various jurisdictions; and iCasino under Hollywood Casino, L'Auberge, ESPN BET, and theScore Bet Sportsbook and Casino brands.

See Also

Before you consider PENN Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PENN Entertainment wasn't on the list.

While PENN Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report