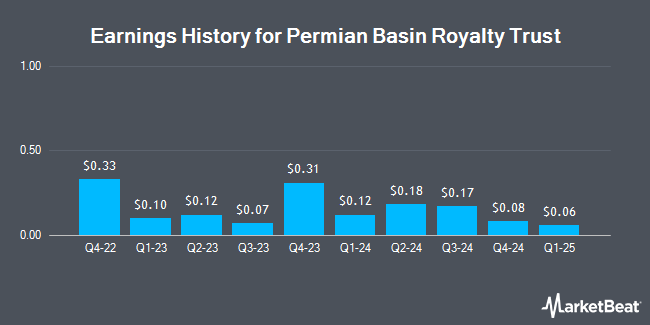

Permian Basin Royalty Trust (NYSE:PBT - Get Free Report) announced its earnings results on Friday. The oil and gas producer reported $0.08 earnings per share (EPS) for the quarter, Zacks reports. The company had revenue of $3.79 million for the quarter. Permian Basin Royalty Trust had a return on equity of 17,811.24% and a net margin of 96.32%.

Permian Basin Royalty Trust Trading Down 0.9 %

Shares of PBT traded down $0.09 during midday trading on Tuesday, hitting $9.91. The stock had a trading volume of 37,498 shares, compared to its average volume of 123,169. Permian Basin Royalty Trust has a fifty-two week low of $9.43 and a fifty-two week high of $14.58. The business has a 50-day simple moving average of $10.98 and a two-hundred day simple moving average of $11.52. The firm has a market cap of $461.90 million, a P/E ratio of 12.71 and a beta of 0.72.

Permian Basin Royalty Trust Cuts Dividend

The company also recently announced a monthly dividend, which was paid on Friday, March 14th. Shareholders of record on Friday, February 28th were issued a $0.0171 dividend. This represents a $0.21 annualized dividend and a dividend yield of 2.07%. The ex-dividend date was Friday, February 28th. Permian Basin Royalty Trust's payout ratio is 36.36%.

Analyst Ratings Changes

Separately, StockNews.com cut shares of Permian Basin Royalty Trust from a "buy" rating to a "hold" rating in a report on Thursday, February 20th.

Get Our Latest Research Report on PBT

About Permian Basin Royalty Trust

(

Get Free Report)

Permian Basin Royalty Trust, an express trust, holds royalty interests in various oil and gas properties in the United States. The company holds a 75% net overriding royalty interest in the Waddell Ranch properties, including Dune, Sand Hills (Judkins), Sand Hills (McKnight), Sand Hills (Tubb), University-Waddell (Devonian) and Waddell fields in Crane County, Texas.

Further Reading

Before you consider Permian Basin Royalty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Permian Basin Royalty Trust wasn't on the list.

While Permian Basin Royalty Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.