Pentair (NYSE:PNR - Get Free Report) was upgraded by equities researchers at StockNews.com from a "hold" rating to a "buy" rating in a note issued to investors on Tuesday.

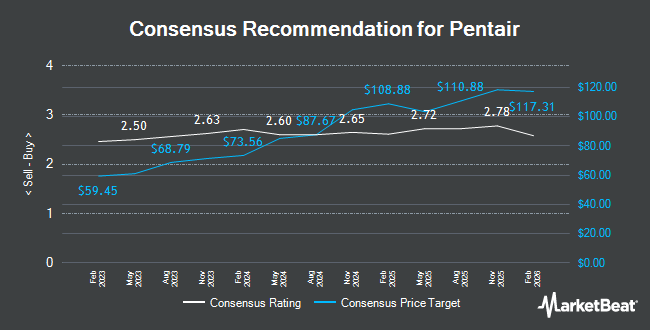

A number of other brokerages have also recently commented on PNR. Stifel Nicolaus decreased their price objective on Pentair from $126.00 to $125.00 and set a "buy" rating for the company in a research note on Friday, January 24th. Citigroup cut their target price on shares of Pentair from $126.00 to $119.00 and set a "buy" rating on the stock in a report on Monday, January 13th. Oppenheimer boosted their price target on shares of Pentair from $110.00 to $115.00 and gave the company an "outperform" rating in a report on Wednesday, November 13th. KeyCorp reaffirmed a "sector weight" rating and set a $115.00 price objective on shares of Pentair in a research note on Monday, January 6th. Finally, Northcoast Research upgraded Pentair from a "hold" rating to a "strong-buy" rating in a report on Wednesday, February 5th. Five analysts have rated the stock with a hold rating, eleven have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $111.25.

View Our Latest Stock Analysis on Pentair

Pentair Price Performance

Shares of NYSE:PNR traded up $0.90 during midday trading on Tuesday, reaching $86.09. The company's stock had a trading volume of 2,364,236 shares, compared to its average volume of 1,489,268. The business's fifty day simple moving average is $97.73 and its 200-day simple moving average is $98.74. The company has a debt-to-equity ratio of 0.46, a current ratio of 1.60 and a quick ratio of 0.92. Pentair has a fifty-two week low of $72.63 and a fifty-two week high of $110.71. The company has a market capitalization of $14.19 billion, a P/E ratio of 23.02, a P/E/G ratio of 1.87 and a beta of 1.23.

Pentair (NYSE:PNR - Get Free Report) last posted its quarterly earnings results on Tuesday, February 4th. The industrial products company reported $1.08 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.02 by $0.06. The business had revenue of $972.90 million for the quarter, compared to analysts' expectations of $970.95 million. Pentair had a return on equity of 20.94% and a net margin of 15.32%. The firm's quarterly revenue was down 1.2% compared to the same quarter last year. During the same quarter last year, the business earned $0.87 earnings per share. As a group, equities research analysts expect that Pentair will post 4.77 EPS for the current fiscal year.

Institutional Trading of Pentair

A number of hedge funds have recently modified their holdings of PNR. Parvin Asset Management LLC bought a new position in Pentair in the 4th quarter valued at about $25,000. Quarry LP increased its stake in shares of Pentair by 105.5% during the third quarter. Quarry LP now owns 261 shares of the industrial products company's stock worth $26,000 after purchasing an additional 134 shares during the period. SJS Investment Consulting Inc. lifted its holdings in Pentair by 753.8% during the 4th quarter. SJS Investment Consulting Inc. now owns 333 shares of the industrial products company's stock worth $34,000 after purchasing an additional 294 shares during the last quarter. Colonial Trust Co SC boosted its stake in Pentair by 230.8% in the 4th quarter. Colonial Trust Co SC now owns 344 shares of the industrial products company's stock valued at $35,000 after purchasing an additional 240 shares during the period. Finally, Eastern Bank grew its holdings in Pentair by 144.9% in the 4th quarter. Eastern Bank now owns 507 shares of the industrial products company's stock valued at $51,000 after buying an additional 300 shares in the last quarter. Institutional investors and hedge funds own 92.37% of the company's stock.

Pentair Company Profile

(

Get Free Report)

Pentair plc provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan. The company operates through three segments: Flow, Water Solutions, and Pool. The Flow segment designs, manufactures, and sells fluid treatment and pump products and systems, including pressure vessels, gas recovery solutions, membrane bioreactors, wastewater reuse systems and advanced membrane filtration, separation systems, water disposal pumps, water supply pumps, fluid transfer pumps, turbine pumps, solid handling pumps, and agricultural spray nozzles for fluid delivery, ion exchange, desalination, food and beverage, separation technologies in the oil and gas industry, residential and municipal wells, water treatment, wastewater solids handling, pressure boosting, circulation and transfer, fire suppression, flood control, agricultural irrigation, and crop spray in residential, commercial, and industrial markets.

Featured Stories

Before you consider Pentair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pentair wasn't on the list.

While Pentair currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.