Philadelphia Trust Co. reduced its holdings in shares of The Goldman Sachs Group, Inc. (NYSE:GS - Free Report) by 1.0% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 58,375 shares of the investment management company's stock after selling 592 shares during the period. The Goldman Sachs Group comprises about 2.5% of Philadelphia Trust Co.'s investment portfolio, making the stock its 9th biggest position. Philadelphia Trust Co.'s holdings in The Goldman Sachs Group were worth $33,427,000 at the end of the most recent quarter.

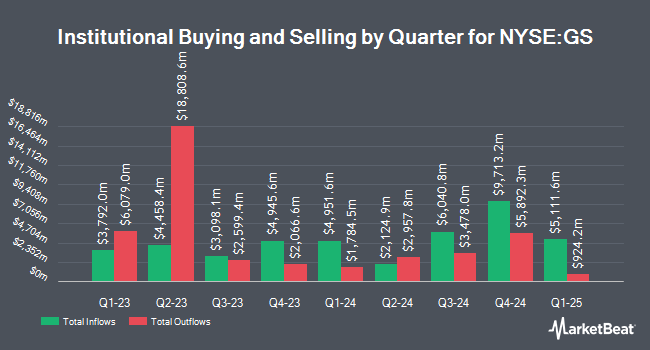

Other large investors have also recently bought and sold shares of the company. Asset Management One Co. Ltd. lifted its position in shares of The Goldman Sachs Group by 2.5% during the fourth quarter. Asset Management One Co. Ltd. now owns 224,148 shares of the investment management company's stock worth $129,144,000 after purchasing an additional 5,541 shares in the last quarter. Baxter Bros Inc. raised its position in shares of The Goldman Sachs Group by 1.0% during the fourth quarter. Baxter Bros Inc. now owns 15,506 shares of the investment management company's stock worth $8,879,000 after purchasing an additional 151 shares during the period. Erste Asset Management GmbH boosted its holdings in shares of The Goldman Sachs Group by 5.9% in the fourth quarter. Erste Asset Management GmbH now owns 5,743 shares of the investment management company's stock valued at $3,309,000 after buying an additional 320 shares during the period. Franklin Street Advisors Inc. NC lifted its holdings in shares of The Goldman Sachs Group by 8.1% in the fourth quarter. Franklin Street Advisors Inc. NC now owns 38,304 shares of the investment management company's stock valued at $21,934,000 after purchasing an additional 2,863 shares in the last quarter. Finally, Atlas Legacy Advisors LLC acquired a new stake in shares of The Goldman Sachs Group in the fourth quarter valued at approximately $356,000. 71.21% of the stock is currently owned by institutional investors.

The Goldman Sachs Group Stock Performance

Shares of NYSE GS traded down $3.18 during trading hours on Wednesday, reaching $504.71. The stock had a trading volume of 1,037,263 shares, compared to its average volume of 3,006,429. The Goldman Sachs Group, Inc. has a fifty-two week low of $401.18 and a fifty-two week high of $672.19. The firm has a 50-day moving average of $570.64 and a 200-day moving average of $572.51. The firm has a market cap of $157.49 billion, a price-to-earnings ratio of 12.45, a PEG ratio of 0.89 and a beta of 1.33. The company has a current ratio of 0.67, a quick ratio of 0.67 and a debt-to-equity ratio of 2.32.

The Goldman Sachs Group (NYSE:GS - Get Free Report) last posted its quarterly earnings data on Monday, April 14th. The investment management company reported $14.12 earnings per share for the quarter, beating the consensus estimate of $12.57 by $1.55. The Goldman Sachs Group had a net margin of 11.32% and a return on equity of 13.30%. The company had revenue of $15.06 billion during the quarter, compared to analyst estimates of $14.99 billion. During the same quarter last year, the firm posted $11.58 EPS. Equities research analysts predict that The Goldman Sachs Group, Inc. will post 47.12 earnings per share for the current year.

The Goldman Sachs Group Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, June 27th. Investors of record on Friday, May 30th will be given a $3.00 dividend. The ex-dividend date is Friday, May 30th. This represents a $12.00 annualized dividend and a dividend yield of 2.38%. The Goldman Sachs Group's dividend payout ratio is presently 29.59%.

Analyst Ratings Changes

GS has been the subject of several research analyst reports. Wells Fargo & Company reduced their target price on The Goldman Sachs Group from $680.00 to $650.00 and set an "overweight" rating for the company in a research note on Tuesday. Evercore ISI lowered their price target on shares of The Goldman Sachs Group from $660.00 to $594.00 and set an "outperform" rating for the company in a report on Tuesday, April 1st. Morgan Stanley set a $558.00 price target on The Goldman Sachs Group and gave the company an "equal weight" rating in a research report on Monday, April 7th. Citigroup cut their price target on The Goldman Sachs Group from $585.00 to $550.00 and set a "neutral" rating on the stock in a report on Monday, March 24th. Finally, Oppenheimer lowered shares of The Goldman Sachs Group from an "outperform" rating to a "market perform" rating in a report on Wednesday, March 19th. Thirteen equities research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $585.38.

Read Our Latest Analysis on GS

Insider Transactions at The Goldman Sachs Group

In other news, CAO Sheara J. Fredman sold 2,034 shares of the firm's stock in a transaction dated Tuesday, January 21st. The shares were sold at an average price of $627.01, for a total value of $1,275,338.34. Following the completion of the sale, the chief accounting officer now directly owns 6,455 shares of the company's stock, valued at approximately $4,047,349.55. This trade represents a 23.96 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Treasurer Carey Halio sold 1,545 shares of the stock in a transaction that occurred on Tuesday, January 21st. The shares were sold at an average price of $624.67, for a total value of $965,115.15. Following the transaction, the treasurer now owns 8,192 shares of the company's stock, valued at $5,117,296.64. This represents a 15.87 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 19,925 shares of company stock valued at $12,630,683 over the last three months. Company insiders own 0.55% of the company's stock.

The Goldman Sachs Group Profile

(

Free Report)

The Goldman Sachs Group, Inc, a financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals worldwide. It operates through Global Banking & Markets, Asset & Wealth Management, and Platform Solutions segments. The Global Banking & Markets segment provides financial advisory services, including strategic advisory assignments related to mergers and acquisitions, divestitures, corporate defense activities, restructurings, and spin-offs; and relationship lending, and acquisition financing, as well as secured lending, through structured credit and asset-backed lending and involved in financing under securities to resale agreements.

Read More

Before you consider The Goldman Sachs Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Goldman Sachs Group wasn't on the list.

While The Goldman Sachs Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report