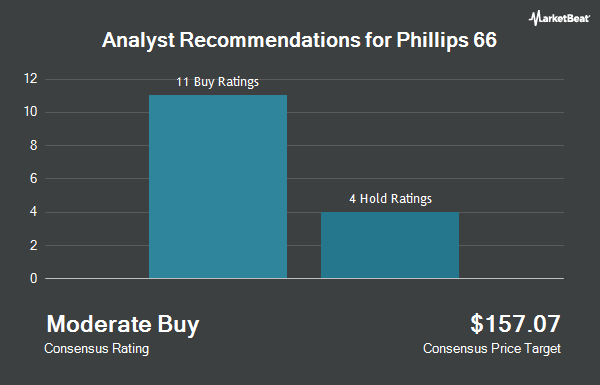

Phillips 66 (NYSE:PSX - Get Free Report) has received a consensus rating of "Moderate Buy" from the fourteen research firms that are covering the company, Marketbeat Ratings reports. Five research analysts have rated the stock with a hold recommendation and nine have issued a buy recommendation on the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $142.00.

A number of equities research analysts have recently weighed in on the company. Piper Sandler lowered Phillips 66 from a "strong-buy" rating to a "hold" rating in a research report on Friday, January 10th. The Goldman Sachs Group cut Phillips 66 from a "buy" rating to a "neutral" rating and set a $132.00 target price for the company. in a research note on Thursday, March 27th. Wolfe Research upgraded Phillips 66 from a "peer perform" rating to an "outperform" rating and set a $143.00 target price for the company in a research note on Friday, January 3rd. Barclays lowered their price objective on Phillips 66 from $135.00 to $106.00 and set an "equal weight" rating for the company in a research note on Thursday, April 10th. Finally, Wells Fargo & Company lifted their price objective on Phillips 66 from $161.00 to $162.00 and gave the company an "overweight" rating in a research note on Monday, February 3rd.

Check Out Our Latest Report on Phillips 66

Phillips 66 Trading Up 3.0 %

Phillips 66 stock traded up $3.07 during mid-day trading on Friday, hitting $103.97. The company's stock had a trading volume of 153,038 shares, compared to its average volume of 3,622,184. The company has a debt-to-equity ratio of 0.62, a current ratio of 1.21 and a quick ratio of 0.83. The stock has a market cap of $42.36 billion, a price-to-earnings ratio of 21.05, a price-to-earnings-growth ratio of 4.84 and a beta of 1.17. The business has a 50 day moving average price of $117.31 and a 200-day moving average price of $121.80. Phillips 66 has a 12 month low of $91.01 and a 12 month high of $158.38.

Phillips 66 (NYSE:PSX - Get Free Report) last posted its quarterly earnings results on Friday, January 31st. The oil and gas company reported ($0.15) earnings per share for the quarter, missing the consensus estimate of $1.23 by ($1.38). Phillips 66 had a return on equity of 8.58% and a net margin of 1.46%. During the same quarter in the prior year, the company earned $3.09 earnings per share. As a group, analysts forecast that Phillips 66 will post 6.8 EPS for the current year.

Phillips 66 Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, June 2nd. Investors of record on Monday, May 19th will be given a dividend of $1.20 per share. The ex-dividend date is Monday, May 19th. This is a positive change from Phillips 66's previous quarterly dividend of $1.15. This represents a $4.80 dividend on an annualized basis and a yield of 4.62%. Phillips 66's payout ratio is presently 93.12%.

Institutional Investors Weigh In On Phillips 66

Institutional investors have recently modified their holdings of the company. Bogart Wealth LLC lifted its holdings in Phillips 66 by 120.0% during the 4th quarter. Bogart Wealth LLC now owns 220 shares of the oil and gas company's stock worth $25,000 after buying an additional 120 shares during the last quarter. J.Safra Asset Management Corp acquired a new position in Phillips 66 in the 4th quarter valued at about $25,000. Pacific Center for Financial Services acquired a new position in Phillips 66 in the 4th quarter valued at about $27,000. Stephens Consulting LLC increased its position in Phillips 66 by 83.5% in the 4th quarter. Stephens Consulting LLC now owns 244 shares of the oil and gas company's stock valued at $28,000 after acquiring an additional 111 shares during the period. Finally, Graney & King LLC purchased a new position in shares of Phillips 66 in the 4th quarter valued at about $28,000. 76.93% of the stock is owned by institutional investors and hedge funds.

About Phillips 66

(

Get Free ReportPhillips 66 operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally. It operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). The Midstream segment transports crude oil and other feedstocks; delivers refined petroleum products to market; provides terminaling and storage services for crude oil and refined petroleum products; transports, stores, fractionates, exports, and markets natural gas liquids; provides other fee-based processing services; and gathers, processes, transports, and markets natural gas.

Featured Articles

Before you consider Phillips 66, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Phillips 66 wasn't on the list.

While Phillips 66 currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.