Pictet Asset Management Holding SA boosted its position in Albertsons Companies, Inc. (NYSE:ACI - Free Report) by 17.9% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 186,030 shares of the company's stock after purchasing an additional 28,303 shares during the period. Pictet Asset Management Holding SA's holdings in Albertsons Companies were worth $3,654,000 at the end of the most recent quarter.

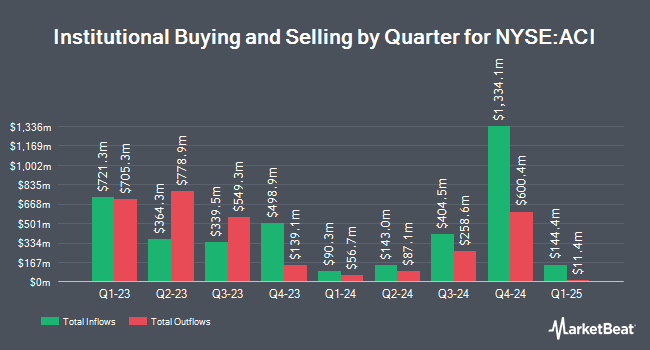

Other large investors have also recently bought and sold shares of the company. Eagle Bay Advisors LLC lifted its position in shares of Albertsons Companies by 108.4% in the 4th quarter. Eagle Bay Advisors LLC now owns 1,346 shares of the company's stock worth $26,000 after purchasing an additional 700 shares during the period. Capital Advisors Ltd. LLC lifted its holdings in Albertsons Companies by 225.1% in the fourth quarter. Capital Advisors Ltd. LLC now owns 1,385 shares of the company's stock valued at $27,000 after buying an additional 959 shares during the period. EverSource Wealth Advisors LLC lifted its holdings in Albertsons Companies by 316.6% in the fourth quarter. EverSource Wealth Advisors LLC now owns 1,787 shares of the company's stock valued at $35,000 after buying an additional 1,358 shares during the period. Steward Partners Investment Advisory LLC boosted its position in Albertsons Companies by 91.0% during the fourth quarter. Steward Partners Investment Advisory LLC now owns 8,610 shares of the company's stock valued at $169,000 after acquiring an additional 4,101 shares during the last quarter. Finally, R Squared Ltd acquired a new stake in Albertsons Companies during the 4th quarter worth about $179,000. 71.35% of the stock is currently owned by institutional investors.

Albertsons Companies Stock Performance

NYSE ACI traded up $0.36 during trading hours on Wednesday, reaching $21.30. The stock had a trading volume of 6,259,596 shares, compared to its average volume of 4,139,859. Albertsons Companies, Inc. has a 52-week low of $17.00 and a 52-week high of $23.20. The stock has a fifty day moving average of $21.11 and a 200 day moving average of $19.85. The company has a debt-to-equity ratio of 2.31, a quick ratio of 0.21 and a current ratio of 0.93. The stock has a market cap of $12.34 billion, a P/E ratio of 11.97, a price-to-earnings-growth ratio of 1.92 and a beta of 0.47.

Albertsons Companies (NYSE:ACI - Get Free Report) last released its quarterly earnings data on Wednesday, January 8th. The company reported $0.71 earnings per share for the quarter, beating analysts' consensus estimates of $0.64 by $0.07. The business had revenue of $18.77 billion during the quarter, compared to analyst estimates of $18.82 billion. Albertsons Companies had a return on equity of 44.70% and a net margin of 1.30%. The company's revenue was up 1.2% on a year-over-year basis. During the same quarter last year, the business posted $0.79 EPS. Sell-side analysts predict that Albertsons Companies, Inc. will post 2.14 earnings per share for the current year.

Analyst Upgrades and Downgrades

ACI has been the topic of a number of research reports. Royal Bank of Canada reiterated an "outperform" rating and set a $23.00 target price on shares of Albertsons Companies in a research report on Thursday, April 3rd. Bank of America began coverage on shares of Albertsons Companies in a research report on Friday, December 13th. They set a "neutral" rating and a $22.00 price objective on the stock. The Goldman Sachs Group restated a "buy" rating and set a $26.00 price objective on shares of Albertsons Companies in a report on Tuesday, February 4th. Evercore ISI boosted their target price on shares of Albertsons Companies from $21.00 to $22.00 and gave the stock an "in-line" rating in a research report on Tuesday, March 11th. Finally, Morgan Stanley lowered their price target on Albertsons Companies from $24.00 to $19.00 and set an "equal weight" rating for the company in a research report on Wednesday, December 11th. Six analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. According to MarketBeat, Albertsons Companies currently has an average rating of "Moderate Buy" and an average target price of $23.50.

View Our Latest Analysis on Albertsons Companies

Albertsons Companies Company Profile

(

Free Report)

Albertsons Companies, Inc, through its subsidiaries, engages in the operation of food and drug stores in the United States. The company's food and drug retail stores offer grocery products, general merchandise, health and beauty care products, pharmacy, fuel, and other items and services. It also manufactures and processes food products for sale in stores.

Recommended Stories

Before you consider Albertsons Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albertsons Companies wasn't on the list.

While Albertsons Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.