Phocas Financial Corp. purchased a new position in shares of LSI Industries Inc. (NASDAQ:LYTS - Free Report) during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor purchased 228,001 shares of the construction company's stock, valued at approximately $3,682,000. Phocas Financial Corp. owned about 0.77% of LSI Industries at the end of the most recent reporting period.

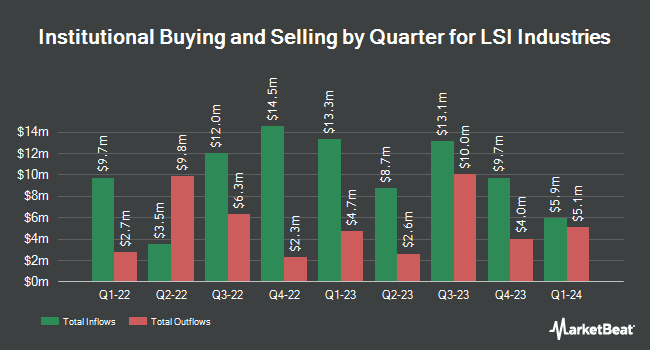

Other large investors have also bought and sold shares of the company. Wedge Capital Management L L P NC grew its position in shares of LSI Industries by 0.9% during the 3rd quarter. Wedge Capital Management L L P NC now owns 85,140 shares of the construction company's stock worth $1,375,000 after buying an additional 740 shares during the period. Price T Rowe Associates Inc. MD raised its position in shares of LSI Industries by 4.6% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 22,770 shares of the construction company's stock valued at $345,000 after acquiring an additional 993 shares during the last quarter. Essex Investment Management Co. LLC lifted its stake in shares of LSI Industries by 0.4% in the 3rd quarter. Essex Investment Management Co. LLC now owns 306,397 shares of the construction company's stock valued at $4,948,000 after purchasing an additional 1,111 shares during the period. Principal Financial Group Inc. boosted its position in shares of LSI Industries by 10.4% in the 2nd quarter. Principal Financial Group Inc. now owns 14,793 shares of the construction company's stock worth $214,000 after purchasing an additional 1,398 shares during the last quarter. Finally, Janney Montgomery Scott LLC grew its stake in shares of LSI Industries by 3.4% during the third quarter. Janney Montgomery Scott LLC now owns 46,911 shares of the construction company's stock worth $758,000 after purchasing an additional 1,535 shares during the period. 73.91% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Separately, HC Wainwright restated a "buy" rating and set a $20.00 target price on shares of LSI Industries in a report on Friday, August 16th.

Check Out Our Latest Analysis on LYTS

LSI Industries Stock Up 0.5 %

Shares of LSI Industries stock traded up $0.09 during trading hours on Tuesday, reaching $20.04. 39,821 shares of the company's stock were exchanged, compared to its average volume of 111,483. The company has a current ratio of 2.08, a quick ratio of 1.19 and a debt-to-equity ratio of 0.21. The company has a 50 day moving average of $16.77 and a two-hundred day moving average of $15.77. The stock has a market cap of $597.99 million, a P/E ratio of 25.38 and a beta of 0.87. LSI Industries Inc. has a fifty-two week low of $12.53 and a fifty-two week high of $21.17.

LSI Industries Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, November 26th. Stockholders of record on Monday, November 18th will be paid a dividend of $0.05 per share. The ex-dividend date of this dividend is Monday, November 18th. This represents a $0.20 annualized dividend and a dividend yield of 1.00%. LSI Industries's dividend payout ratio is currently 25.32%.

LSI Industries Company Profile

(

Free Report)

LSI Industries Inc produces and sells non-residential lighting and retail display solutions in the United States, Canada, Mexico, and Latin America. It operates through two segments, Lighting and Display Solutions. The Lighting segment manufactures, markets, and sells non-residential outdoor and indoor lighting fixture and control solutions in the commercial and industrial markets.

Recommended Stories

Before you consider LSI Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LSI Industries wasn't on the list.

While LSI Industries currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.