Phocas Financial Corp. lowered its holdings in shares of Ryman Hospitality Properties, Inc. (NYSE:RHP - Free Report) by 6.2% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 90,528 shares of the real estate investment trust's stock after selling 5,937 shares during the period. Phocas Financial Corp. owned about 0.15% of Ryman Hospitality Properties worth $9,708,000 as of its most recent SEC filing.

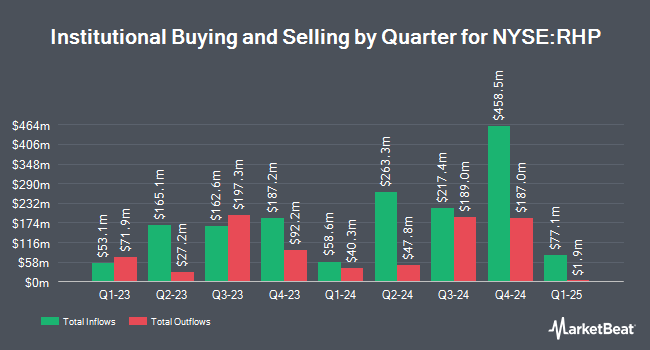

A number of other hedge funds also recently modified their holdings of the business. Pathstone Holdings LLC boosted its position in Ryman Hospitality Properties by 9.6% during the third quarter. Pathstone Holdings LLC now owns 20,528 shares of the real estate investment trust's stock valued at $2,203,000 after acquiring an additional 1,800 shares during the last quarter. Metis Global Partners LLC boosted its position in Ryman Hospitality Properties by 29.7% during the third quarter. Metis Global Partners LLC now owns 6,167 shares of the real estate investment trust's stock valued at $661,000 after acquiring an additional 1,412 shares during the last quarter. Victory Capital Management Inc. boosted its position in Ryman Hospitality Properties by 3,800.4% during the third quarter. Victory Capital Management Inc. now owns 292,410 shares of the real estate investment trust's stock valued at $31,358,000 after acquiring an additional 284,913 shares during the last quarter. Aigen Investment Management LP bought a new stake in Ryman Hospitality Properties during the third quarter valued at $287,000. Finally, Versor Investments LP bought a new stake in Ryman Hospitality Properties during the third quarter valued at $247,000. Institutional investors and hedge funds own 94.48% of the company's stock.

Insider Buying and Selling

In related news, Director Alvin L. Bowles, Jr. sold 900 shares of Ryman Hospitality Properties stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $107.32, for a total value of $96,588.00. Following the sale, the director now owns 3,148 shares of the company's stock, valued at approximately $337,843.36. The trade was a 22.23 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Fazal F. Merchant sold 1,269 shares of Ryman Hospitality Properties stock in a transaction that occurred on Wednesday, November 13th. The stock was sold at an average price of $113.98, for a total transaction of $144,640.62. Following the completion of the sale, the director now directly owns 4,825 shares in the company, valued at $549,953.50. This trade represents a 20.82 % decrease in their position. The disclosure for this sale can be found here. 3.00% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently issued reports on RHP shares. Jefferies Financial Group assumed coverage on shares of Ryman Hospitality Properties in a research report on Wednesday, November 6th. They set a "buy" rating and a $130.00 price objective on the stock. StockNews.com upgraded Ryman Hospitality Properties from a "sell" rating to a "hold" rating in a research note on Friday, August 9th. Truist Financial raised their target price on Ryman Hospitality Properties from $130.00 to $136.00 and gave the company a "buy" rating in a research note on Monday. JPMorgan Chase & Co. raised their target price on Ryman Hospitality Properties from $104.00 to $105.00 and gave the company a "neutral" rating in a research note on Friday, August 2nd. Finally, Wells Fargo & Company reduced their target price on Ryman Hospitality Properties from $127.00 to $115.00 and set an "overweight" rating for the company in a research note on Friday, September 13th. Two equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $126.17.

Check Out Our Latest Stock Analysis on RHP

Ryman Hospitality Properties Stock Performance

Shares of Ryman Hospitality Properties stock traded down $0.37 during mid-day trading on Tuesday, hitting $110.82. 197,089 shares of the stock were exchanged, compared to its average volume of 454,315. Ryman Hospitality Properties, Inc. has a 12 month low of $93.76 and a 12 month high of $122.91. The company has a 50-day simple moving average of $108.64 and a 200 day simple moving average of $104.15. The company has a debt-to-equity ratio of 6.07, a quick ratio of 1.73 and a current ratio of 1.73. The company has a market capitalization of $6.64 billion, a P/E ratio of 19.75, a P/E/G ratio of 1.96 and a beta of 1.65.

Ryman Hospitality Properties (NYSE:RHP - Get Free Report) last posted its earnings results on Monday, November 4th. The real estate investment trust reported $0.94 EPS for the quarter, missing the consensus estimate of $1.83 by ($0.89). Ryman Hospitality Properties had a return on equity of 61.94% and a net margin of 14.84%. The firm had revenue of $549.90 million for the quarter, compared to the consensus estimate of $545.93 million. During the same period in the prior year, the business earned $1.73 EPS. Ryman Hospitality Properties's quarterly revenue was up 4.0% compared to the same quarter last year. Sell-side analysts anticipate that Ryman Hospitality Properties, Inc. will post 8.44 earnings per share for the current fiscal year.

Ryman Hospitality Properties Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be given a dividend of $1.15 per share. The ex-dividend date is Tuesday, December 31st. This represents a $4.60 annualized dividend and a dividend yield of 4.15%. This is a boost from Ryman Hospitality Properties's previous quarterly dividend of $1.10. Ryman Hospitality Properties's dividend payout ratio (DPR) is currently 78.15%.

About Ryman Hospitality Properties

(

Free Report)

Ryman Hospitality Properties, Inc NYSE: RHP is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences. The Company's holdings include Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; Gaylord National Resort & Convention Center; and Gaylord Rockies Resort & Convention Center, five of the top seven largest non-gaming convention center hotels in the United States based on total indoor meeting space.

Featured Articles

Before you consider Ryman Hospitality Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryman Hospitality Properties wasn't on the list.

While Ryman Hospitality Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.