Peoples Financial Services (NASDAQ:PFIS - Get Free Report) is expected to be issuing its quarterly earnings data before the market opens on Thursday, April 24th. Analysts expect the company to announce earnings of $1.35 per share and revenue of $44.35 million for the quarter.

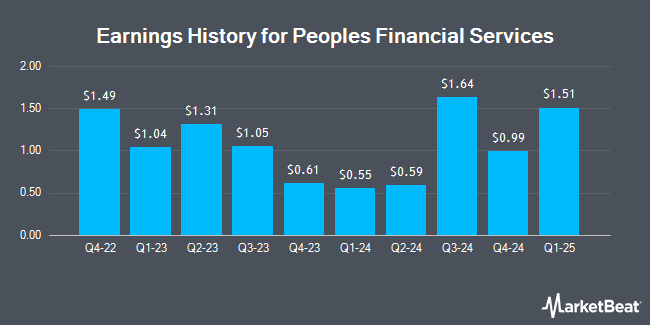

Peoples Financial Services (NASDAQ:PFIS - Get Free Report) last posted its earnings results on Thursday, February 6th. The financial services provider reported $0.99 earnings per share for the quarter, missing analysts' consensus estimates of $1.16 by ($0.17). Peoples Financial Services had a return on equity of 8.97% and a net margin of 3.70%.

Peoples Financial Services Stock Up 1.1 %

Shares of NASDAQ:PFIS traded up $0.45 on Friday, reaching $42.59. The company had a trading volume of 33,715 shares, compared to its average volume of 23,183. The firm has a market capitalization of $425.77 million, a PE ratio of 37.69 and a beta of 0.57. The company has a current ratio of 0.93, a quick ratio of 0.93 and a debt-to-equity ratio of 0.32. Peoples Financial Services has a 52-week low of $36.52 and a 52-week high of $59.70. The firm's 50 day simple moving average is $46.00 and its 200-day simple moving average is $49.15.

Peoples Financial Services Cuts Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, March 14th. Stockholders of record on Friday, February 28th were given a $0.6175 dividend. This represents a $2.47 dividend on an annualized basis and a dividend yield of 5.80%. The ex-dividend date was Friday, February 28th. Peoples Financial Services's payout ratio is currently 218.58%.

Insider Activity

In related news, Director Richard S. Lochen, Jr. bought 1,000 shares of the company's stock in a transaction on Wednesday, March 5th. The shares were bought at an average price of $47.12 per share, with a total value of $47,120.00. Following the transaction, the director now owns 17,129 shares in the company, valued at approximately $807,118.48. This trade represents a 6.20 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 4.10% of the company's stock.

About Peoples Financial Services

(

Get Free Report)

Peoples Financial Services Corp. operates as the bank holding company for Peoples Security Bank and Trust Company that provides various commercial and retail banking services. The company accepts money market, negotiable order of withdrawal, savings, individual retirement, demand deposit, and certificates of deposit accounts.

Read More

Before you consider Peoples Financial Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Peoples Financial Services wasn't on the list.

While Peoples Financial Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.