Bronte Capital Management Pty Ltd. grew its stake in Philip Morris International Inc. (NYSE:PM - Free Report) by 1.1% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 549,299 shares of the company's stock after buying an additional 5,756 shares during the period. Philip Morris International accounts for 5.8% of Bronte Capital Management Pty Ltd.'s investment portfolio, making the stock its 7th largest holding. Bronte Capital Management Pty Ltd.'s holdings in Philip Morris International were worth $66,685,000 as of its most recent filing with the Securities and Exchange Commission.

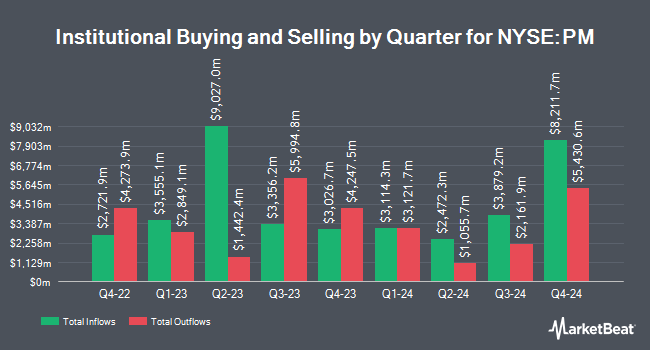

Several other hedge funds have also recently added to or reduced their stakes in the business. White Lighthouse Investment Management Inc. raised its stake in shares of Philip Morris International by 71.4% during the 3rd quarter. White Lighthouse Investment Management Inc. now owns 11,999 shares of the company's stock worth $1,457,000 after purchasing an additional 4,999 shares in the last quarter. Axxcess Wealth Management LLC raised its holdings in Philip Morris International by 25.4% during the first quarter. Axxcess Wealth Management LLC now owns 34,390 shares of the company's stock worth $3,151,000 after acquiring an additional 6,974 shares in the last quarter. Kennebec Savings Bank acquired a new stake in Philip Morris International during the third quarter worth approximately $692,000. Sequoia Financial Advisors LLC boosted its position in shares of Philip Morris International by 17.9% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 31,591 shares of the company's stock worth $3,203,000 after acquiring an additional 4,793 shares in the last quarter. Finally, Burke & Herbert Bank & Trust Co. raised its holdings in Philip Morris International by 68.0% in the 2nd quarter. Burke & Herbert Bank & Trust Co. now owns 20,896 shares of the company's stock valued at $2,117,000 after buying an additional 8,455 shares during the last quarter. 78.63% of the stock is currently owned by hedge funds and other institutional investors.

Philip Morris International Stock Performance

Shares of PM stock traded down $0.65 on Tuesday, reaching $124.30. 922,425 shares of the company's stock traded hands, compared to its average volume of 5,381,111. The business's 50 day moving average price is $124.24 and its two-hundred day moving average price is $112.81. The company has a market capitalization of $193.27 billion, a P/E ratio of 19.81, a price-to-earnings-growth ratio of 2.21 and a beta of 0.54. Philip Morris International Inc. has a 12-month low of $87.82 and a 12-month high of $134.15.

Philip Morris International (NYSE:PM - Get Free Report) last announced its quarterly earnings results on Tuesday, October 22nd. The company reported $1.91 earnings per share for the quarter, topping analysts' consensus estimates of $1.82 by $0.09. The firm had revenue of $9.91 billion for the quarter, compared to the consensus estimate of $9.68 billion. Philip Morris International had a negative return on equity of 117.94% and a net margin of 10.35%. The business's revenue was up 8.4% compared to the same quarter last year. During the same quarter in the previous year, the business earned $1.67 earnings per share. Research analysts predict that Philip Morris International Inc. will post 6.51 earnings per share for the current year.

Philip Morris International Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, October 10th. Shareholders of record on Thursday, September 26th were given a dividend of $1.35 per share. The ex-dividend date was Thursday, September 26th. This represents a $5.40 annualized dividend and a yield of 4.34%. This is a positive change from Philip Morris International's previous quarterly dividend of $1.30. Philip Morris International's dividend payout ratio (DPR) is 85.71%.

Insider Buying and Selling at Philip Morris International

In other Philip Morris International news, insider Werner Barth sold 7,500 shares of the firm's stock in a transaction that occurred on Wednesday, October 23rd. The shares were sold at an average price of $129.98, for a total transaction of $974,850.00. Following the sale, the insider now owns 95,418 shares of the company's stock, valued at approximately $12,402,431.64. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In related news, insider Werner Barth sold 7,500 shares of the firm's stock in a transaction on Wednesday, October 23rd. The stock was sold at an average price of $129.98, for a total transaction of $974,850.00. Following the transaction, the insider now directly owns 95,418 shares in the company, valued at $12,402,431.64. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Chairman Andre Calantzopoulos sold 101,918 shares of the stock in a transaction on Wednesday, October 23rd. The shares were sold at an average price of $129.85, for a total value of $13,234,052.30. Following the completion of the transaction, the chairman now owns 959,761 shares of the company's stock, valued at $124,624,965.85. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders own 0.13% of the company's stock.

Analyst Ratings Changes

A number of brokerages have recently issued reports on PM. Deutsche Bank Aktiengesellschaft boosted their price objective on shares of Philip Morris International from $118.00 to $135.00 and gave the company a "buy" rating in a research report on Tuesday, October 1st. UBS Group upped their price objective on shares of Philip Morris International from $103.00 to $105.00 and gave the company a "sell" rating in a research note on Wednesday, October 23rd. Barclays increased their price objective on shares of Philip Morris International from $145.00 to $155.00 and gave the company an "overweight" rating in a research report on Wednesday, October 30th. Stifel Nicolaus restated a "buy" rating and issued a $145.00 target price (up previously from $138.00) on shares of Philip Morris International in a research note on Wednesday, October 23rd. Finally, Bank of America lifted their price target on shares of Philip Morris International from $125.00 to $139.00 and gave the company a "buy" rating in a research report on Wednesday, September 4th. One analyst has rated the stock with a sell rating, three have assigned a hold rating and eight have given a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $127.85.

Get Our Latest Report on PM

Philip Morris International Profile

(

Free Report)

Philip Morris International Inc operates as a tobacco company working to delivers a smoke-free future and evolving portfolio for the long-term to include products outside of the tobacco and nicotine sector. The company's product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products primarily under the IQOS and ZYN brands; and consumer accessories, such as lighters and matches.

Recommended Stories

Before you consider Philip Morris International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Philip Morris International wasn't on the list.

While Philip Morris International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report