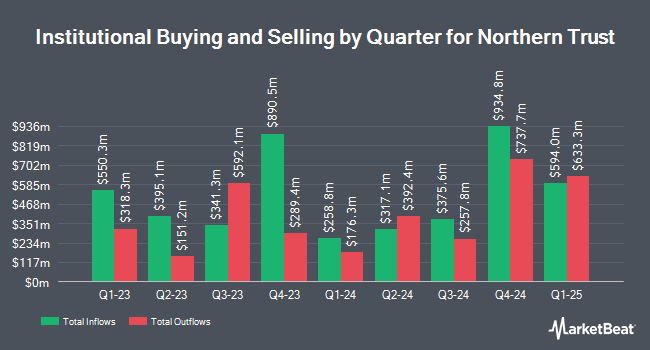

PGGM Investments purchased a new stake in Northern Trust Co. (NASDAQ:NTRS - Free Report) in the 4th quarter, according to its most recent disclosure with the SEC. The fund purchased 31,507 shares of the asset manager's stock, valued at approximately $3,229,000.

A number of other institutional investors have also modified their holdings of NTRS. Y.D. More Investments Ltd boosted its stake in Northern Trust by 118.4% in the fourth quarter. Y.D. More Investments Ltd now owns 249 shares of the asset manager's stock valued at $26,000 after acquiring an additional 135 shares during the period. Empirical Asset Management LLC acquired a new position in Northern Trust during the 4th quarter valued at approximately $33,000. Brooklyn Investment Group grew its stake in Northern Trust by 51.2% during the 4th quarter. Brooklyn Investment Group now owns 378 shares of the asset manager's stock worth $39,000 after buying an additional 128 shares during the last quarter. Assetmark Inc. increased its position in Northern Trust by 528.3% in the fourth quarter. Assetmark Inc. now owns 377 shares of the asset manager's stock worth $39,000 after buying an additional 317 shares during the period. Finally, Proficio Capital Partners LLC bought a new stake in Northern Trust in the fourth quarter valued at $51,000. Institutional investors own 83.19% of the company's stock.

Insiders Place Their Bets

In other Northern Trust news, insider Jason J. Tyler sold 2,237 shares of Northern Trust stock in a transaction that occurred on Thursday, January 30th. The shares were sold at an average price of $112.67, for a total transaction of $252,042.79. Following the transaction, the insider now directly owns 58,449 shares in the company, valued at approximately $6,585,448.83. The trade was a 3.69 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, COO Peter Cherecwich sold 26,132 shares of the business's stock in a transaction on Wednesday, January 29th. The shares were sold at an average price of $112.36, for a total transaction of $2,936,191.52. Following the sale, the chief operating officer now directly owns 26,586 shares in the company, valued at approximately $2,987,202.96. This trade represents a 49.57 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 35,335 shares of company stock worth $3,970,211. Company insiders own 0.64% of the company's stock.

Northern Trust Trading Down 2.2 %

Shares of NTRS stock opened at $96.09 on Friday. The company has a quick ratio of 0.71, a current ratio of 0.68 and a debt-to-equity ratio of 0.58. The stock has a 50-day simple moving average of $107.85 and a 200 day simple moving average of $102.00. Northern Trust Co. has a fifty-two week low of $79.30 and a fifty-two week high of $114.67. The stock has a market capitalization of $18.80 billion, a P/E ratio of 9.83, a P/E/G ratio of 1.72 and a beta of 1.07.

Northern Trust (NASDAQ:NTRS - Get Free Report) last issued its earnings results on Thursday, January 23rd. The asset manager reported $2.26 earnings per share for the quarter, topping analysts' consensus estimates of $1.96 by $0.30. Northern Trust had a net margin of 12.77% and a return on equity of 13.74%. On average, sell-side analysts expect that Northern Trust Co. will post 8.27 earnings per share for the current fiscal year.

Northern Trust Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, April 1st. Investors of record on Friday, March 14th will be paid a $0.75 dividend. The ex-dividend date is Friday, March 14th. This represents a $3.00 dividend on an annualized basis and a yield of 3.12%. Northern Trust's dividend payout ratio is currently 30.67%.

Analyst Ratings Changes

Several research firms have recently commented on NTRS. Keefe, Bruyette & Woods upped their price target on shares of Northern Trust from $113.00 to $122.00 and gave the stock a "market perform" rating in a research report on Friday, January 24th. Truist Financial raised their price target on shares of Northern Trust from $110.00 to $116.00 and gave the company a "hold" rating in a research note on Friday, January 24th. Wells Fargo & Company boosted their price objective on Northern Trust from $108.00 to $110.00 and gave the stock an "equal weight" rating in a research report on Friday, November 15th. StockNews.com cut Northern Trust from a "buy" rating to a "hold" rating in a research report on Tuesday, February 25th. Finally, Royal Bank of Canada boosted their price target on Northern Trust from $107.00 to $115.00 and gave the stock an "outperform" rating in a research report on Friday, January 24th. One research analyst has rated the stock with a sell rating, nine have given a hold rating and three have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $113.50.

Get Our Latest Analysis on Northern Trust

Northern Trust Profile

(

Free Report)

Northern Trust Corporation, a financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide. It operates in two segments, Asset Servicing and Wealth Management. The Asset Servicing segment offers asset servicing and related services, including custody, fund administration, investment operations outsourcing, investment management, investment risk and analytical services, employee benefit services, securities lending, foreign exchange, treasury management, brokerage services, transition management services, banking, and cash management services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Northern Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Trust wasn't on the list.

While Northern Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report