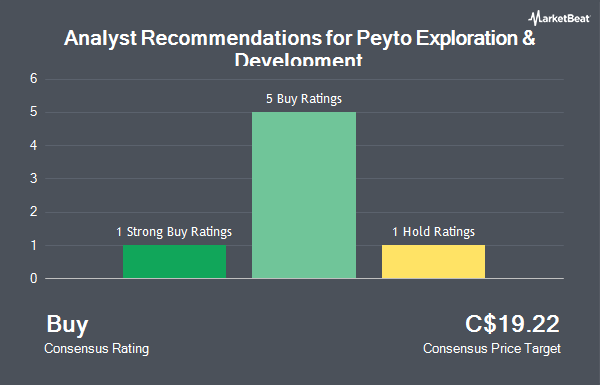

Shares of Peyto Exploration & Development Corp. (TSE:PEY - Get Free Report) have been given an average recommendation of "Buy" by the ten analysts that are currently covering the stock, Marketbeat.com reports. One analyst has rated the stock with a hold recommendation, seven have assigned a buy recommendation and two have given a strong buy recommendation to the company. The average 1 year target price among brokerages that have issued a report on the stock in the last year is C$17.60.

A number of research firms have recently weighed in on PEY. National Bankshares boosted their target price on Peyto Exploration & Development from C$18.00 to C$18.50 in a research note on Friday, September 27th. TD Securities lowered their target price on Peyto Exploration & Development from C$19.00 to C$18.00 in a research note on Tuesday, October 1st. Finally, Atlantic Securities boosted their price target on Peyto Exploration & Development from C$17.50 to C$18.50 and gave the company an "outperform" rating in a report on Monday, October 7th.

Get Our Latest Analysis on PEY

Insider Activity at Peyto Exploration & Development

In other news, Director Stephen Jonathan Chetner sold 3,831 shares of the firm's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of C$14.80, for a total value of C$56,698.80. Also, Senior Officer Riley Millar Frame bought 31,000 shares of the company's stock in a transaction that occurred on Friday, August 23rd. The stock was bought at an average cost of C$14.55 per share, for a total transaction of C$451,050.00. In the last quarter, insiders acquired 35,675 shares of company stock valued at $522,419 and sold 180,240 shares valued at $2,642,246. 2.36% of the stock is owned by corporate insiders.

Peyto Exploration & Development Stock Performance

Peyto Exploration & Development stock traded down C$0.01 during mid-day trading on Tuesday, reaching C$15.74. 491,833 shares of the company's stock were exchanged, compared to its average volume of 913,353. The company has a quick ratio of 0.32, a current ratio of 1.15 and a debt-to-equity ratio of 50.02. The business's fifty day simple moving average is C$15.18 and its 200 day simple moving average is C$14.95. Peyto Exploration & Development has a one year low of C$11.09 and a one year high of C$16.32. The firm has a market capitalization of C$3.08 billion, a PE ratio of 10.16, a P/E/G ratio of -0.46 and a beta of 1.75.

Peyto Exploration & Development Announces Dividend

The business also recently announced a monthly dividend, which was paid on Friday, November 15th. Stockholders of record on Thursday, October 31st were paid a dividend of $0.11 per share. The ex-dividend date of this dividend was Thursday, October 31st. This represents a $1.32 dividend on an annualized basis and a dividend yield of 8.39%. Peyto Exploration & Development's dividend payout ratio is currently 85.16%.

Peyto Exploration & Development Company Profile

(

Get Free ReportPeyto Exploration & Development Corp., an energy company, engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Deep Basin of Alberta. The company was formerly known as Peyto Energy Trust and changed its name to Peyto Exploration & Development Corp.

Read More

Before you consider Peyto Exploration & Development, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Peyto Exploration & Development wasn't on the list.

While Peyto Exploration & Development currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.