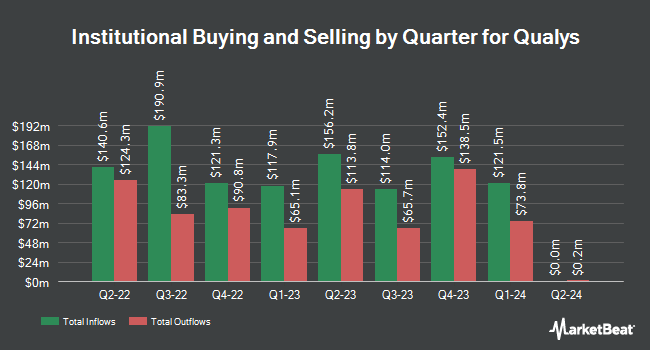

Penserra Capital Management LLC lifted its position in shares of Qualys, Inc. (NASDAQ:QLYS - Free Report) by 8.3% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 373,995 shares of the software maker's stock after buying an additional 28,802 shares during the quarter. Qualys comprises about 1.0% of Penserra Capital Management LLC's holdings, making the stock its 21st largest position. Penserra Capital Management LLC owned 1.02% of Qualys worth $48,043,000 at the end of the most recent reporting period.

Other hedge funds have also bought and sold shares of the company. Citigroup Inc. raised its stake in Qualys by 40.8% during the 3rd quarter. Citigroup Inc. now owns 60,146 shares of the software maker's stock worth $7,726,000 after buying an additional 17,440 shares during the period. Landscape Capital Management L.L.C. bought a new position in shares of Qualys during the 3rd quarter valued at approximately $252,000. Intech Investment Management LLC increased its position in Qualys by 428.9% in the third quarter. Intech Investment Management LLC now owns 18,256 shares of the software maker's stock worth $2,345,000 after buying an additional 14,804 shares during the last quarter. Advisors Asset Management Inc. increased its holdings in Qualys by 68.6% in the 3rd quarter. Advisors Asset Management Inc. now owns 730 shares of the software maker's stock worth $94,000 after acquiring an additional 297 shares during the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. grew its stake in Qualys by 208.5% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 86,187 shares of the software maker's stock valued at $11,072,000 after buying an additional 58,252 shares in the last quarter. Institutional investors own 99.31% of the company's stock.

Insider Transactions at Qualys

In other Qualys news, Director Jeffrey P. Hank sold 4,000 shares of the firm's stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $146.31, for a total value of $585,240.00. Following the transaction, the director now directly owns 12,666 shares of the company's stock, valued at approximately $1,853,162.46. This trade represents a 24.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Bruce K. Posey sold 1,330 shares of the stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $123.80, for a total transaction of $164,654.00. Following the completion of the transaction, the insider now owns 55,618 shares in the company, valued at $6,885,508.40. This trade represents a 2.34 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 21,919 shares of company stock valued at $2,993,000 in the last quarter. 1.00% of the stock is owned by insiders.

Qualys Trading Up 2.1 %

Qualys stock traded up $3.19 during trading hours on Friday, hitting $153.37. 303,879 shares of the stock traded hands, compared to its average volume of 639,782. Qualys, Inc. has a one year low of $119.17 and a one year high of $206.35. The company has a market cap of $5.61 billion, a PE ratio of 33.78 and a beta of 0.47. The firm's 50-day moving average price is $131.26 and its two-hundred day moving average price is $134.81.

Qualys (NASDAQ:QLYS - Get Free Report) last released its earnings results on Tuesday, November 5th. The software maker reported $1.56 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.33 by $0.23. Qualys had a net margin of 28.72% and a return on equity of 40.24%. The firm had revenue of $153.87 million during the quarter, compared to analyst estimates of $150.74 million. During the same period last year, the business earned $1.24 earnings per share. The business's revenue was up 8.4% on a year-over-year basis. On average, sell-side analysts expect that Qualys, Inc. will post 4.34 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities analysts recently commented on the stock. Truist Financial boosted their price objective on shares of Qualys from $120.00 to $145.00 and gave the company a "hold" rating in a research note on Wednesday, November 6th. UBS Group boosted their price target on shares of Qualys from $140.00 to $160.00 and gave the company a "neutral" rating in a research report on Wednesday, November 6th. Piper Sandler dropped their price objective on Qualys from $116.00 to $115.00 and set an "underweight" rating for the company in a research note on Wednesday, August 7th. Needham & Company LLC initiated coverage on Qualys in a research report on Wednesday, November 6th. They set a "hold" rating for the company. Finally, Jefferies Financial Group raised their price target on Qualys from $135.00 to $155.00 and gave the company a "hold" rating in a report on Wednesday, November 6th. Three equities research analysts have rated the stock with a sell rating, fourteen have issued a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat.com, Qualys currently has a consensus rating of "Hold" and an average price target of $152.80.

Read Our Latest Analysis on Qualys

Qualys Profile

(

Free Report)

Qualys, Inc, together with its subsidiaries, provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally. It offers Qualys Cloud Apps, which include Cybersecurity Asset Management and External Attack Surface Management; Vulnerability Management, Detection and Response; Web Application Scanning; Patch Management; Custom Assessment and Remediation; Multi-Vector Endpoint Detection and Response; Context Extended Detection and Response; Policy Compliance; File Integrity Monitoring; and Qualys TotalCloud, as well as Cloud Workload Protection, Cloud Detection and Response, Cloud Security Posture Management, Infrastructure as Code, and Container Security.

Featured Articles

Before you consider Qualys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qualys wasn't on the list.

While Qualys currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.