Philip James Wealth Mangement LLC bought a new stake in Rio Tinto Group (NYSE:RIO - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 18,894 shares of the mining company's stock, valued at approximately $1,345,000.

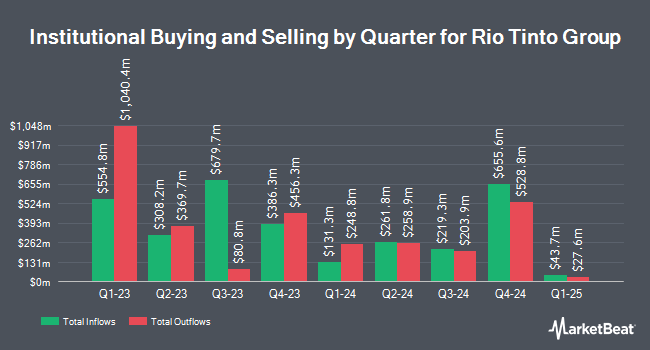

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the company. Bank of Montreal Can boosted its stake in shares of Rio Tinto Group by 237.0% in the 2nd quarter. Bank of Montreal Can now owns 2,472,471 shares of the mining company's stock valued at $164,493,000 after purchasing an additional 1,738,752 shares during the last quarter. Earnest Partners LLC raised its position in shares of Rio Tinto Group by 1.4% in the 1st quarter. Earnest Partners LLC now owns 1,395,961 shares of the mining company's stock worth $88,979,000 after acquiring an additional 19,334 shares in the last quarter. National Bank of Canada FI boosted its position in shares of Rio Tinto Group by 296.2% during the 1st quarter. National Bank of Canada FI now owns 1,022,765 shares of the mining company's stock valued at $71,382,000 after purchasing an additional 764,635 shares in the last quarter. MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH boosted its position in shares of Rio Tinto Group by 9.8% during the 3rd quarter. MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH now owns 932,151 shares of the mining company's stock valued at $66,341,000 after purchasing an additional 83,569 shares in the last quarter. Finally, Dimensional Fund Advisors LP grew its stake in Rio Tinto Group by 78.3% during the second quarter. Dimensional Fund Advisors LP now owns 858,050 shares of the mining company's stock worth $56,565,000 after purchasing an additional 376,778 shares during the period. Institutional investors and hedge funds own 19.33% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have issued reports on the company. Macquarie restated a "neutral" rating on shares of Rio Tinto Group in a report on Wednesday, October 16th. Royal Bank of Canada raised shares of Rio Tinto Group to a "hold" rating in a research report on Wednesday, July 31st. Hsbc Global Res raised Rio Tinto Group to a "strong-buy" rating in a research report on Tuesday, July 23rd. Berenberg Bank raised Rio Tinto Group from a "hold" rating to a "buy" rating in a research note on Wednesday, October 2nd. Finally, StockNews.com raised Rio Tinto Group from a "buy" rating to a "strong-buy" rating in a research report on Friday, September 6th. Four research analysts have rated the stock with a hold rating, four have given a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat, the company has an average rating of "Moderate Buy".

View Our Latest Stock Report on Rio Tinto Group

Rio Tinto Group Price Performance

Rio Tinto Group stock traded down $3.04 during trading on Friday, hitting $64.43. 4,745,979 shares of the company were exchanged, compared to its average volume of 2,754,398. The business's 50 day moving average is $65.40 and its 200 day moving average is $66.29. Rio Tinto Group has a 52 week low of $59.35 and a 52 week high of $75.09. The company has a current ratio of 1.70, a quick ratio of 1.16 and a debt-to-equity ratio of 0.23.

Rio Tinto Group Company Profile

(

Free Report)

Rio Tinto Group engages in exploring, mining, and processing mineral resources worldwide. The company operates through Iron Ore, Aluminium, Copper, and Minerals Segments. The Iron Ore segment engages in the iron ore mining, and salt and gypsum production in Western Australia. The Aluminum segment is involved in bauxite mining; alumina refining; and aluminium smelting.

Featured Articles

Before you consider Rio Tinto Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rio Tinto Group wasn't on the list.

While Rio Tinto Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.