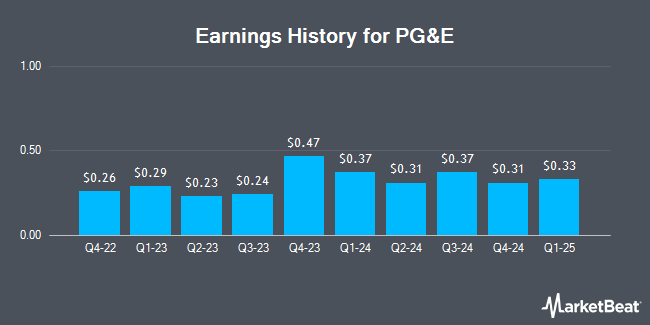

PG&E (NYSE:PCG - Get Free Report) announced its quarterly earnings results on Thursday. The utilities provider reported $0.37 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.32 by $0.05, Briefing.com reports. The business had revenue of $5.94 billion for the quarter, compared to analyst estimates of $6.58 billion. PG&E had a net margin of 10.22% and a return on equity of 11.76%. The company's revenue was up .9% on a year-over-year basis. During the same quarter last year, the firm earned $0.24 EPS.

PG&E Stock Up 1.2 %

PCG stock traded up $0.24 during trading on Friday, hitting $20.60. 15,107,801 shares of the stock traded hands, compared to its average volume of 13,812,556. The stock has a market cap of $53.87 billion, a price-to-earnings ratio of 17.61, a price-to-earnings-growth ratio of 1.55 and a beta of 1.03. The company has a debt-to-equity ratio of 1.99, a current ratio of 0.90 and a quick ratio of 0.86. PG&E has a 1 year low of $15.94 and a 1 year high of $20.93. The firm's 50 day moving average is $20.03 and its two-hundred day moving average is $18.75.

PG&E Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Shareholders of record on Monday, September 30th were issued a $0.01 dividend. This represents a $0.04 annualized dividend and a yield of 0.19%. The ex-dividend date was Monday, September 30th. PG&E's dividend payout ratio (DPR) is 3.42%.

Analyst Ratings Changes

PCG has been the subject of several research analyst reports. Wells Fargo & Company increased their price objective on PG&E from $21.00 to $22.00 and gave the stock an "overweight" rating in a report on Friday, July 26th. Morgan Stanley raised their price target on PG&E from $19.00 to $20.00 and gave the stock an "equal weight" rating in a research note on Wednesday, September 25th. Bank of America initiated coverage on shares of PG&E in a report on Thursday, September 12th. They issued a "buy" rating and a $24.00 price objective for the company. Jefferies Financial Group assumed coverage on shares of PG&E in a research report on Monday, October 14th. They set a "buy" rating and a $24.00 price target on the stock. Finally, Barclays raised their price objective on shares of PG&E from $24.00 to $25.00 and gave the stock an "overweight" rating in a report on Monday, October 21st. Two research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat, PG&E presently has a consensus rating of "Moderate Buy" and a consensus target price of $22.80.

Read Our Latest Research Report on PCG

Insider Buying and Selling

In other news, VP Stephanie N. Williams sold 38,601 shares of the firm's stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $18.32, for a total transaction of $707,170.32. Following the sale, the vice president now owns 19,114 shares of the company's stock, valued at $350,168.48. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. 0.15% of the stock is owned by company insiders.

PG&E Company Profile

(

Get Free Report)

PG&E Corporation, through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States. It generates electricity using nuclear, hydroelectric, fossil fuel-fired, fuel cell, and photovoltaic sources.

Featured Articles

Before you consider PG&E, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PG&E wasn't on the list.

While PG&E currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.