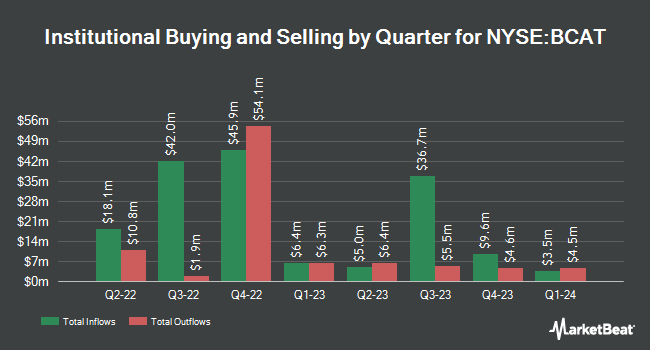

Penserra Capital Management LLC purchased a new position in BlackRock Capital Allocation Term Trust (NYSE:BCAT - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 966,654 shares of the company's stock, valued at approximately $15,901,000. Penserra Capital Management LLC owned approximately 0.90% of BlackRock Capital Allocation Term Trust at the end of the most recent quarter.

A number of other hedge funds have also recently made changes to their positions in the stock. Transcend Capital Advisors LLC raised its holdings in BlackRock Capital Allocation Term Trust by 7.3% in the second quarter. Transcend Capital Advisors LLC now owns 65,207 shares of the company's stock worth $1,070,000 after purchasing an additional 4,435 shares in the last quarter. Cambridge Investment Research Advisors Inc. raised its stake in shares of BlackRock Capital Allocation Term Trust by 4.3% during the 2nd quarter. Cambridge Investment Research Advisors Inc. now owns 133,238 shares of the company's stock worth $2,186,000 after acquiring an additional 5,438 shares in the last quarter. Blue Bell Private Wealth Management LLC lifted its position in BlackRock Capital Allocation Term Trust by 4.0% during the second quarter. Blue Bell Private Wealth Management LLC now owns 104,722 shares of the company's stock valued at $1,718,000 after acquiring an additional 4,059 shares during the last quarter. Prevail Innovative Wealth Advisors LLC acquired a new stake in BlackRock Capital Allocation Term Trust in the second quarter valued at approximately $1,452,000. Finally, Almitas Capital LLC purchased a new position in BlackRock Capital Allocation Term Trust in the second quarter worth $728,000. 36.12% of the stock is currently owned by hedge funds and other institutional investors.

BlackRock Capital Allocation Term Trust Stock Performance

Shares of BCAT traded up $0.08 during midday trading on Friday, hitting $16.11. 263,276 shares of the company's stock traded hands, compared to its average volume of 355,060. BlackRock Capital Allocation Term Trust has a 1 year low of $14.60 and a 1 year high of $17.18. The firm's fifty day moving average is $16.24 and its 200-day moving average is $16.32.

BlackRock Capital Allocation Term Trust Increases Dividend

The firm also recently declared a monthly dividend, which will be paid on Friday, November 29th. Shareholders of record on Friday, November 15th will be paid a $0.2885 dividend. The ex-dividend date is Friday, November 15th. This is a boost from BlackRock Capital Allocation Term Trust's previous monthly dividend of $0.10. This represents a $3.46 dividend on an annualized basis and a yield of 21.49%.

Insiders Place Their Bets

In other BlackRock Capital Allocation Term Trust news, major shareholder Saba Capital Management, L.P. sold 14,973 shares of the company's stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $16.41, for a total transaction of $245,706.93. Following the transaction, the insider now owns 16,302,733 shares in the company, valued at approximately $267,527,848.53. This represents a 0.09 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Over the last 90 days, insiders sold 723,927 shares of company stock valued at $11,925,047.

About BlackRock Capital Allocation Term Trust

(

Free Report)

-

Read More

Before you consider BlackRock Capital Allocation Term Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackRock Capital Allocation Term Trust wasn't on the list.

While BlackRock Capital Allocation Term Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.