The Manufacturers Life Insurance Company lowered its holdings in PepsiCo, Inc. (NASDAQ:PEP - Free Report) by 17.6% in the 3rd quarter, according to the company in its most recent filing with the SEC. The firm owned 833,988 shares of the company's stock after selling 178,176 shares during the quarter. The Manufacturers Life Insurance Company owned approximately 0.06% of PepsiCo worth $141,820,000 at the end of the most recent quarter.

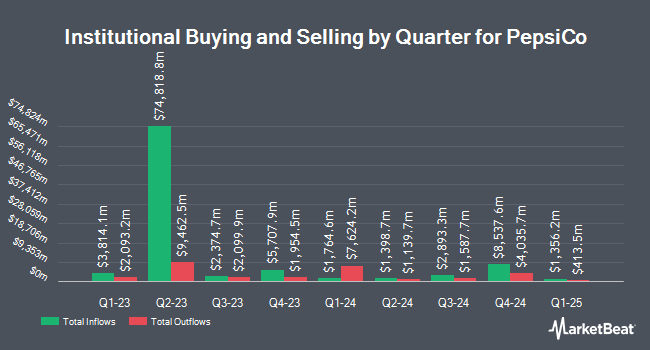

Several other hedge funds have also recently made changes to their positions in PEP. Qsemble Capital Management LP bought a new position in shares of PepsiCo in the 3rd quarter worth approximately $3,419,000. Acorn Wealth Advisors LLC raised its holdings in PepsiCo by 23.1% in the third quarter. Acorn Wealth Advisors LLC now owns 1,786 shares of the company's stock worth $304,000 after purchasing an additional 335 shares in the last quarter. Private Trust Co. NA lifted its position in PepsiCo by 0.6% during the third quarter. Private Trust Co. NA now owns 31,738 shares of the company's stock valued at $5,397,000 after buying an additional 188 shares during the period. Horizon Kinetics Asset Management LLC boosted its holdings in shares of PepsiCo by 5.4% during the 3rd quarter. Horizon Kinetics Asset Management LLC now owns 2,313 shares of the company's stock valued at $393,000 after buying an additional 118 shares in the last quarter. Finally, Diversified LLC grew its position in shares of PepsiCo by 2.3% in the 3rd quarter. Diversified LLC now owns 5,819 shares of the company's stock worth $989,000 after buying an additional 130 shares during the period. 73.07% of the stock is owned by hedge funds and other institutional investors.

PepsiCo Stock Performance

Shares of PepsiCo stock traded up $0.56 during trading hours on Wednesday, reaching $162.72. 3,620,676 shares of the stock traded hands, compared to its average volume of 5,488,934. The company has a 50 day moving average price of $168.18 and a 200 day moving average price of $170.60. PepsiCo, Inc. has a one year low of $155.85 and a one year high of $183.41. The company has a quick ratio of 0.70, a current ratio of 0.89 and a debt-to-equity ratio of 1.96. The firm has a market capitalization of $223.25 billion, a price-to-earnings ratio of 24.00, a P/E/G ratio of 3.04 and a beta of 0.53.

PepsiCo (NASDAQ:PEP - Get Free Report) last released its quarterly earnings results on Tuesday, October 8th. The company reported $2.31 earnings per share for the quarter, topping the consensus estimate of $2.30 by $0.01. The business had revenue of $23.32 billion for the quarter, compared to the consensus estimate of $23.86 billion. PepsiCo had a net margin of 10.18% and a return on equity of 57.32%. The company's quarterly revenue was down .6% on a year-over-year basis. During the same period last year, the firm earned $2.25 earnings per share. On average, equities research analysts expect that PepsiCo, Inc. will post 8.15 earnings per share for the current fiscal year.

PepsiCo Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, January 6th. Shareholders of record on Friday, December 6th will be paid a dividend of $1.355 per share. This represents a $5.42 dividend on an annualized basis and a yield of 3.33%. The ex-dividend date is Friday, December 6th. PepsiCo's payout ratio is 79.94%.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on PEP shares. Hsbc Global Res raised shares of PepsiCo to a "hold" rating in a research note on Thursday, October 10th. Morgan Stanley downgraded PepsiCo from an "overweight" rating to an "equal weight" rating and set a $185.00 price target on the stock. in a research note on Friday, September 20th. JPMorgan Chase & Co. lowered their price objective on PepsiCo from $185.00 to $183.00 and set a "neutral" rating for the company in a research note on Wednesday, October 9th. Royal Bank of Canada reduced their price target on PepsiCo from $177.00 to $176.00 and set a "sector perform" rating for the company in a report on Friday, October 4th. Finally, StockNews.com upgraded shares of PepsiCo from a "hold" rating to a "buy" rating in a research note on Tuesday, November 5th. One research analyst has rated the stock with a sell rating, ten have given a hold rating and six have assigned a buy rating to the stock. Based on data from MarketBeat, PepsiCo has a consensus rating of "Hold" and an average price target of $183.92.

View Our Latest Analysis on PEP

PepsiCo Company Profile

(

Free Report)

PepsiCo, Inc engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East and South Asia; and Asia Pacific, Australia and New Zealand and China Region.

Featured Stories

Before you consider PepsiCo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PepsiCo wasn't on the list.

While PepsiCo currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.