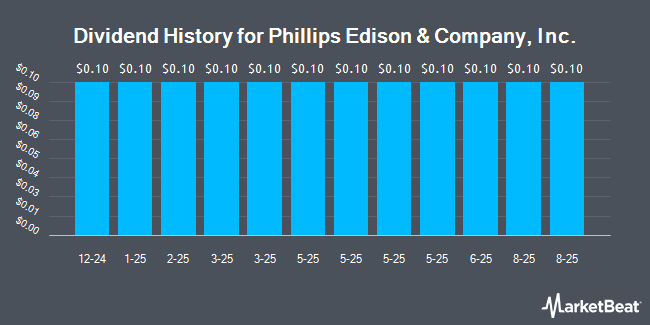

Phillips Edison & Company, Inc. (NASDAQ:PECO - Get Free Report) announced a monthly dividend on Friday, February 14th,Wall Street Journal reports. Investors of record on Tuesday, April 15th will be given a dividend of 0.1025 per share on Thursday, May 1st. This represents a $1.23 dividend on an annualized basis and a dividend yield of 3.40%. The ex-dividend date is Tuesday, April 15th.

Phillips Edison & Company, Inc. has increased its dividend by an average of 31.1% per year over the last three years. Phillips Edison & Company, Inc. has a dividend payout ratio of 183.6% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Research analysts expect Phillips Edison & Company, Inc. to earn $2.68 per share next year, which means the company should continue to be able to cover its $1.23 annual dividend with an expected future payout ratio of 45.9%.

Phillips Edison & Company, Inc. Stock Down 1.1 %

PECO traded down $0.41 on Tuesday, reaching $36.17. The company's stock had a trading volume of 508,868 shares, compared to its average volume of 585,815. The stock has a 50 day moving average of $37.05 and a two-hundred day moving average of $37.31. The company has a market capitalization of $4.43 billion, a price-to-earnings ratio of 72.34, a P/E/G ratio of 1.76 and a beta of 0.58. Phillips Edison & Company, Inc. has a fifty-two week low of $30.62 and a fifty-two week high of $40.12.

Phillips Edison & Company, Inc. (NASDAQ:PECO - Get Free Report) last announced its quarterly earnings results on Thursday, February 6th. The company reported $0.62 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.12 by $0.50. Phillips Edison & Company, Inc. had a return on equity of 2.40% and a net margin of 9.48%. As a group, analysts anticipate that Phillips Edison & Company, Inc. will post 2.55 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of equities analysts recently issued reports on PECO shares. Wells Fargo & Company lowered their price target on Phillips Edison & Company, Inc. from $39.00 to $37.00 and set an "equal weight" rating for the company in a report on Wednesday, January 29th. Wolfe Research raised Phillips Edison & Company, Inc. from a "peer perform" rating to an "outperform" rating and set a $44.00 price objective for the company in a report on Wednesday, November 13th. JPMorgan Chase & Co. decreased their price objective on Phillips Edison & Company, Inc. from $41.00 to $40.00 and set a "neutral" rating for the company in a report on Tuesday, January 7th. Finally, Mizuho increased their price objective on Phillips Edison & Company, Inc. from $39.00 to $41.00 and gave the company an "outperform" rating in a report on Tuesday, December 10th. Three equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $39.50.

View Our Latest Stock Analysis on PECO

Phillips Edison & Company, Inc. Company Profile

(

Get Free Report)

Phillips Edison & Co, Inc is a real estate investment trust, which engages in the ownership and operation of shopping centers. It also offers an investment management business providing property management and advisory services. Its portfolio consists of well-occupied, grocery-anchored neighborhood and community shopping centers having a mix of national, regional, and local retailers offering necessity-based goods and services.

Read More

Before you consider Phillips Edison & Company, Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Phillips Edison & Company, Inc. wasn't on the list.

While Phillips Edison & Company, Inc. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.